Vermont Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

How to fill out Resolution Selecting Depository Bank For Corporation And Account Signatories?

US Legal Forms - one of the most substantial collections of legal documents in the United States - provides a wide variety of legal document templates you can download or print.

Through the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can find the latest types of documents such as the Vermont Resolution for Choosing a Depository Bank for Corporation and Account Signatories in just a few moments.

If you already hold a subscription, Log In and download the Vermont Resolution for Choosing a Depository Bank for Corporation and Account Signatories from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Edit. Fill out, modify, print, and sign the downloaded Vermont Resolution for Choosing a Depository Bank for Corporation and Account Signatories.

Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire. Access the Vermont Resolution for Choosing a Depository Bank for Corporation and Account Signatories with US Legal Forms, the most extensive repository of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are straightforward instructions to begin.

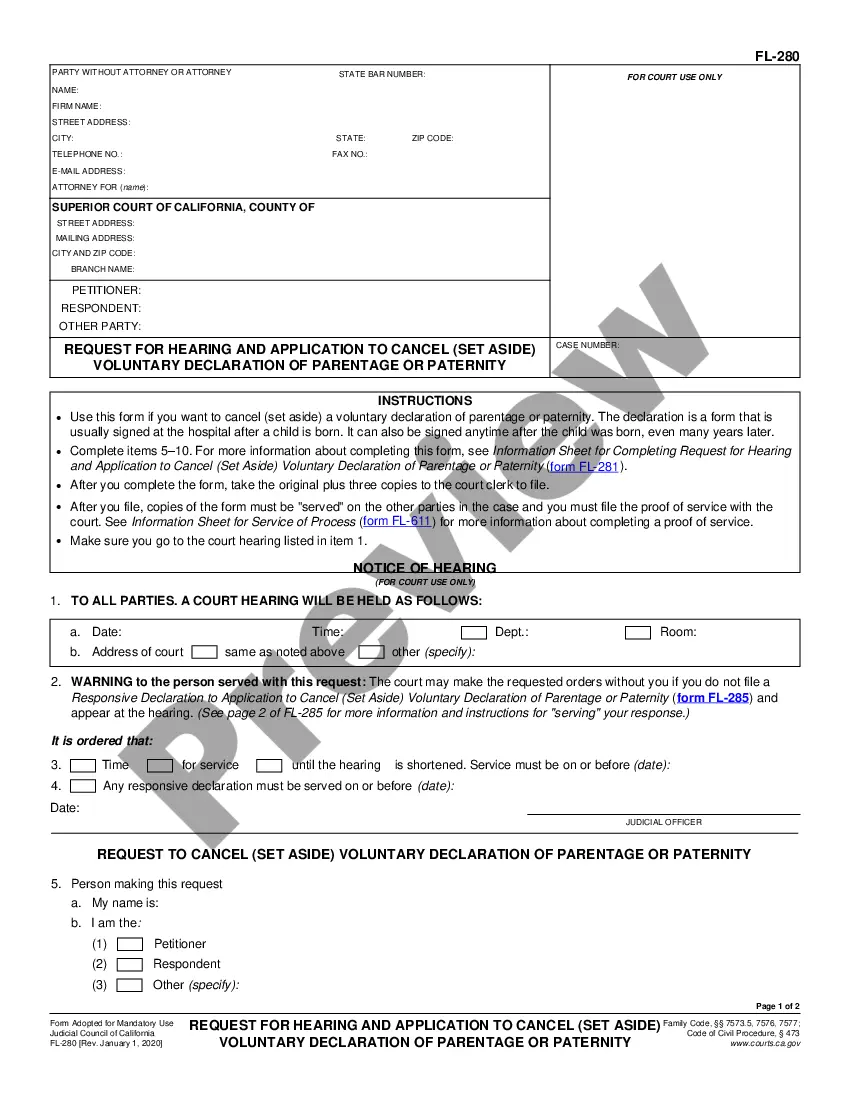

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's details. Check the description to confirm that you have chosen the right form.

- If the form doesn't meet your requirements, utilize the Search box at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the payment plan you prefer and provide your details to register for an account.

- Process the payment. Use your Visa or Mastercard or PayPal account for the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

To fill out a banking resolution, first identify your corporation and state the purpose of the document. Include details about who will serve as authorized signers and what actions they can perform, such as accessing accounts or executing financial instruments. For a seamless experience during Vermont Resolution Selecting Depository Bank for Corporation and Account Signatories, consider using USLegalForms for easy-to-follow templates that guide you through the necessary steps.

A corporate resolution for authorized signer is a formal document that declares specific individuals as having the authority to execute agreements and conduct bank transactions on behalf of the corporation. In relation to Vermont Resolution Selecting Depository Bank for Corporation and Account Signatories, this resolution is vital for establishing trust with banks and ensuring proper account management. It serves as a legal safeguard for both the corporation and the financial institution.

To fill out a corporate resolution form, begin by providing your corporation's name, address, and the official date. Next, clearly outline the decisions being made and specify who is authorized to act on behalf of the corporation in these matters. Utilizing resources from USLegalForms can simplify this process, especially in the context of Vermont Resolution Selecting Depository Bank for Corporation and Account Signatories, ensuring you capture all necessary information correctly.

An authorized signer of a corporation is an individual who has been officially granted the authority to sign documents and make legal commitments for the company. In the framework of Vermont Resolution Selecting Depository Bank for Corporation and Account Signatories, this individual typically holds a significant role, such as a corporate officer or member of the board. Knowing who the authorized signers are is essential for banking and financial operations.

A corporate resolution identifying authorized signers is an official document that outlines which individuals have the authority to act on behalf of a corporation. This document is crucial during the Vermont Resolution Selecting Depository Bank for Corporation and Account Signatories process. By clearly stating the authorized signers, the corporation mitigates risks and ensures that only designated individuals can manage financial transactions.

Proof of signatory authority is documentation that verifies who has the legal power to act on behalf of a corporation. In the context of Vermont Resolution Selecting Depository Bank for Corporation and Account Signatories, this proof ensures that the depository understands who is authorized to manage the corporation's accounts. Such proof typically includes a corporate resolution or similar official documents that define the roles of signers.

Filling out a company resolution to open a bank account involves listing the authority and details of the individuals you intend to designate. Include your corporation’s legal name, the purpose of the resolution, and the specific powers granted to the signers. For efficient processing, familiarize yourself with the bank's requirements and consider utilizing uslegalforms for templates and guidance during Vermont resolution selecting depository bank for corporation and account signatories.

A corporate resolution is a formal document that records decisions made by a corporation's board of directors or shareholders. This may include actions like appointing officers, approving contracts, or opening bank accounts. Understanding the importance of these resolutions is key for effective governance during Vermont resolution selecting depository bank for corporation and account signatories.

A resolution to add a bank signatory is a formal document that authorizes a specific individual to manage a corporation's bank account. It generally includes the individual's name, role, and the extent of their authority. Having this resolution in place is vital for ensuring smooth operations and compliance during Vermont resolution selecting depository bank for corporation and account signatories.

A corporate resolution for a bank account is a document that outlines the authority granted to individuals within a corporation regarding the management of its bank accounts. This includes who can deposit, withdraw, and manage funds. For your organization’s needs, remember that establishing clear guidelines is essential during Vermont resolution selecting depository bank for corporation and account signatories.