Colorado Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

Have you ever found yourself in a situation where you need to obtain documents for business or personal reasons almost all the time.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

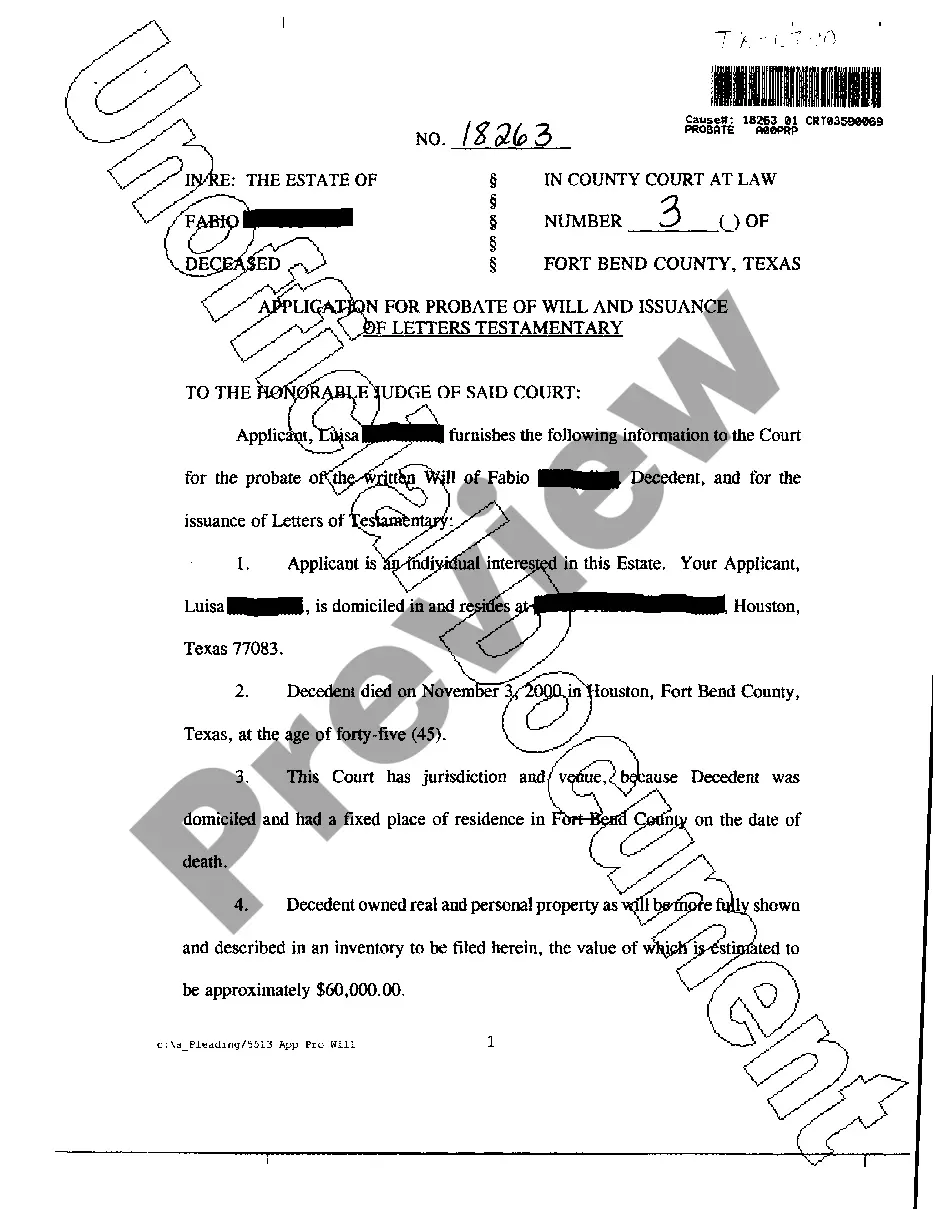

US Legal Forms offers an extensive selection of document templates, including the Colorado Revocable Trust for Asset Protection, which is designed to comply with federal and state regulations.

Select the payment plan you prefer, enter the required details to create your account, and complete your purchase using PayPal or a credit card.

Choose a convenient file format and download your copy. You can access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Colorado Revocable Trust for Asset Protection whenever necessary. Just select the required document to download or print the template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. This service provides properly crafted legal document templates for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Colorado Revocable Trust for Asset Protection template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you need and ensure it is for the correct city/region.

- Utilize the Review button to evaluate the form.

- Check the description to confirm you have chosen the correct document.

- If the document is not what you require, use the Search field to find the template that fits your needs and specifications.

- Once you find the right document, click Buy now.

Form popularity

FAQ

The major disadvantage of a trust, like a Colorado Revocable Trust for Asset Protection, is that it does not provide protection from creditors while you are alive. This means that if you face legal or financial issues, your assets in the trust could still be accessed by creditors. Therefore, careful planning and thorough understanding of your financial situation are crucial.

One key disadvantage of a family trust, including a Colorado Revocable Trust for Asset Protection, is that it may require ongoing management and legal oversight. Furthermore, if the trust is not set up properly, it can lead to unintended tax implications. Regular consultations with a legal expert are essential to navigate these complexities effectively.

Considering a Colorado Revocable Trust for Asset Protection can be beneficial for your parents, especially if they want to manage their assets efficiently and reduce the risk of probate. It provides them with the flexibility to modify the trust as their circumstances change. By placing their assets in a trust, they can maintain control while ensuring their wishes are honored.

To create a Colorado Revocable Trust for Asset Protection, start by drafting a trust document that outlines your assets and the terms of the trust. You can include specific provisions for asset management and distribution. It's advisable to consult with a legal professional who specializes in trusts to ensure all necessary legal requirements are met and your assets are well-protected.

Several states have strong trust laws, yet Colorado’s emphasis on the Colorado Revocable Trust for Asset Protection offers unique benefits. It combines estate planning ease with a manageable approach to asset distribution. If you seek to optimize your asset protection strategy, consulting with professionals familiar with Colorado laws can guide you in making informed decisions.

The best type of trust for asset protection often depends on your individual situation, but the Colorado Revocable Trust for Asset Protection is a solid choice for many. It allows for the management of assets during your lifetime while providing flexibility for changes. For more robust protection against creditors, exploring irrevocable trusts may also be beneficial.

In Colorado, certain assets are typically protected from lawsuits, including pensions, some retirement accounts, and specific types of trust assets. However, the Colorado Revocable Trust for Asset Protection can also play a role by ensuring your assets are managed and distributed according to your needs. It’s wise to consult with legal professionals to understand how to maximize protection effectively.

The Colorado Revocable Trust for Asset Protection aids in protecting assets mainly through efficient management and transfer during your lifetime. While it does not offer total protection from creditors, it ensures your assets are distributed according to your wishes and can avoid some complications associated with probate. Additionally, its flexibility allows for amendments as your circumstances change.

Choosing between a will and a trust in Colorado depends on your specific estate planning goals. A Colorado Revocable Trust for Asset Protection can provide management advantages and avoid probate, which is beneficial for many. In contrast, a will is straightforward but may lead to prolonged probate processes without the same level of control over assets.

A revocable trust, including the Colorado Revocable Trust for Asset Protection, offers some benefits but is not a complete shield against creditors. The primary purpose of such trusts is to manage assets efficiently and avoid probate. To enhance asset protection, it might be wise to explore irrevocable options or other financial strategies.