Colorado Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

It is feasible to spend hours on the internet trying to locate the legal document template that satisfies the national and state requirements you require.

US Legal Forms offers a wide array of legal templates that are evaluated by experts.

It's easy to obtain or create the Colorado Private Annuity Agreement from their service.

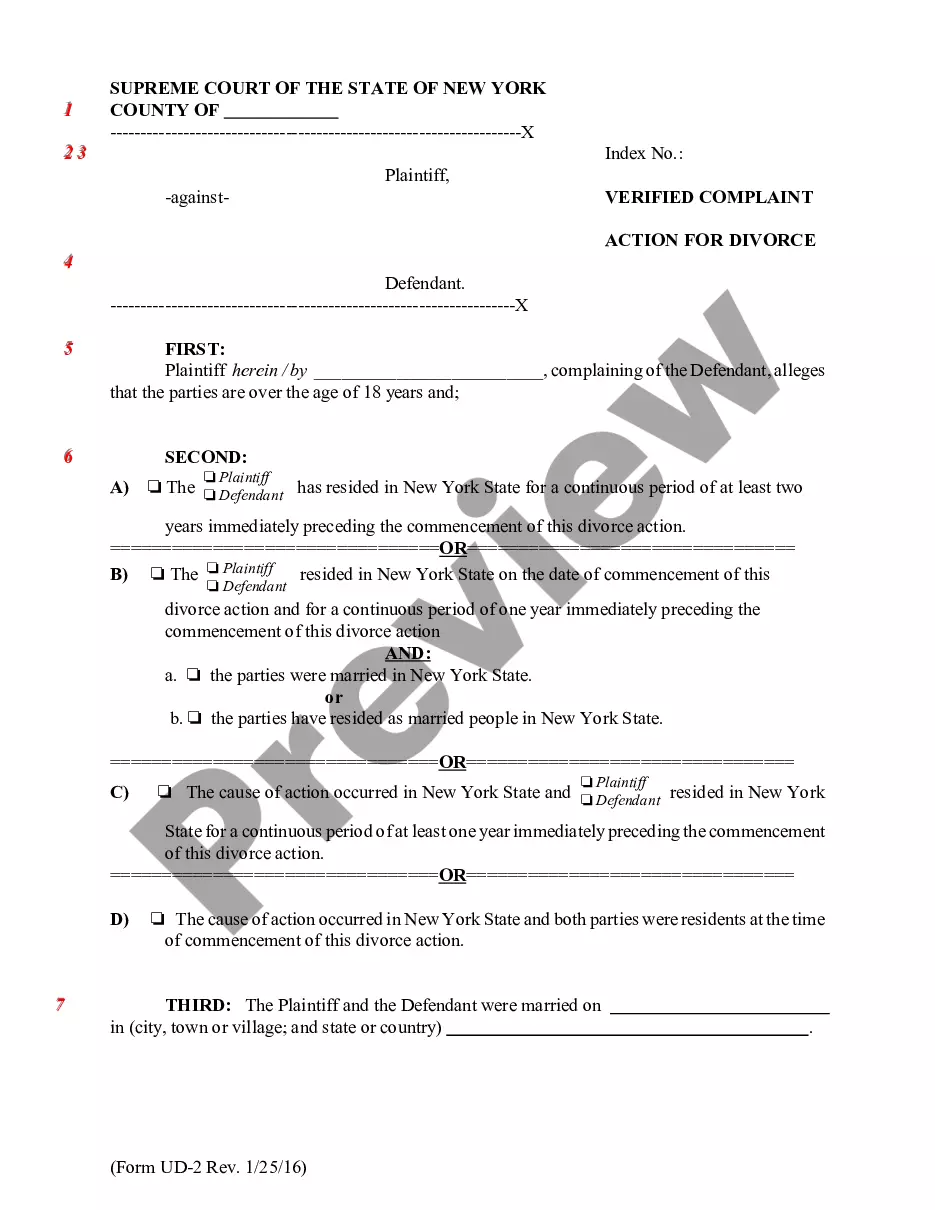

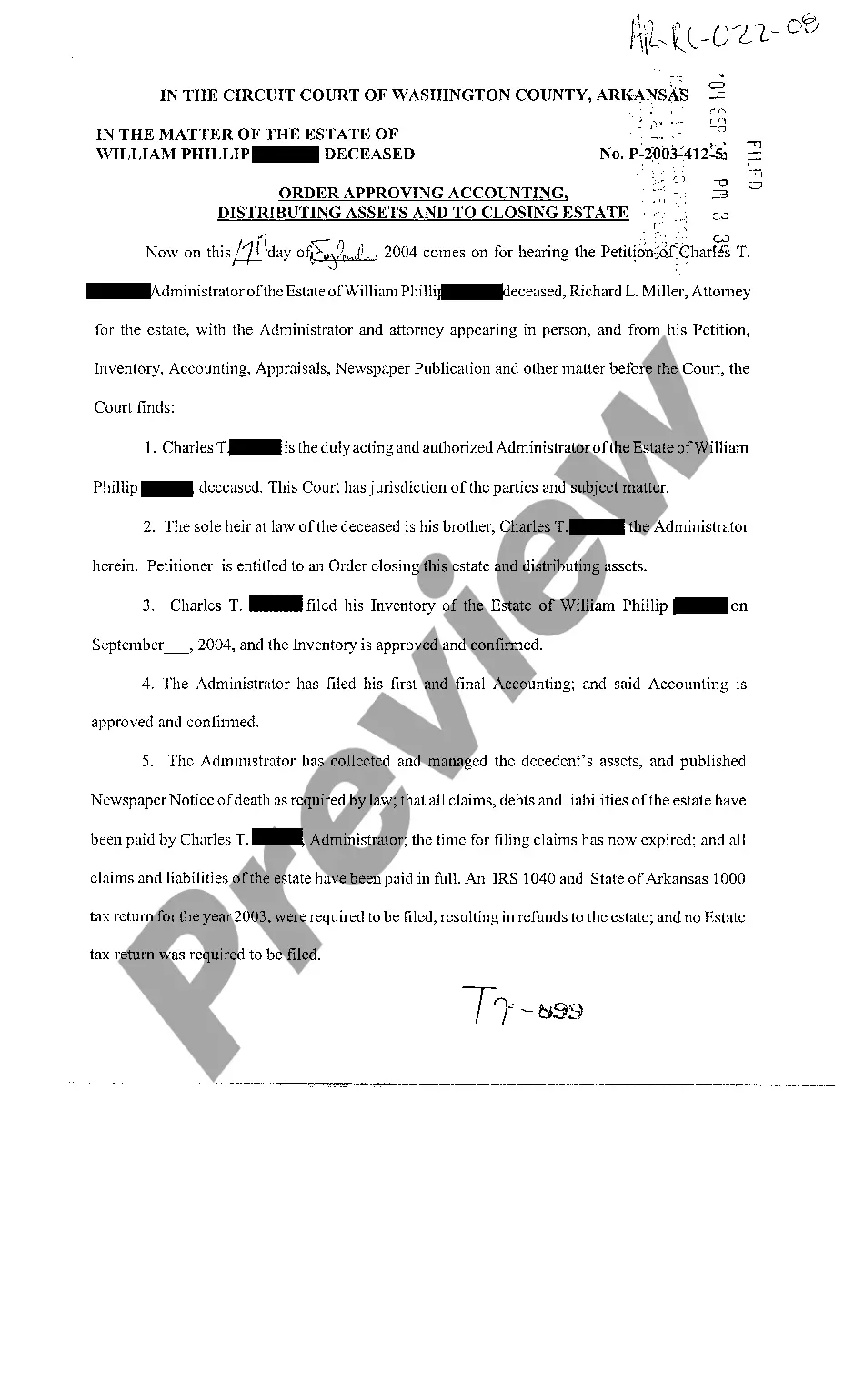

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the Colorado Private Annuity Agreement.

- Each legal document template you obtain is yours permanently.

- To acquire another copy of the purchased form, visit the My documents tab and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the state/region you choose.

- Review the form details to confirm you have selected the right template.

Form popularity

FAQ

One significant disadvantage of an annuity is the potential for reduced liquidity. Once you invest in a Colorado Private Annuity Agreement, accessing your funds can become complicated or delayed. Additionally, surrender charges may apply if you decide to withdraw from the annuity early. Understanding these limitations helps you make an informed decision.

In Colorado, the pension and annuity exclusion allows retirees to deduct a certain amount of their pension and annuity income from state taxes. Generally, this exclusion applies to the first $100,000 for individuals and $200,000 for couples filers. However, not all private annuity agreements automatically qualify. Therefore, understanding the specifics of your Colorado Private Annuity Agreement is crucial for maximizing tax benefits.

A private annuity may come with several disadvantages. First, the seller might face a loss of control over the assets used to fund the agreement. Furthermore, since the payments are made over time, there could be tax implications affecting your income. It's essential to weigh these factors carefully when considering a Colorado Private Annuity Agreement.

Several factors create nexus in Colorado, such as having employees, property, or significant sales within the state. For businesses involved in a Colorado Private Annuity Agreement, these factors can be crucial for tax purposes. Regularly assessing your business activities can help you stay informed about your nexus status.

Nexus in Colorado is determined by the business's level of connection to the state, which can include physical presence, sales amounts, or employee location. Factors such as entering into a Colorado Private Annuity Agreement may also create nexus. It's important to analyze your business operations closely for compliance.

Doing business in Colorado includes various activities such as having an office, employing workers, or generating income in the state. Engaging in a Colorado Private Annuity Agreement can also fall under this definition if it establishes an ongoing presence in the state. Be sure to evaluate your business activities to determine your status.

Form 104 is the individual income tax return form used in Colorado. This form is essential for filing your state taxes, including any income derived from a Colorado Private Annuity Agreement. You can find this form online in PDF format, allowing you to fill it out and submit it according to state guidelines.

Yes, having a remote employee in Colorado can create nexus for your business. This means your business may be subject to Colorado state taxes and regulations, including those affecting a Colorado Private Annuity Agreement. Take time to review your business presence in the state to ensure compliance with all applicable laws.

Yes, Colorado does impose taxes on annuities, including distributions from a Colorado Private Annuity Agreement. However, the specific tax obligations can vary based on the annuity type and the taxpayer's situation. It is important to consult with a tax professional to ensure you understand your responsibilities regarding annuity taxation.

The nexus threshold for Colorado income tax generally depends on the amount of business activities conducted in the state. If your operations exceed a certain sales and revenue threshold, your business may establish nexus, thus requiring you to file taxes. Understanding this aspect is crucial, especially when dealing with agreements like a Colorado Private Annuity Agreement.