A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Colorado Receipt by Trustor for Trust Property Upon Revocation of Trust

Description

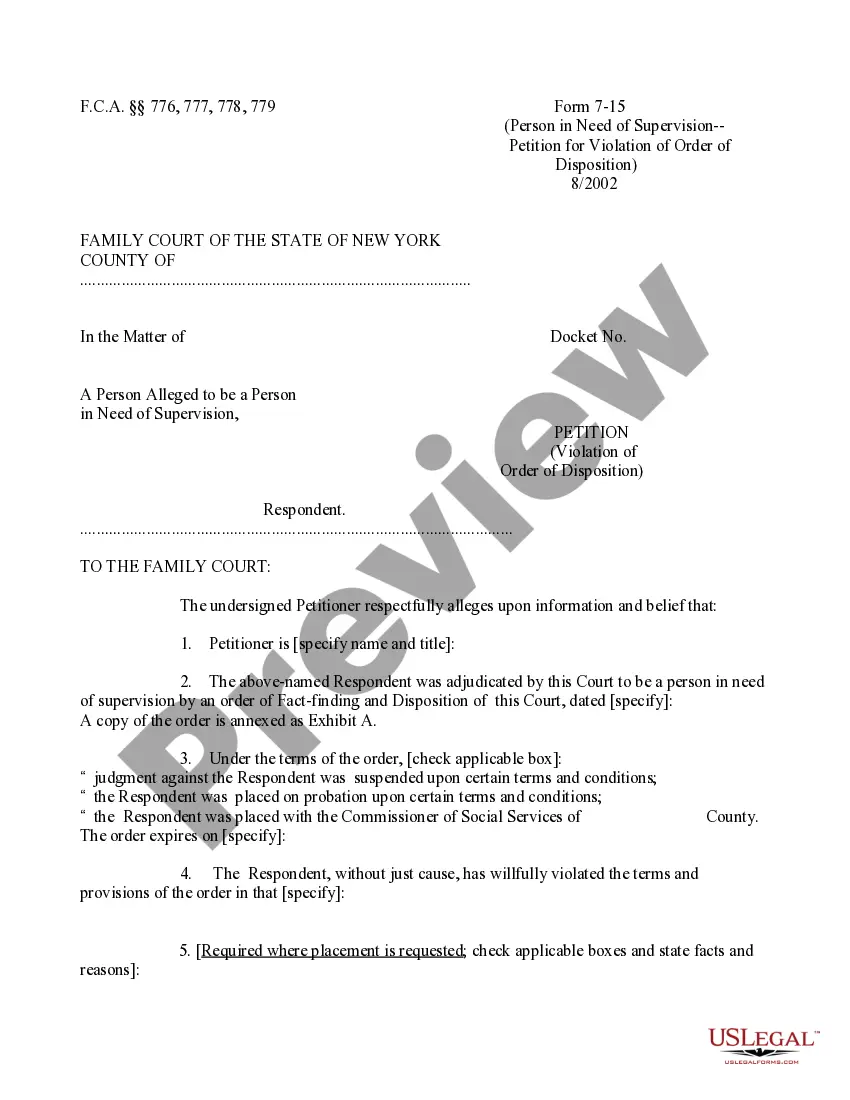

How to fill out Receipt By Trustor For Trust Property Upon Revocation Of Trust?

It is feasible to spend time online looking for the official document template that complies with the state and federal requirements you demand.

US Legal Forms provides an extensive array of official forms that can be reviewed by experts.

It is easy to obtain or print the Colorado Receipt by Trustor for Trust Property Upon Revocation of Trust through our services.

If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, modify, print, or sign the Colorado Receipt by Trustor for Trust Property Upon Revocation of Trust.

- Every official document template you purchase is yours permanently.

- To retrieve another copy of any purchased form, go to the My documents section and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the form description to ensure you have chosen the right one.

Form popularity

FAQ

One disadvantage of a family trust is the potential for disputes among family members regarding the distribution of assets. This can strain familial relationships, particularly if expectations are not clearly communicated. To mitigate this risk, it is wise to have a legally binding document, such as a Colorado Receipt by Trustor for Trust Property Upon Revocation of Trust, that outlines the terms and intentions behind the trust.

In the UK, a common mistake parents make is failing to regularly review and update their trust plans to reflect changes in circumstances. This can lead to outdated or ineffective management of the trust. Parents should ensure they handle any necessary documents, such as a Colorado Receipt by Trustor for Trust Property Upon Revocation of Trust, to maintain clarity and relevance in their trust agreements.

Setting up a trust can come with several pitfalls, such as high initial costs and ongoing maintenance fees. Furthermore, selecting an unqualified trustee can lead to mismanagement of assets. To safeguard against these challenges, consider utilizing a proper legal framework, like obtaining a Colorado Receipt by Trustor for Trust Property Upon Revocation of Trust, which can clarify ownership and management.

Parents often overlook the importance of clearly defining their beneficiaries and the conditions under which the trust will distribute assets. This can lead to confusion and disputes among family members later on. To avoid such issues, obtain a Colorado Receipt by Trustor for Trust Property Upon Revocation of Trust, ensuring your intentions are legally documented and respected.

One downside of a trust is the complexity involved in its setup and maintenance. Moreover, there may be tax implications you need to consider, which can be significant. Additionally, if you plan to revoke the trust, you'll require a Colorado Receipt by Trustor for Trust Property Upon Revocation of Trust, to ensure proper documentation and compliance.

To revoke a revocable trust, a trustor should provide a clear and documented notice of revocation. This notice should include the date and details of the trust, along with a Colorado Receipt by Trustor for Trust Property Upon Revocation of Trust to outline the distribution of assets. It is also important to inform all beneficiaries and any financial institutions involved to prevent any confusion post-revocation. Legal assistance can enhance this process to ensure compliance with state laws.

A trust can be terminated in several ways, with the most common being the expiration of its term, the completion of its purpose, or through a settlor's action. For revocable trusts, the trustor may revoke the trust, typically accompanied by a Colorado Receipt by Trustor for Trust Property Upon Revocation of Trust. Additionally, a court may terminate a trust if deemed necessary, such as when the trust is no longer viable or if it becomes contrary to the trustor's intent.

To dissolve a revocable trust in Colorado, the trustor typically needs to follow a few key steps. First, review the trust document for any specific instructions regarding dissolution. Then, execute a formal revocation, which should include a Colorado Receipt by Trustor for Trust Property Upon Revocation of Trust, detailing which assets are being reverted to the trustor. It is advisable to also notify all relevant parties, such as beneficiaries, to ensure transparency during the process.

The 5-year rule for trusts typically refers to the timeframe within which certain financial transactions may be scrutinized for tax implications or transfer of assets. Understanding how this rule applies can be complex, especially when dealing with revocations. Consulting resources like uslegalforms can help clarify processes, including the Colorado Receipt by Trustor for Trust Property Upon Revocation of Trust, ensuring compliance and legality. It’s important to be aware of these rules to secure your estate effectively.

Upon revocation of a trust, the trust assets are generally returned to the trustor or distributed according to specified terms. It’s vital to execute a Colorado Receipt by Trustor for Trust Property Upon Revocation of Trust to verify the transfer of assets. This document helps provide a record of the transaction and protects the trustor’s rights. Proper management of these assets ensures clarity and minimizes the risk of disputes.