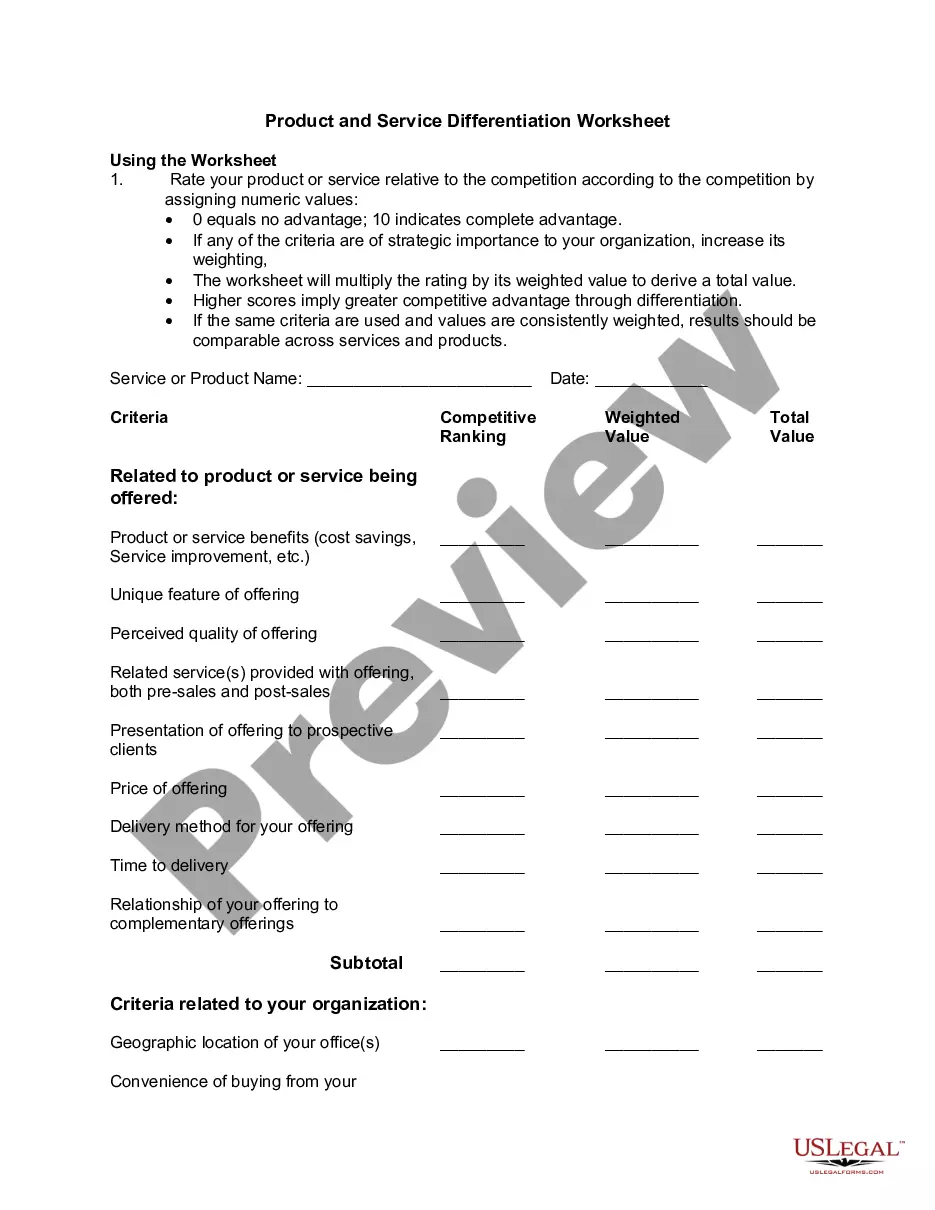

Colorado Worksheet - New Product or Service

Description

How to fill out Worksheet - New Product Or Service?

You might devote multiple hours on the web trying to locate the legal document template that meets the state and federal requirements you require.

US Legal Forms offers a vast selection of legal templates that have been reviewed by experts.

You can easily download or print the Colorado Worksheet - New Product or Service from the services.

If available, use the Preview button to look through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can fill out, modify, print, or sign the Colorado Worksheet - New Product or Service.

- Every legal document template you obtain is yours forever.

- To retrieve another copy of any purchased form, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, confirm that you have selected the correct document template for the state/city of your choice.

- Review the form description to ensure you have chosen the appropriate template.

Form popularity

FAQ

Colorado imposes sales tax on retail sales of tangible personal property. In general, the tax does not apply to sales of services, except for those services specifically taxed by law.

The state exempts groceries, prescription drugs, and certain medical devices from the general sales tax. In addition, any leases of tangible property with terms of three years or less are also considered to be exempt from taxation.

3. What are the steps?Register to be a Withholding Submitter.Decide how you will report Year-End Withholding Statements.Submit year-end statements in Revenue Online. Although not recommended, employers or 1099 payers may submit paper statements along with DR 1093 or DR 1106 if they have fewer than 250 employees/payees.

Withholding Formula (Effective Pay Period 05, 2021)Multiply the adjusted gross biweekly wages by the number of pay dates in the tax year to obtain the gross annual wages. Multiply the taxable wages in step 5 by 4.55 percent to determine the annual tax amount.

Generally, labor and services are not subject to sales tax. Colorado taxes retail sales of tangible personal property and select services including telephone services, rooms and accommodations, food for immediate consumption, and certain utility services.

To file and pay electronically, you can use the DOR's Revenue Online system or Electronic Funds Transfer (EFT). There is a fee to use Revenue Online. Employers with high amounts of withholding must use EFT. To file on paper, use Form DR 1094, Colorado W-2 Wage Withholding Tax Return.

The Denver Revised Municipal Code (DRMC) imposes a 4.31% sales tax on the purchase price paid or charged on retail sales, leases or rentals of tangible personal property, products, and on certain services. Retail sales made online to customers located in Denver are subject to sales tax.

Colorado-source income includes any income derived from sources within Colorado including, but not limited to: (a) Ownership of Real or Tangible Personal Property.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.

Does Colorado have a W-4 form? Yes. Starting in 2022, an employee may complete a Colorado Employee Withholding Certificate (form DR 0004), but it is not required. If an employee completes form DR 0004, the employer must calculate Colorado withholding based on the amounts the employee entered.