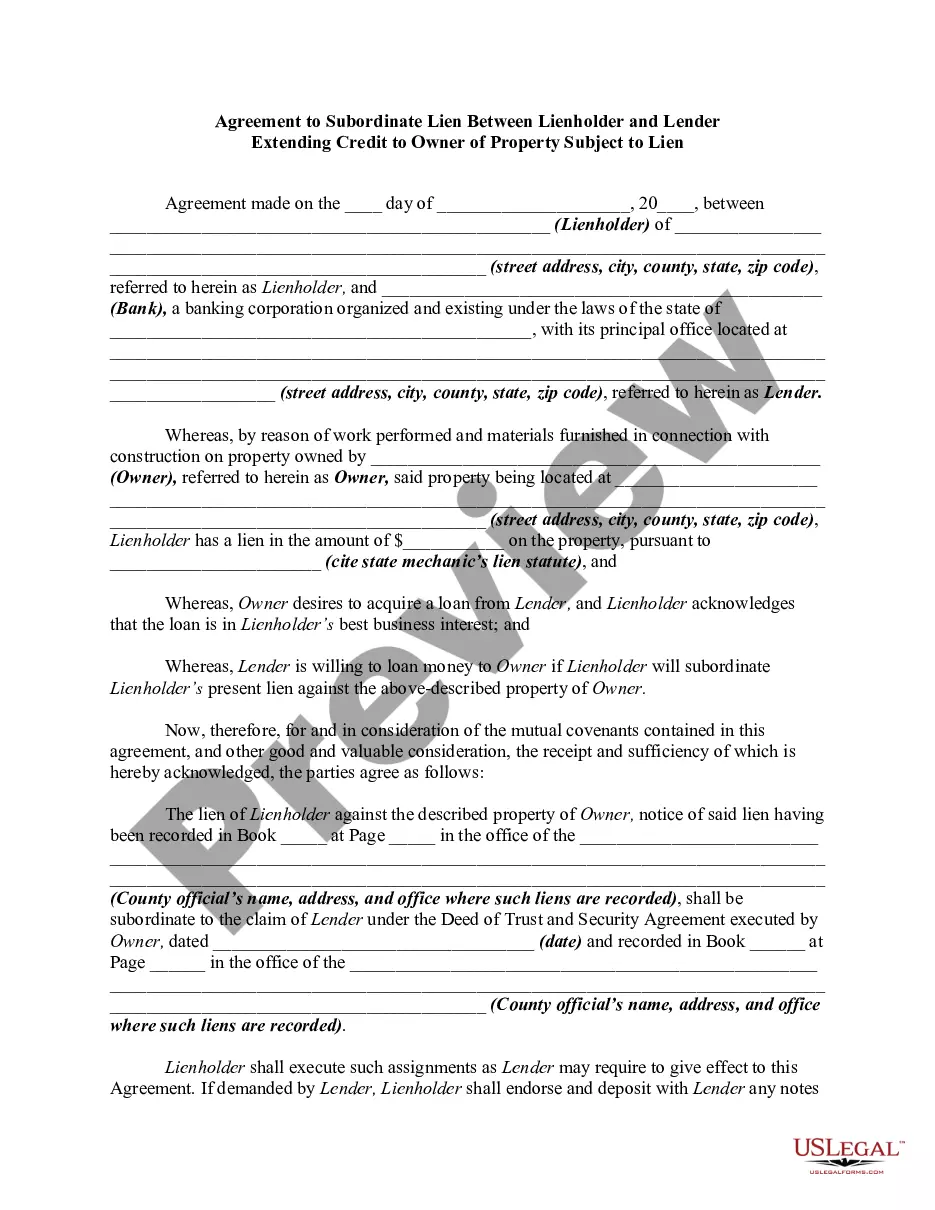

Colorado Subordination Agreement - Lien

Description

How to fill out Subordination Agreement - Lien?

It is feasible to invest hours online trying to locate the legal template that complies with the federal and state requirements you need. US Legal Forms provides a vast array of legal documents that are vetted by experts. You can easily download or print the Colorado Subordination Agreement - Lien from their service.

If you already have a US Legal Forms account, you can Log In and click on the Download button. After that, you can complete, modify, print, or sign the Colorado Subordination Agreement - Lien. Every legal template you obtain is yours permanently. To retrieve another copy of any downloaded form, visit the My documents tab and click on the appropriate button.

If you are accessing the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct format for the area/city of your choice. Read the form description to confirm you have chosen the right document. If available, use the Preview button to review the format as well.

- To find another version of the document, use the Search field to locate the template that suits your needs and requirements.

- Once you have found the format you desire, click Buy now to proceed.

- Select the pricing plan you prefer, enter your details, and create an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

- Select the format of the file and download it to your device.

- Make any necessary changes to the document. You can complete, modify, and sign and print Colorado Subordination Agreement - Lien.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

When you get a mortgage loan, the lender will likely include a subordination clause essentially stating that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender if a homeowner defaults.

A Subordination Agreement is a legal document that establishes the priority of liens or claims against a specific asset.

There are two ways to subordinate tranches of debt so that one tranche takes priority over the other. The first is called lien subordination, in which two forms of senior, equally ranked debt share the same collateral, but one is given priority over that collateral in case of liquidation.

Payment subordination establishes the hierarchy of interest and principal payments in case of default or liquidation. Senior debt is paid first, followed by junior debt. Lien subordination does not imply payment subordination. In the case of default, payments must continue to be made to all senior lenders equally.

8) Keep the original signed subordination agreement in your file to be given to your title agent to record AT THE SAME TIME they record the RIM easement. Do not record the mortgage subordination agreement ahead of easement recording.

There are many examples of subordinate financing, but some of the most common include: Home Equity Loan. Home equity loans are a type of second mortgage and are taken out against the equity that you have built up in the home. ... Home Equity Line of Credit (HELOC). ... Other Second Mortgages.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on their payments or declares bankruptcy.

An example is a trust document that includes a subordinate clause. This requires it to state that once the primary lien becomes active, a secondary lien becomes automatically subordinate. For instance, if a trust pays education funding as a first priority, the first lien is tuition.