Colorado Revocable Living Trust for Unmarried Couples

Description

How to fill out Revocable Living Trust For Unmarried Couples?

Locating the suitable legal document template can be challenging. Naturally, numerous templates exist on the web, but how can you find the legal form you need? Turn to the US Legal Forms website.

The service provides thousands of templates, such as the Colorado Revocable Living Trust for Unmarried Couples, which you can utilize for both business and personal purposes. Every one of the forms is reviewed by professionals and complies with state and federal regulations.

If you are currently registered, Log In to your account and click on the Obtain button to access the Colorado Revocable Living Trust for Unmarried Couples. Use your account to search for the legal forms you have previously acquired. Navigate to the My documents section of your account to download another version of the document you need.

Choose the file format and download the legal document template to your system. Complete, modify, print, and sign the acquired Colorado Revocable Living Trust for Unmarried Couples. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to obtain professionally-crafted documents that adhere to state requirements.

- First, ensure you have selected the correct form for your jurisdiction/county.

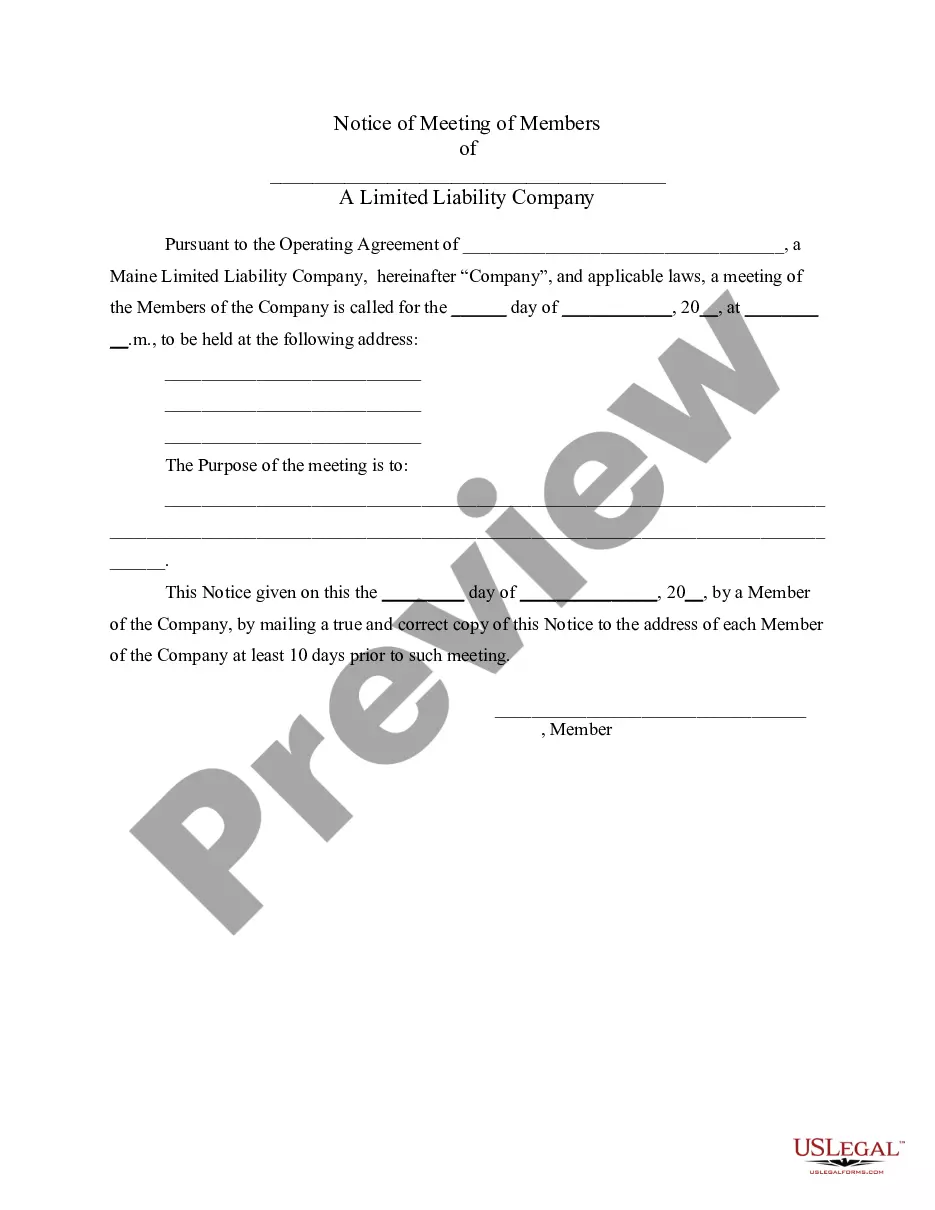

- You can review the form by using the Preview button and check the form outline to confirm it's suitable for you.

- If the form does not meet your needs, utilize the Search field to find the appropriate form.

- Once you are confident the form is suitable, click on the Buy now button to purchase the form.

- Select the pricing plan you wish to use and provide the necessary information.

- Create your account and complete the payment for the order using your PayPal account or credit card.

Form popularity

FAQ

Yes, you can establish a Colorado Revocable Living Trust for Unmarried Couples without your spouse. This type of trust allows you to manage your assets independently and designate beneficiaries as you choose. However, it is advisable to consult with an estate planning attorney to ensure your trust document aligns with your goals and legal requirements.

Filling out a Colorado Revocable Living Trust for Unmarried Couples involves several steps. Begin by identifying the assets you wish to include in the trust and gather necessary information about them. Use a detailed guide or assistance from platforms like uslegalforms to ensure that you complete each section correctly, providing clarity on how you wish to manage your assets.

One downside of a Colorado Revocable Living Trust for Unmarried Couples is that it does not protect your assets from creditors. Additionally, while revocable trusts can provide flexibility during your lifetime, they might not offer the same tax benefits as other estate planning tools. Therefore, it is crucial to evaluate your specific situation and consult with a professional to weigh the pros and cons.

To fill out a Colorado Revocable Living Trust for Unmarried Couples, start by gathering important documents, including titles for property and account information. Next, decide who will be the trustee and the beneficiaries of the trust. Finally, use a trustworthy platform like uslegalforms to guide you in filling out the trust paperwork accurately and efficiently.

When creating a Colorado Revocable Living Trust for Unmarried Couples, it is essential to avoid putting certain types of assets into the trust. Do not place assets that you want to retain control over, like your retirement accounts or life insurance policies, directly into the trust. Additionally, if you own property with someone else, make sure to consult with a legal expert to determine the best way to handle that in your trust.

Absolutely, you can write your own trust in Colorado. It is essential to clearly define your assets and beneficiaries in the Colorado Revocable Living Trust for Unmarried Couples. By doing so, you can specify how your assets should be managed and distributed, which can be particularly beneficial for unmarried couples. Online resources like U.S. Legal Forms can provide templates to ensure that your trust abides by Colorado laws.

Yes, you can write your own living trust in Colorado. A Colorado Revocable Living Trust for Unmarried Couples can be customized to fit your needs and preferences. Make sure to follow legal requirements for valid documents, such as signing and witnessing. Utilizing resources like U.S. Legal Forms can assist you in creating a legally sound trust.

Determining whether a will or trust is better in Colorado depends on your needs and circumstances. Generally, the Colorado Revocable Living Trust for Unmarried Couples provides numerous advantages, such as avoiding probate and allowing for seamless asset management. Unlike a will, a trust can offer ongoing management of your assets in case of incapacity. It’s often wise to consult with a legal professional to decide what best suits your situation.

The best trust for an unmarried couple is often the Colorado Revocable Living Trust for Unmarried Couples. This type of trust provides flexibility and control over your assets during your lifetime and after your passing. By establishing this trust, you can ensure that your partner receives benefits while also retaining the ability to amend the trust as needed. It commonly helps in avoiding probate and providing peace of mind.

Putting your house in a Colorado Revocable Living Trust for Unmarried Couples can provide multiple benefits. This strategy can help avoid probate, ensuring your property transfers smoothly to your beneficiaries upon your passing. It also allows you to maintain control over your property while you are alive, making it easier to manage your assets. Consider using a platform like USLegalForms to simplify the process and ensure compliance with Colorado laws.