Colorado Bill of Sale by Corporation of all or Substantially all of its Assets

Description

How to fill out Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

You may spend many hours online looking for the legal document template that fulfills the federal and state requirements you need.

US Legal Forms provides thousands of legal forms that are reviewed by experts.

It is easy to download or print the Colorado Bill of Sale by Corporation of all or substantially all of its Assets from this service.

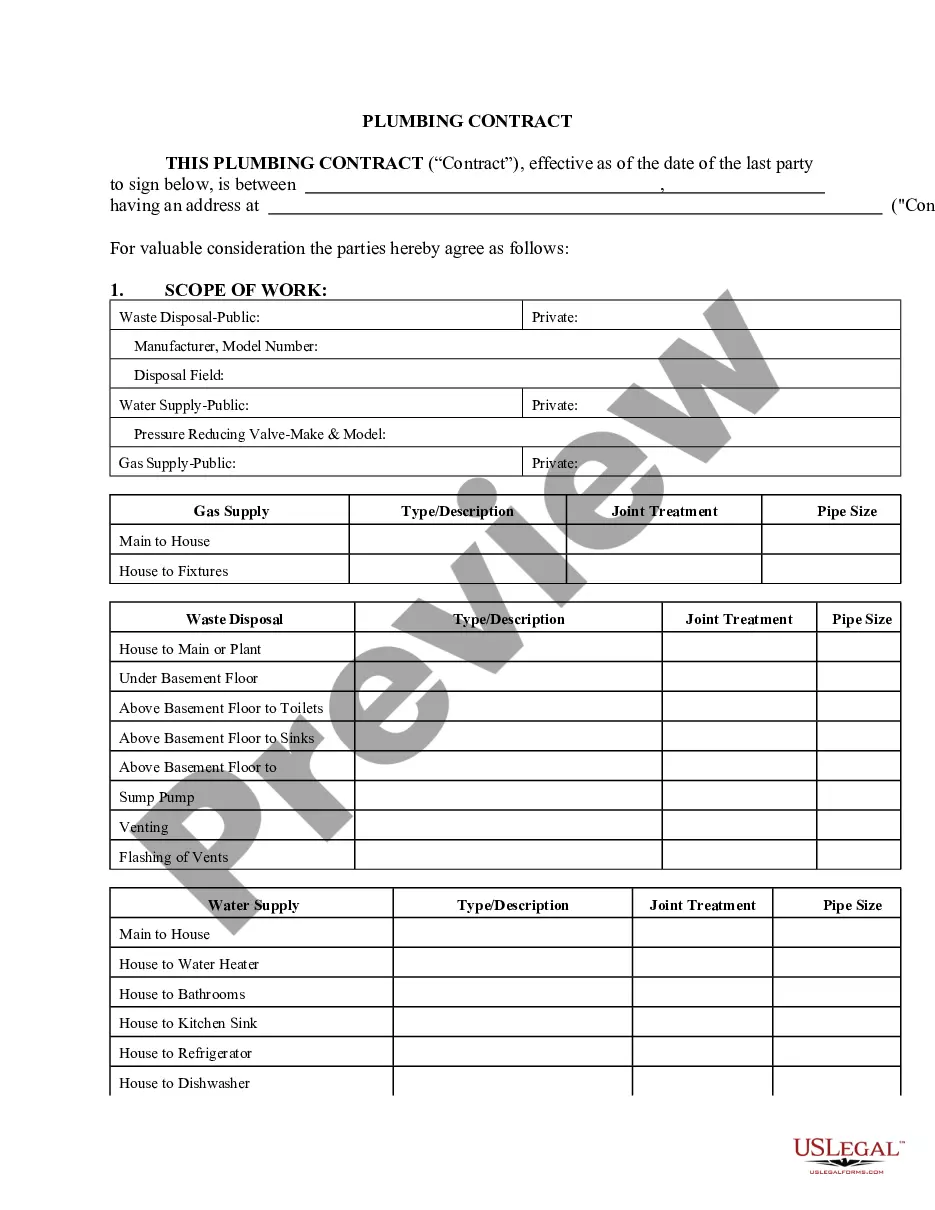

If available, utilize the Preview button to view the document template simultaneously.

- If you already possess a US Legal Forms account, you can Log In and then select the Obtain button.

- Subsequently, you can fill out, modify, print, or sign the Colorado Bill of Sale by Corporation of all or substantially all of its Assets.

- Every legal document template you acquire is your permanent property.

- To get another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Review the form details to confirm you have chosen the appropriate template.

Form popularity

FAQ

The Nexus threshold in Colorado establishes the minimum level of business activity that a company must meet to be subject to state taxes. Reaching this threshold involves factors such as sales volume and number of transactions. If your company is involved in complex asset transfers, like a Colorado Bill of Sale by Corporation of all or Substantially all of its Assets, understanding your Nexus threshold is essential to avoid implications.

Generally, all corporations doing business or earning income in Colorado must file a corporate tax return. This includes corporations that engage in transactions like selling assets or conducting sales that require a Colorado Bill of Sale by Corporation of all or Substantially all of its Assets. Compliance is key, so always assess your business activities to determine filing requirements.

Various activities can trigger income tax nexus, including having a physical location, employees, or making significant sales in Colorado. Changes in business operations may also create nexus unexpectedly. If you’re engaging in transactions that involve a Colorado Bill of Sale by Corporation of all or Substantially all of its Assets, ensure you understand how these triggers apply to your business.

A state of Colorado consolidated return allows corporations that are part of a group to file taxes as one entity. This can simplify the tax filing process and potentially reduce liabilities for businesses operating across multiple jurisdictions. If you’re preparing a Colorado Bill of Sale by Corporation of all or Substantially all of its Assets, consider whether filing a consolidated return is beneficial for your corporate structure.

Income tax nexus in Colorado is primarily created through physical presence, such as an office or employees, or through economic activities that meet specific thresholds. Companies that sell products or provide services in Colorado must evaluate their operations to determine if they meet these nexus requirements. If you’re transferring assets using a Colorado Bill of Sale by Corporation of all or Substantially all of its Assets, make sure your nexus status is clear.

In Colorado, the highly compensated threshold refers to the income level that designates an employee as highly compensated for tax and benefit purposes. This threshold can affect how companies structure their compensation packages. When forming an agreement, such as a Colorado Bill of Sale by Corporation of all or Substantially all of its Assets, it's useful to consider the implications for your business and employees.

The corporate Net Operating Loss (NOL) limitation in Colorado is a provision that determines how much loss businesses can carry forward or back to offset taxes. In Colorado, there are specific caps that affect these losses, important for businesses filing corporate tax returns. If you're considering a Colorado Bill of Sale by Corporation of all or Substantially all of its Assets, know how NOLs may influence your tax situation.

The Nexus threshold refers to the level of business activity that establishes a connection between a company and a state, affecting tax obligations. In Colorado, maintaining a certain volume of sales or transactions can create this nexus. Understanding your Nexus threshold is crucial for compliance, especially when issuing a Colorado Bill of Sale by Corporation of all or Substantially all of its Assets.

When transferring ownership in Colorado, you need to complete the title transfer section on the back of the title document. Ensure you include pertinent details such as the buyer's name, address, and the sale amount. After completing this, both the seller and buyer must sign the title. To make this process smoother, consider using a Colorado Bill of Sale by Corporation of all or Substantially all of its Assets to document the transaction.

Section 7-107-104 of the Colorado Business Corporation Act outlines the requirements for a corporation to sell all or substantially all of its assets. This section emphasizes the need for board approval and, in some cases, shareholder approval before proceeding with the sale. Understanding this section helps when drafting a Colorado Bill of Sale by Corporation of all or Substantially all of its Assets to comply with legal standards.