Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Colorado Demand for Accounting from a Fiduciary

Description

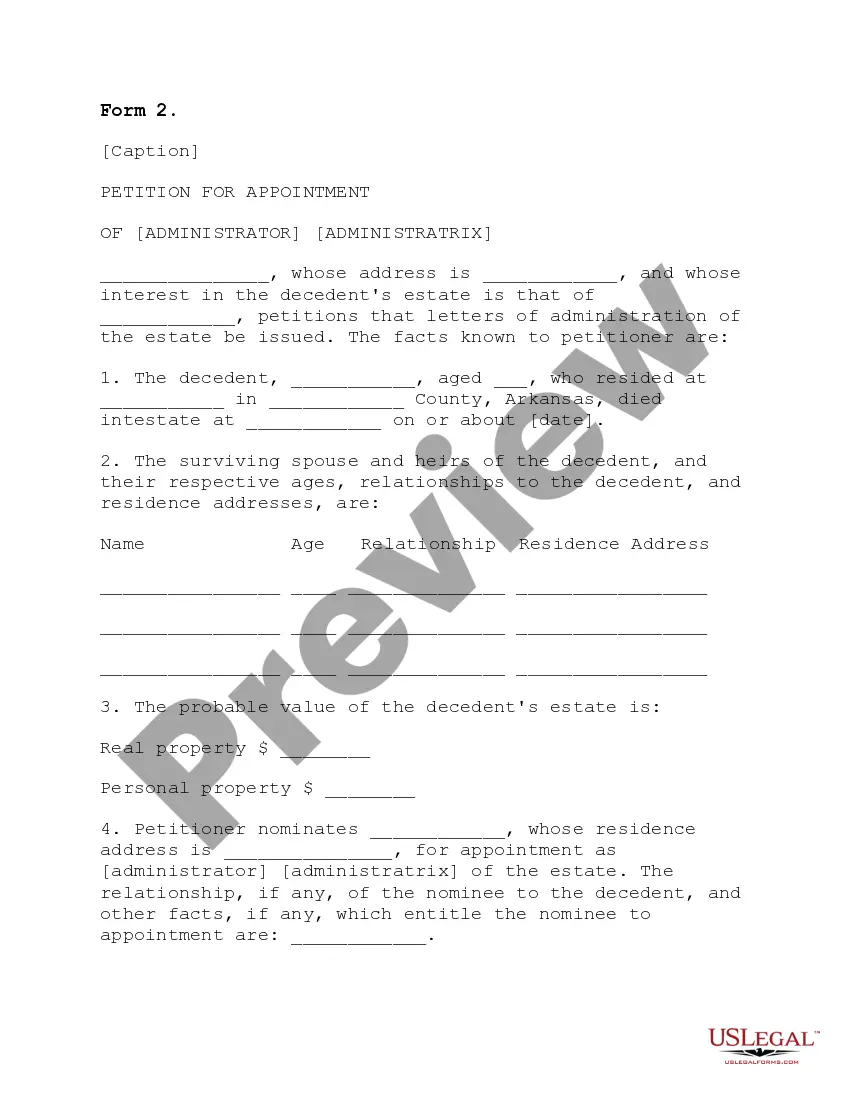

How to fill out Demand For Accounting From A Fiduciary?

It is feasible to invest time on the internet searching for the approved document template that meets the federal and state requirements you desire.

US Legal Forms offers a vast array of legal forms that are assessed by professionals.

You can obtain or print the Colorado Request for Accounting from a Fiduciary using our services.

Review the form description to confirm you have selected the correct form. If available, utilize the Review button to browse through the document template as well.

- If you already possess a US Legal Forms account, you may sign in and click the Download button.

- Afterward, you can complete, modify, print, or sign the Colorado Request for Accounting from a Fiduciary.

- Each legal document template you receive is yours indefinitely.

- To retrieve another copy of any purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/region of your choice.

Form popularity

FAQ

In a trust, the trustee holds the legal power to manage the assets, but the beneficiary holds equitable power. This means the trustee must act in the best interest of the beneficiary, maintaining transparency through practices like a Colorado Demand for Accounting from a Fiduciary. While trustees handle operational decisions, beneficiaries have the right to question actions and seek information. This balance is crucial for a trustworthy and functional trust relationship.

Typically, beneficiaries have the right to demand an accounting from a fiduciary. This right extends to individuals named in the trust document as well as those who may have a financial interest in the trust. A Colorado Demand for Accounting from a Fiduciary can empower beneficiaries to request detailed financial information. This promotes accountability and transparency in trust management.

In Colorado, an executor must notify beneficiaries within a reasonable timeframe, usually within 90 days of being appointed. Timely notification is crucial as it allows beneficiaries to review the terms of the will or trust. If there are discrepancies, they may use a Colorado Demand for Accounting from a Fiduciary to request formal financial disclosures. This ensures transparency and builds trust in the management process.

Yes, trustees are generally required to inform beneficiaries about the trust's activities. This includes providing updates on financial performance and important decisions. A Colorado Demand for Accounting from a Fiduciary can help ensure beneficiaries receive the necessary information. Staying informed allows beneficiaries to understand their rights and the management of the trust.

The 5-year rule for trusts in Colorado stipulates that trustees must account for trust assets every five years or upon a beneficiary's request. This regulation aims to ensure that beneficiaries receive regular updates about the trust's performance. Utilizing a Colorado Demand for Accounting from a Fiduciary can facilitate compliance with this rule and support beneficiaries' needs.

The fiduciary duty in Colorado requires trustees to act in the best interests of the beneficiaries while managing the trust assets. This duty produces a high standard of care, ensuring that trustees make decisions that maximize the beneficiaries' benefits. If you suspect a breach of this duty, a Colorado Demand for Accounting from a Fiduciary can help clarify the situation.

In Colorado, a trustee is required to notify beneficiaries within a reasonable time after the trust is accepted and establish. This notice should keep beneficiaries informed about their rights and the trust's existence. If you feel this obligation has not been met, consider making a Colorado Demand for Accounting from a Fiduciary to address the issue.

In Colorado, trust beneficiaries have several rights, including the right to receive timely financial information from the trustee. They can also request a formal accounting of the trust, which outlines all transactions and current assets. By filing a Colorado Demand for Accounting from a Fiduciary, beneficiaries can enforce these rights and ensure proper management.

Fiduciary accounting serves to ensure transparency and accountability in managing the assets held in trust. It provides beneficiaries with a comprehensive overview of how funds are managed and disbursed. When in doubt about the fiduciary's actions, a Colorado Demand for Accounting from a Fiduciary can push for clarity.

A beneficiary possesses the power to request trust documents and ask for updates regarding the trust's performance. They can also contest the actions of the trustee if they believe the fiduciary is not acting in their best interest. Making a Colorado Demand for Accounting from a Fiduciary is a crucial step if you seek clarity on the trust's management.