Colorado Agreement to Assign Lease to Incorporator in Forming Corporation

Description

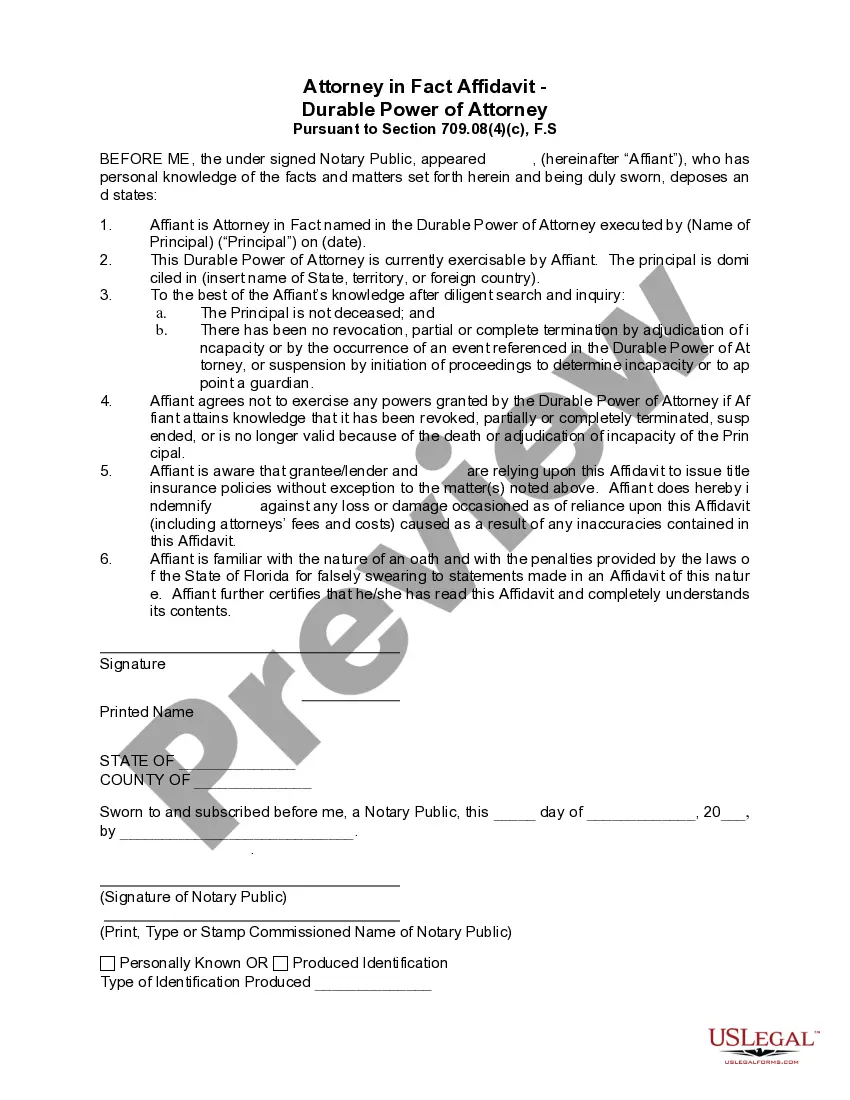

How to fill out Agreement To Assign Lease To Incorporator In Forming Corporation?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal template formats that you can download or print. By using the website, you will find thousands of forms for business and individual purposes, organized by categories, states, or keywords.

You can access the most recent versions of forms such as the Colorado Agreement to Assign Lease to Incorporator When Forming a Corporation in just seconds.

If you already have a monthly membership, Log In and download the Colorado Agreement to Assign Lease to Incorporator When Forming a Corporation from your US Legal Forms repository. The Acquire button will appear on each document you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Colorado Agreement to Assign Lease to Incorporator When Forming a Corporation. Every template you have added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the document you need. Access the Colorado Agreement to Assign Lease to Incorporator When Forming a Corporation with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific formats that meet your business or personal requirements.

- Make sure you have selected the correct form for your city/state.

- Click the Preview button to review the form’s details.

- Read the form description to confirm that you have chosen the right document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy Now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

A lease assignment transfers the original tenant's rights and responsibilities under the lease to a new tenant. Typically, the original tenant must obtain the landlord's approval before completing the assignment. For those using a Colorado Agreement to Assign Lease to Incorporator in Forming Corporation, understanding this process can help facilitate smoother transitions and maintain legal compliance.

The purpose of an assignment clause in a lease is to give landlords control over who can occupy their property and ensure that the new tenant is qualified. This clause protects landlords from potential risks associated with unvetted tenants. In the context of a Colorado Agreement to Assign Lease to Incorporator in Forming Corporation, this clause plays a crucial role in maintaining the integrity of lease agreements.

Yes, landlords can refuse a lease assignment if the lease agreement includes a clause that requires their consent. However, the refusal must be reasonable and not based on arbitrary or discriminatory reasons. When handling a Colorado Agreement to Assign Lease to Incorporator in Forming Corporation, it is vital to understand your rights and obligations regarding lease assignments to avoid potential disputes.

The assignment clause in a lease agreement outlines the tenant’s ability to transfer their lease obligations to another party. This clause specifies whether the tenant can assign the lease without the landlord's consent. If you are working with a Colorado Agreement to Assign Lease to Incorporator in Forming Corporation, understanding this clause can help you navigate lease transfers effectively.

An example of an assignment clause could state, 'The tenant shall not assign or sublet the premises without the landlord's prior written consent.' This type of clause ensures landlords maintain control over who occupies their property. When dealing with a Colorado Agreement to Assign Lease to Incorporator in Forming Corporation, it’s important to consider how the assignment clause affects your lease agreements.

To add an owner to your LLC in Colorado, you must revise your operating agreement to include the new member's details. It is equally important to notify existing members and comply with any state filing requirements. After making these changes, file the necessary documents with the Colorado Secretary of State for official recognition. Consider the Colorado Agreement to Assign Lease to Incorporator in Forming Corporation as a resource to support you in this process.

Forming a corporation in Colorado requires filing Articles of Incorporation with the Secretary of State. You will need to choose a unique name for your corporation and designate a registered agent. Additionally, creating bylaws is essential for internal operations. The Colorado Agreement to Assign Lease to Incorporator in Forming Corporation can provide a structured approach, making the process clearer and more efficient.

An LLC in Colorado can have multiple DBAs (Doing Business As), allowing for flexibility in branding. Each DBA must be registered with the state to ensure compliance. However, it's crucial to keep track of each name to avoid confusion in your operations. Utilizing resources like US Legal Forms can assist you in managing these registrations smoothly.

Yes, you can add a co-owner to your LLC, and the process is manageable with the right documentation. Ensure that you revise your operating agreement to reflect this change. Filing the necessary paperwork with the Colorado Secretary of State is also essential for proper legal recognition. The Colorado Agreement to Assign Lease to Incorporator in Forming Corporation can help guide you through these steps seamlessly.

Adding someone to an LLC is generally a straightforward process, though it requires compliance with state laws. You will need to update your operating agreement and inform any existing members. If you're unfamiliar with the procedure, using resources like the Colorado Agreement to Assign Lease to Incorporator in Forming Corporation can facilitate a smoother transition, ensuring legal safeguards.