This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities

Description

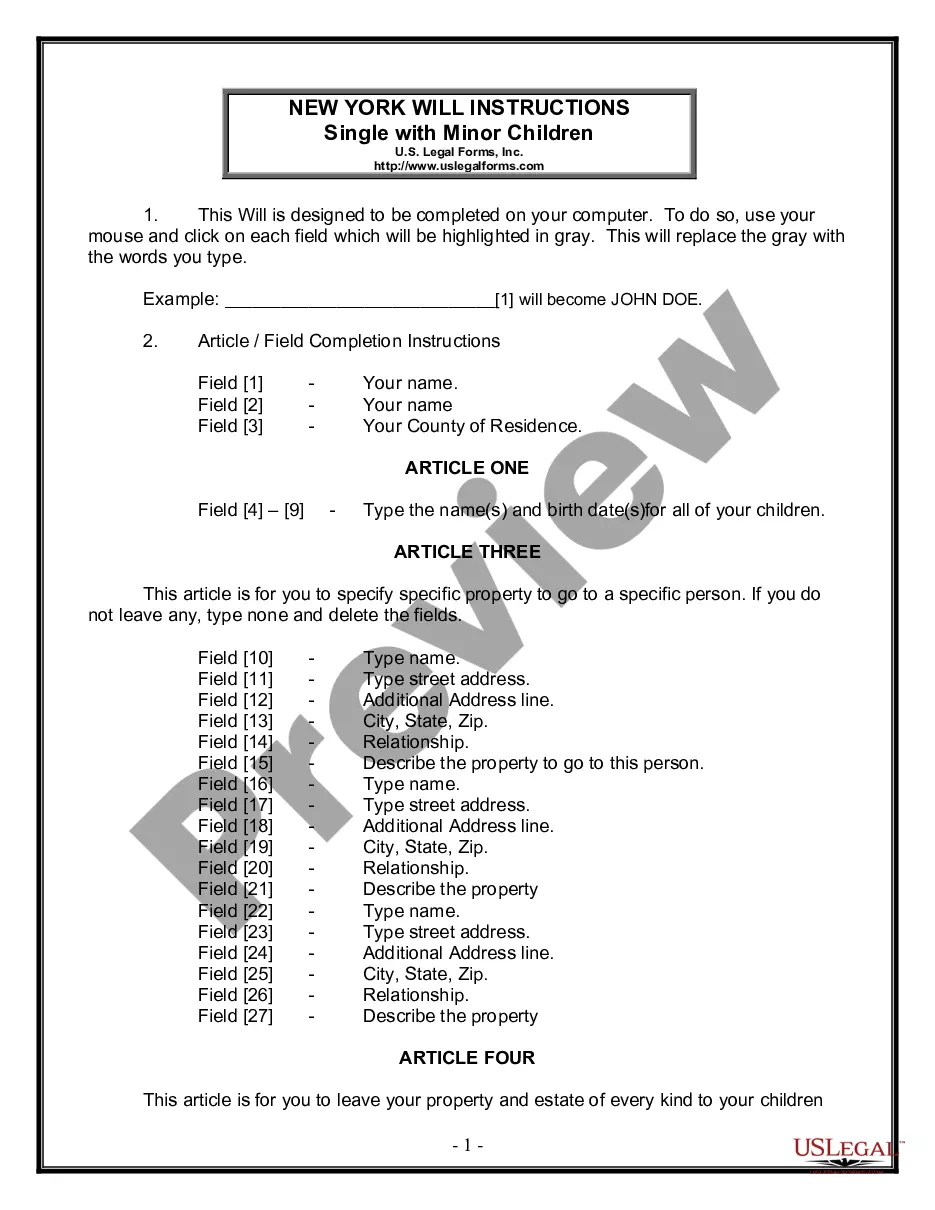

How to fill out Affidavit Of Financial Resources And Debt - Assets And Liabilities?

Are you presently in a situation where you require documents for potential business or specific purposes almost every single day.

There are many authentic document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides a vast array of form templates, including the Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities, which are designed to comply with federal and state requirements.

Once you have obtained the correct form, click Acquire now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient document format and download your copy. You can find all the document templates you have purchased in the My documents section. You can retrieve another copy of the Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities whenever needed. Just select the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for your specific city/county.

- Use the Review option to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you're looking for, utilize the Search field to find a form that meets your needs and requirements.

Form popularity

FAQ

To fill out a child support affidavit, gather all relevant financial documents such as income records and expense summaries. Enter the financial information carefully, ensuring that it reflects your ability to provide support. This information is crucial for calculating child support obligations, particularly in the context of the Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities, so accuracy is key.

Financial requirements for an affidavit of support generally include proof of income that meets minimum thresholds set by immigration laws. You must demonstrate the ability to support the immigrant without government assistance. For clarity on these requirements related to the Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities, consulting the US Legal Forms platform can provide you with detailed guidance.

A financial affidavit should include a complete overview of your financial situation. This means detailing your income, expenses, assets, investments, and any outstanding debts. When preparing your Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities, completeness will improve the document’s effectiveness in court.

To fill out a financial statement for divorce, start by itemizing all assets and liabilities. Include income details, monthly expenses, and any debts. Ensure accuracy, as the financial statement must reflect your true financial position under the guidelines of the Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities. Using our US Legal Forms platform can simplify this process with structured templates.

In a financial affidavit, you should include your income, expenses, assets, and liabilities. This information is essential for a comprehensive view of your financial situation, especially when dealing with the Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities. Accuracy and completeness are vital, as this document will influence financial decisions in legal matters.

An affidavit should contain your personal information, such as your name and address, as well as a clear statement of the facts you are swearing to. It should also include any relevant financial details pertaining to the Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities. Lastly, the affidavit must be signed in the presence of a notary public to confirm its validity.

Financial disclosure requirements refer to the specific information that an individual must provide regarding their financial status in legal settings. These requirements include detailed outlines of income, assets, expenses, and debts, ensuring a complete understanding of one's financial situation. In Colorado, completing the Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities meets these financial disclosure requirements during legal proceedings.

Yes, Colorado is a mandatory disclosure state, meaning that individuals in legal proceedings are required to disclose their financial resources and liabilities formally. This requirement aids in ensuring fairness and transparency during disputes such as divorces or child support cases. Utilizing tools like the Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities can help you fulfill these legal obligations effectively.

In Colorado, mandatory financial disclosures typically involve providing a detailed overview of financial resources, including income, assets, investments, and debts. Parties involved in legal proceedings are required to submit this information to facilitate fair outcomes. Utilizing the Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities ensures you meet these mandatory disclosure requirements efficiently and correctly.

Mandatory disclosures in financial statements include specific information that an individual or organization must provide to comply with legal and regulatory requirements. These disclosures ensure transparency and help stakeholders make informed decisions. In the context of the Colorado Affidavit of Financial Resources and Debt - Assets and Liabilities, mandatory disclosures help establish a complete picture of an individual's financial situation during legal processes.