Colorado Complex Will - Credit Shelter Marital Trust for Spouse

Description

How to fill out Complex Will - Credit Shelter Marital Trust For Spouse?

Are you presently inside a placement that you will need paperwork for sometimes business or person uses virtually every time? There are tons of legitimate document templates available on the Internet, but finding versions you can rely on isn`t easy. US Legal Forms offers a huge number of develop templates, such as the Colorado Complex Will - Credit Shelter Marital Trust for Spouse, that happen to be written to satisfy federal and state demands.

In case you are presently familiar with US Legal Forms site and get your account, merely log in. After that, you are able to down load the Colorado Complex Will - Credit Shelter Marital Trust for Spouse template.

Should you not provide an account and need to begin using US Legal Forms, abide by these steps:

- Discover the develop you need and make sure it is to the proper city/county.

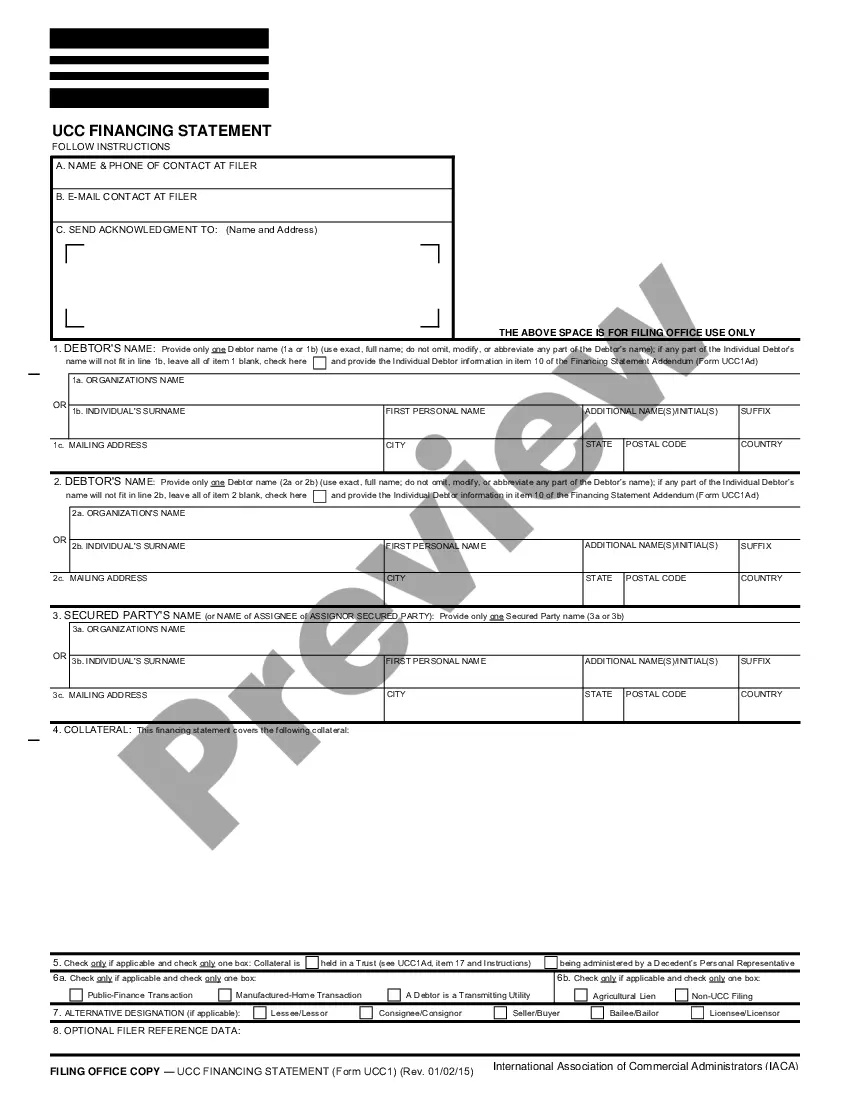

- Utilize the Preview key to review the shape.

- Look at the description to ensure that you have selected the appropriate develop.

- When the develop isn`t what you are searching for, take advantage of the Search area to find the develop that fits your needs and demands.

- Once you find the proper develop, just click Acquire now.

- Opt for the pricing strategy you need, submit the necessary information to create your bank account, and pay for the order using your PayPal or bank card.

- Select a convenient paper format and down load your version.

Discover every one of the document templates you may have purchased in the My Forms menus. You can aquire a further version of Colorado Complex Will - Credit Shelter Marital Trust for Spouse at any time, if possible. Just go through the required develop to down load or print the document template.

Use US Legal Forms, one of the most substantial collection of legitimate kinds, to conserve time and avoid faults. The services offers skillfully manufactured legitimate document templates which can be used for a selection of uses. Generate your account on US Legal Forms and commence generating your life easier.

Form popularity

FAQ

Disadvantages. Irrevocability: A Credit Shelter Trust is irrevocable, which means that the grantor cannot make changes, amendments, or terminate the trust after it is established. This lack of flexibility can be a disadvantage if the grantor's wishes or circumstances change over time. Credit Shelter Trusts: A Powerful Estate Planning Tool for Married ... getsnug.com ? post ? credit-shelter-trusts-a-... getsnug.com ? post ? credit-shelter-trusts-a-...

The major disadvantages that are associated with trusts are their perceived irrevocability, the loss of control over assets that are put into trust and their costs. In fact trusts can be made revocable, but this generally has negative consequences in respect of tax, estate duty, asset protection and stamp duty.

Survivor's Trusts give the surviving spouse more control over their interest in the estate while sheltering more of the decedent's assets from taxes. In other words, the Survivor's Trust acts as the middle ground between too little and too much access.

No. Credit Shelter Trusts are a popular tool for estate planning, and there are two main types of CSTs, the Marital Gift Trust and the Qualified Terminable Interest Property Trust (QTIP). Both of these Trusts preserve wealth via estate tax exemptions. Credit Shelter Trust - What You Need to Know trustandwill.com ? learn ? credit-shelter-trust trustandwill.com ? learn ? credit-shelter-trust

Family trusts can be used to pass on wealth within the family. They allow you to specify who should receive the money and what it should be used for, whether during the settlor's lifetime or after their death. One advantage of using a trust is that it can prevent children from frittering away their inheritances.

Credit shelter trust (CST) (also called an AB trust or a bypass trust) is a tool used by well-off married individuals to legally maximize their estate tax exemptions. The strategy involves creating two separate trusts after one spouse passes. credit shelter trust | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? credit_shelter_trust cornell.edu ? wex ? credit_shelter_trust

Example of a Credit Shelter Trust After the husband dies, his $6 million estate and any income it generated passes free of estate tax to his wife because it falls below the federal exemption. What Is a Credit Shelter Trust (CST)? Role in Estate Taxes Investopedia ? terms ? creditsheltertr... Investopedia ? terms ? creditsheltertr...

A spousal lifetime access trust (SLAT) is a trust created by one spouse (trustmaker spouse) for the benefit of the other (beneficiary spouse). This estate planning tool can be used to retain as much control over your property and assets as possible while not paying any more taxes than you have to.