Are you presently in the position in which you require documents for possibly business or individual purposes just about every day time? There are tons of legal record themes available on the Internet, but discovering types you can trust is not straightforward. US Legal Forms delivers 1000s of type themes, much like the Colorado Complaint for Past Due Promissory Note, which can be composed to meet state and federal needs.

In case you are already acquainted with US Legal Forms website and have an account, basically log in. Following that, you can acquire the Colorado Complaint for Past Due Promissory Note format.

Unless you have an profile and want to start using US Legal Forms, abide by these steps:

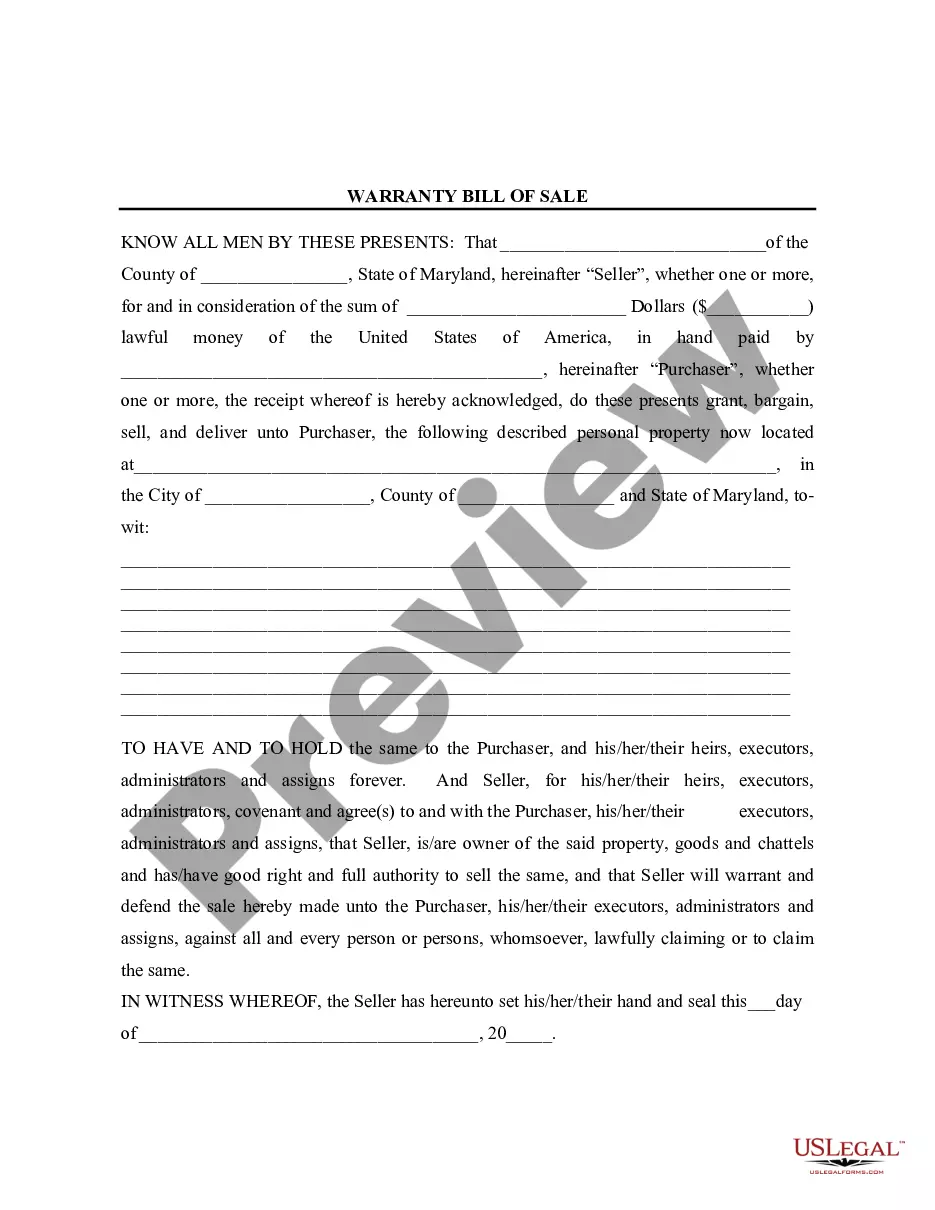

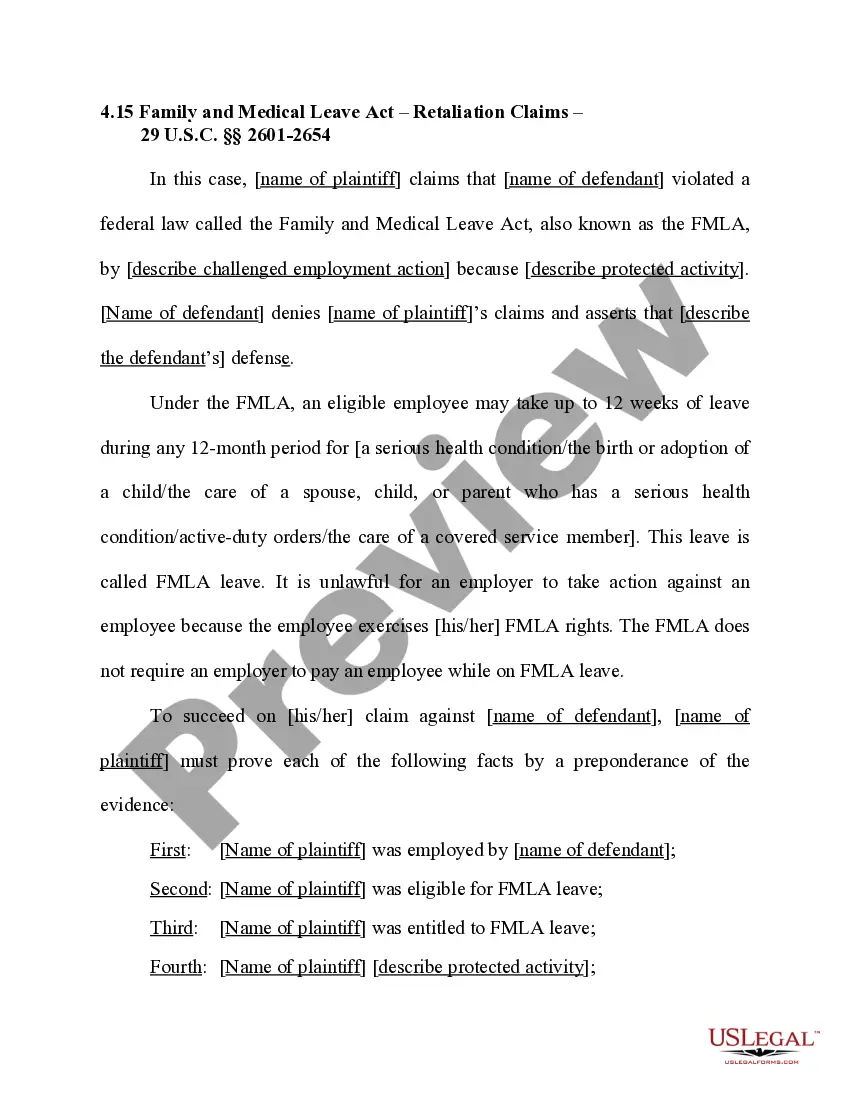

- Get the type you require and ensure it is for that correct metropolis/region.

- Make use of the Preview button to review the form.

- Browse the information to ensure that you have chosen the proper type.

- In the event the type is not what you`re seeking, take advantage of the Lookup industry to find the type that meets your requirements and needs.

- When you get the correct type, simply click Purchase now.

- Opt for the prices program you need, submit the specified info to create your money, and pay money for the transaction utilizing your PayPal or bank card.

- Select a hassle-free file formatting and acquire your copy.

Locate all of the record themes you might have purchased in the My Forms food selection. You may get a additional copy of Colorado Complaint for Past Due Promissory Note at any time, if needed. Just select the needed type to acquire or print the record format.

Use US Legal Forms, by far the most comprehensive assortment of legal types, to conserve some time and prevent mistakes. The support delivers skillfully created legal record themes that you can use for a variety of purposes. Generate an account on US Legal Forms and commence generating your daily life a little easier.