Colorado Contract for Part-Time Assistance from Independent Contractor

Description

How to fill out Contract For Part-Time Assistance From Independent Contractor?

Locating the appropriate legal document template can be quite a challenge.

Naturally, there are numerous designs available online, but how do you find the legal form you require.

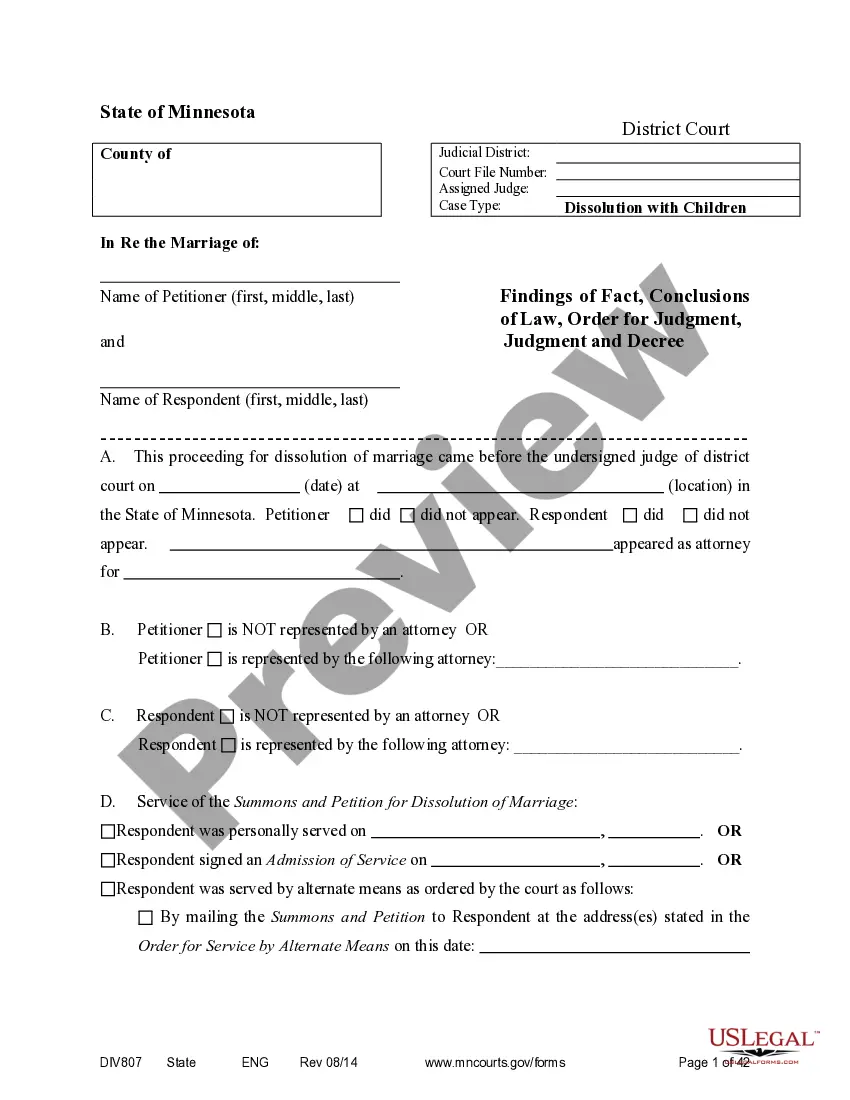

Utilize the US Legal Forms website. This platform offers thousands of templates, including the Colorado Contract for Part-Time Assistance from Independent Contractor, which you can employ for both business and personal needs.

You can preview the form using the Preview button and read the form description to confirm this is indeed the right one for you.

- All of the forms are vetted by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Colorado Contract for Part-Time Assistance from Independent Contractor.

- Use your account to view the legal documents you have previously acquired.

- Navigate to the My documents tab of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

The 2 year contractor rule refers to a guideline used by the IRS to classify the relationship between contractors and employers. Under this rule, if you continuously work as an independent contractor for more than two years, your relationship with the client may shift, potentially leading to reclassification as an employee. It is important to have a well-drafted Colorado Contract for Part-Time Assistance from Independent Contractor to clarify the terms and maintain your contractor status. Engaging with legal documents from uslegalforms can help ensure compliance and protect your interests.

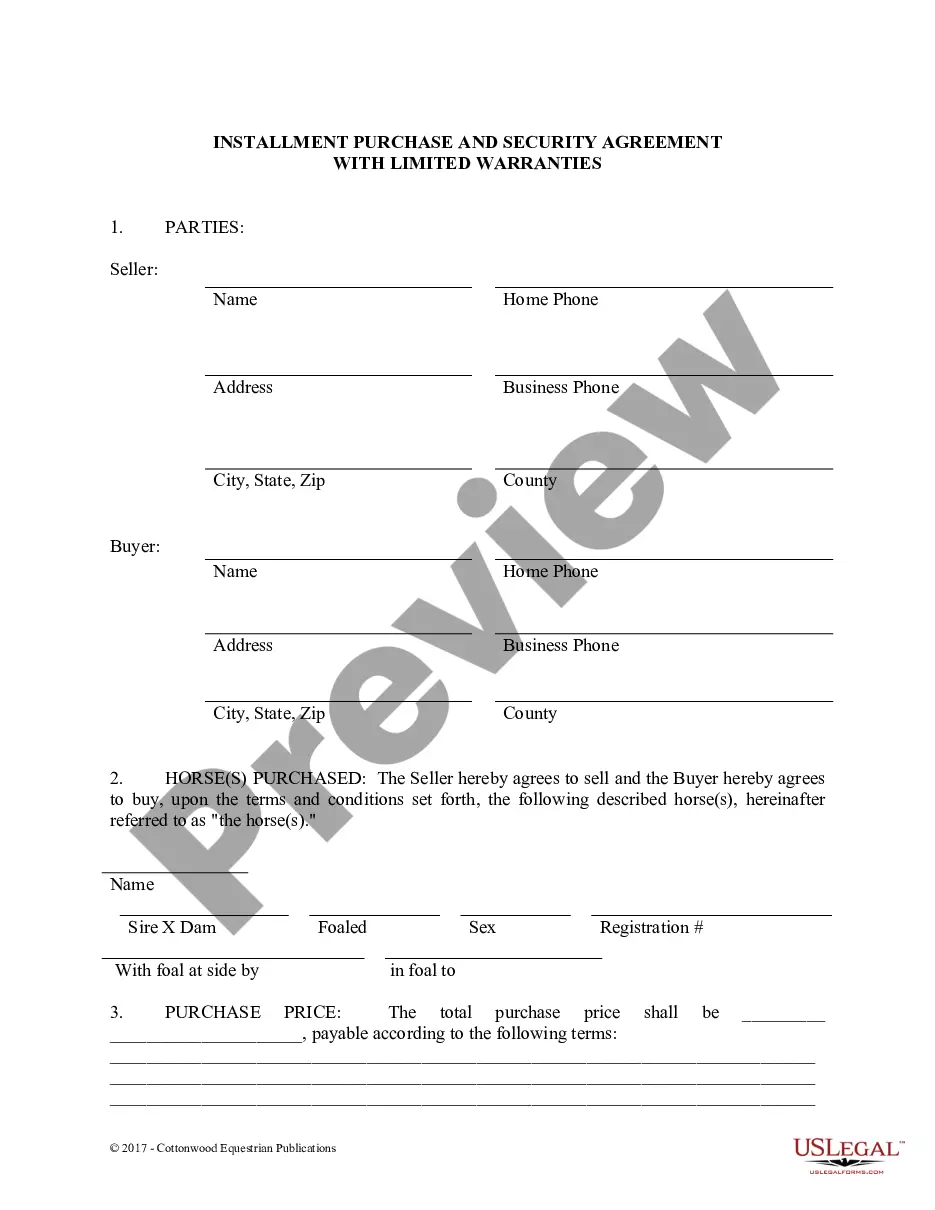

Writing a contract as an independent contractor involves several key steps. Start by outlining the project scope, deliverables, and payment terms in your Colorado Contract for Part-Time Assistance from Independent Contractor. Include provisions for timelines, confidentiality, and termination to cover all aspects of your arrangement. If you need assistance, uslegalforms offers resources to help you draft a professional contract.

Yes, you can technically be a 1099 employee without a formal contract, but it is not advisable. Without a Colorado Contract for Part-Time Assistance from Independent Contractor, the details of your work arrangement remain ambiguous. This can lead to confusion regarding roles, responsibilities, and payment terms. A contract provides clarity and legal protection for both parties involved.

Absolutely, having a contract for an independent contractor is vital for a successful partnership. A well-drafted Colorado Contract for Part-Time Assistance from Independent Contractor serves as a framework for your collaboration. It specifies important details like deliverables, timelines, and compensation, ensuring both parties are aligned. This proactive approach minimizes potential conflicts.

Not having a contract can lead to various complications, as the terms of the working relationship may become unclear. In the absence of a Colorado Contract for Part-Time Assistance from Independent Contractor, you risk disputes over payments and responsibilities. This uncertainty could result in losses or legal issues down the line. It’s important to document the agreement to safeguard your interests.

Yes, independent contractors should have a contract to outline the terms of their work. A Colorado Contract for Part-Time Assistance from Independent Contractor clarifies expectations and protects both parties. It establishes payment terms, project scope, and deadlines, reducing misunderstandings. Having a contract helps foster a professional relationship.

Setting up an independent contractor agreement is straightforward. You need to outline the scope of work, terms of payment, and duration of the contract. A well-crafted Colorado Contract for Part-Time Assistance from Independent Contractor provides a solid foundation for this agreement. You can find templates and guidelines on platforms like uslegalforms, simplifying the process and ensuring all essential elements are included.

Yes, as an independent contractor, you generally have the freedom to set your own hours. This flexibility allows you to balance your work and personal commitments as you see fit. When you create a Colorado Contract for Part-Time Assistance from Independent Contractor, specify your working hours to ensure your availability aligns with client expectations. Clear communication of hours helps maintain a positive working relationship.

Absolutely, you can work part-time as a contractor. Many businesses rely on independent contractors to help with projects on a part-time basis. By using a Colorado Contract for Part-Time Assistance from Independent Contractor, you can define the scope and hours of work, ensuring clarity for both you and the contractor. This flexibility makes contracting a popular option for many seeking part-time opportunities.

Yes, a part-time employee can work as a 1099 independent contractor. This arrangement allows you to hire someone for specific tasks without the full benefits associated with traditional employment. A Colorado Contract for Part-Time Assistance from Independent Contractor clearly outlines the responsibilities and payment terms for such agreements. This gives flexibility while ensuring compliance with state regulations.