Colorado Contractor's Final Affidavit of Payment to Subcontractors

Description

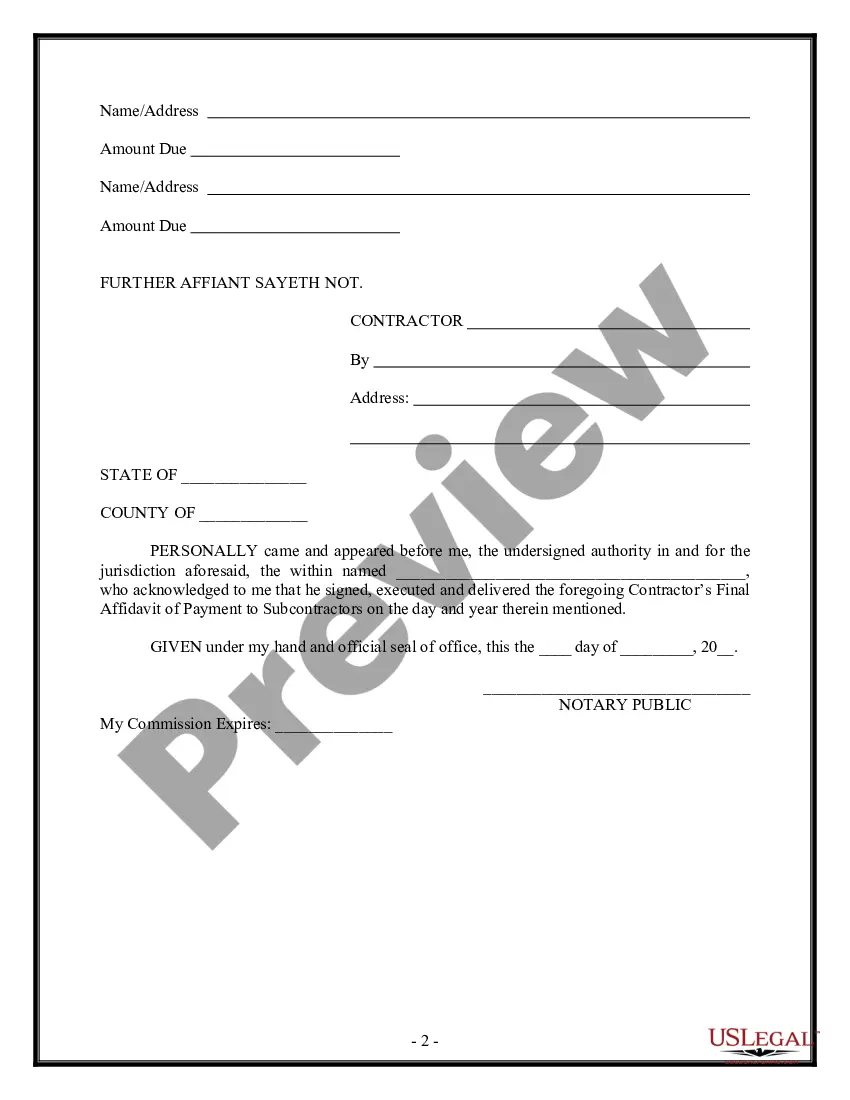

How to fill out Contractor's Final Affidavit Of Payment To Subcontractors?

You can dedicate multiple hours online searching for the valid document template that meets the state and federal criteria you will require.

US Legal Forms provides thousands of legal documents that can be reviewed by experts.

You can conveniently obtain or create the Colorado Contractor's Final Affidavit of Payment to Subcontractors through my assistance.

If available, utilize the Preview feature to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- Next, you can fill out, modify, create, or sign the Colorado Contractor's Final Affidavit of Payment to Subcontractors.

- Every legal document template you purchase is yours permanently.

- To retrieve another copy of any acquired form, navigate to the My documents section and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow these basic instructions below.

- First, confirm that you have selected the correct document template for the region/city of your choice.

- Review the form details to ensure you have chosen the right document.

Form popularity

FAQ

The Colorado Prompt Pay Act establishes a framework for timely payment of contractors and suppliers on public projects. This collection of statutes sets the deadlines for payment, the release of retainage, and imposes interest rates for violations.

CDOT's prompt payment requirements are outlined in Section 109.6(e) of the standard construction specifications. Prime contractors must pay their subcontractors and suppliers within 7 days of receiving payment from CDOT.

Certificate. The document that you send to the subcontractor, usually with the payments, as an acknowledgement of the payment.

Even if you are covered by the builder's policy, it is common in subcontract agreements for the builder to expect that the subcontractor is liable for any damage or injury that they are directly at fault for.

You usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

How to get paid (faster) on every construction projectGet licensed.Write a credit policy.Prequalify potential customers.Get the contract in writing.Collect information about the property and other parties.Track your deadlines.Send Preliminary Notice.Submit Detailed Pay Applications or Invoices.More items...?

When you pay subcontractors, you'll usually need to make deductions from their payments and pay the money to HMRC. Deductions count as advance payments towards the subcontractor's tax and National Insurance bill. You'll need to file monthly returns and keep full CIS records - you may get a penalty if you do not.

When the subcontractor does not get paid then they have grounds to pursue the contractor for monies owed. This could be in the form of wages or unpaid invoices for services rendered. In the USA, the owner of the property can be held liable for payment under a Mechanics Lien.

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.