The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

Colorado Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities

Description

How to fill out Debtor's Affidavit Of Financial Status To Induce Creditor To Compromise Or Write Off The Debt Which Is Past Due - Assets And Liabilities?

If you want to be thorough, acquire, or create legal document templates, utilize US Legal Forms, the foremost collection of legal forms available online.

Use the site's straightforward and convenient search to find the documents you require.

A selection of templates for business and personal purposes is organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get Now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the payment. Step 6. Select the file format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Colorado Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities.

- Utilize US Legal Forms to obtain the Colorado Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to retrieve the Colorado Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Verify that you have selected the form for the correct city/state.

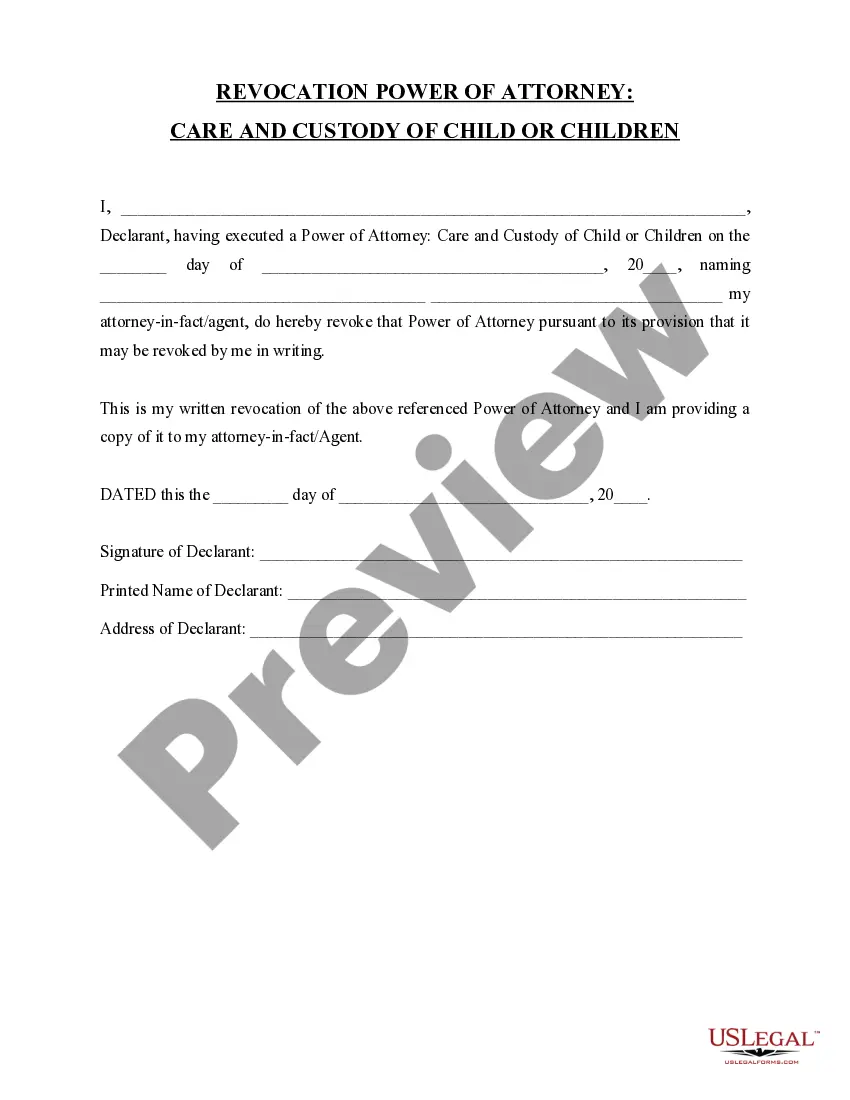

- Step 2. Use the Preview option to review the form’s content. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The word bankrupt comes from the Latin banca rupta, which literally means broken bench, after the practice of moneylenders breaking the table they used when they were no longer in business.

Chapter 11 refers to the chapter of the US Bankruptcy Code that sets out the statutory procedure for reorganisation proceedings under US bankruptcy law. (US bankruptcy law is a federal law that applies across all US states.)

Start by sending a friendly reminder to your customers stating they are late and reminding them of your payment terms. They may have a good reason for being late such as losing track of the due date or paying into the wrong bank account.

The actions to be taken by an agency to collect the debt, such as adding interest and late charges, offset or garnishment, foreclosure of collateral property, and credit bureau reporting.

Follow these strategies to avoid falling into a hole of debt.If you can't afford it without a credit card, don't buy it.Have a fallback emergency fund.Pay off your credit card balances in full.Cut-out the wants, focus on the needs.Everything is better with a budget.Do not use your credit card for cash advances.More items...

In most cases, paying off Chapter 13 early isn't a good idea. By paying off Chapter 13 early, you're required to repay 100 percent of the debt you owe to your creditors instead of the reduced amount.

Chapter 11 can be done by almost any individual or business, with no specific debt-level limits and no required income. Chapter 13 is reserved for individuals with stable incomes, while also having specific debt limits.

If your debt isn't for your mortgage or another secured loan, your creditor can take legal action to stop you selling your home. This power is called inhibition and is used by a creditor to safeguard the value in your property.

This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time.

Emerging from bankruptcy means to successfully come through bankruptcy after a reorganization or elimination of debts. Although in common usage the term "emergence" generally applies more to corporate bankruptcies, it also describes the end of the personal bankruptcy process.