This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Colorado Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

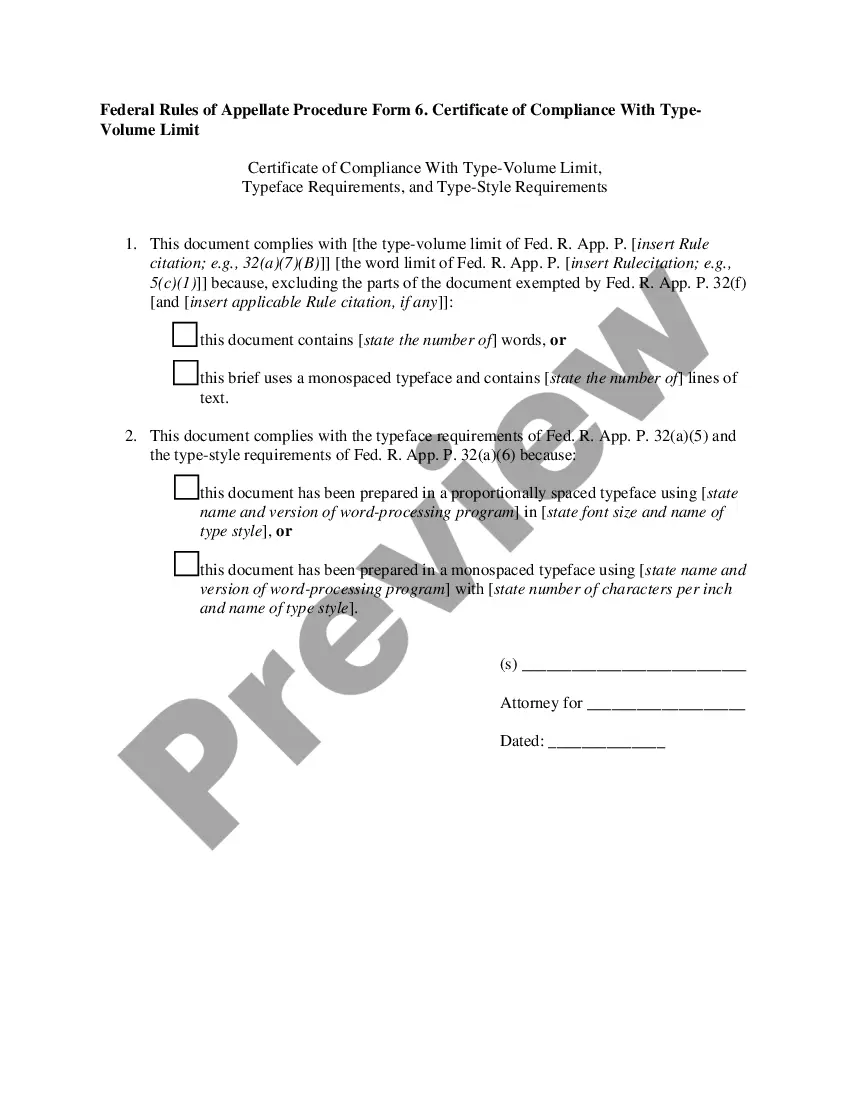

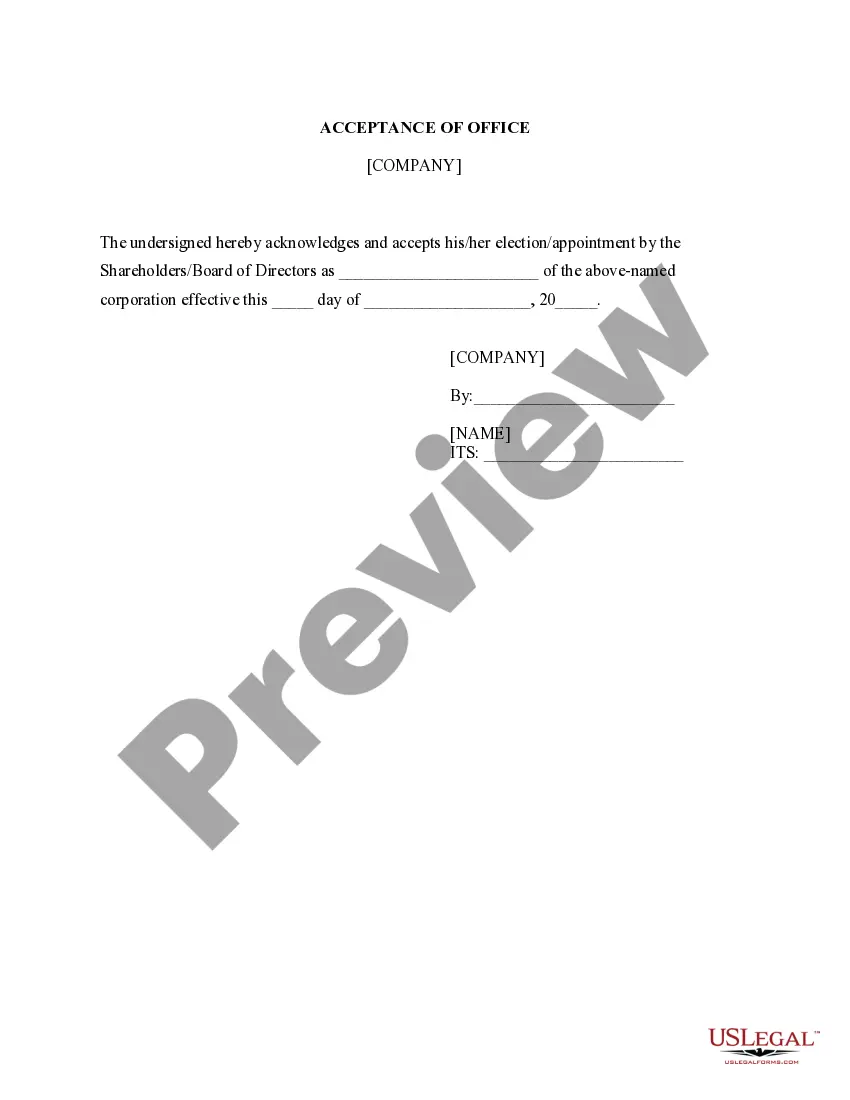

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

It is feasible to spend hours online trying to find the legal document format that satisfies the federal and state criteria you require. US Legal Forms provides a vast array of legal templates that are reviewed by experts.

You can easily download or print the Colorado Application for Release of Right to Redeem Property from IRS After Foreclosure from their services. If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

Then, you can fill out, modify, print, or sign the Colorado Application for Release of Right to Redeem Property from IRS After Foreclosure. Every legal document template you obtain is yours permanently. To get another copy of the purchased form, go to the My documents tab and click on the corresponding button.

Complete the transaction. You can use your credit card or PayPal account to purchase the legal form. Choose the format of your document and download it to your device. Make changes to your document if necessary. You can fill out, modify, and sign and print the Colorado Application for Release of Right to Redeem Property from IRS After Foreclosure. Obtain and print a vast number of document templates using the US Legal Forms site, which offers the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the region/town of your choice.

- Check the form details to confirm you have chosen the right template.

- If available, utilize the Preview button to review the document format as well.

- If you wish to find another version of your form, use the Search field to locate the template that fits your needs and requirements.

- Once you have found the template you need, click Purchase now to proceed.

- Select the pricing plan you need, enter your details, and register for a free account on US Legal Forms.

Form popularity

FAQ

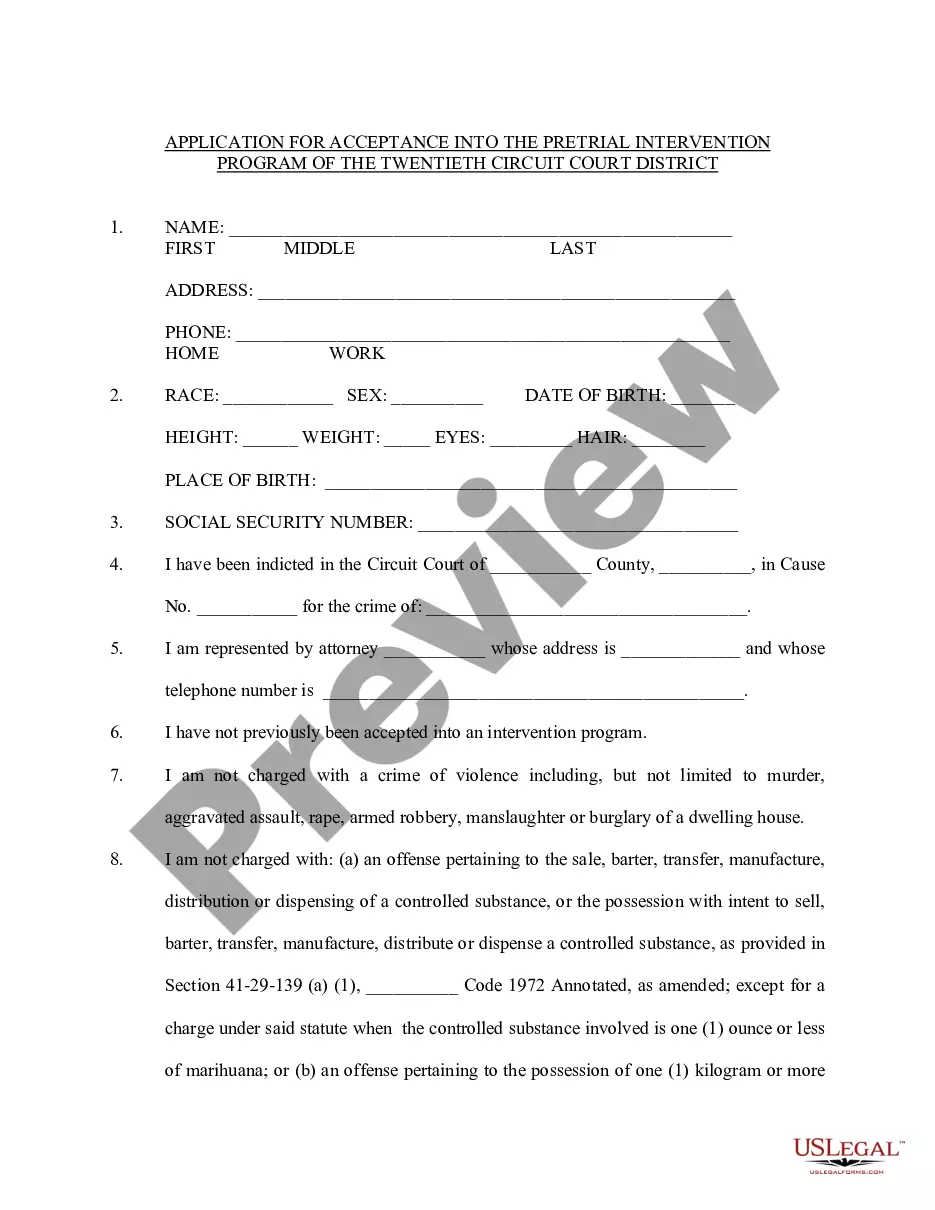

In Colorado, the redemption period for tax liens typically lasts for three years after the foreclosure sale. During this time, property owners can redeem their property by paying off the tax lien and any associated costs. This period provides a critical window for homeowners to act and secure their rights. Filing a Colorado Application for Release of Right to Redeem Property from IRS After Foreclosure can streamline this process and enhance your chances of reclaiming your property.

Foreclosure does not automatically eliminate an IRS lien on a property. Even after a foreclosure, the IRS retains the right to collect owed taxes, which can complicate the owner's situation. It's essential to understand the implications of an IRS lien during and after foreclosure. Using the Colorado Application for Release of Right to Redeem Property from IRS After Foreclosure can help clarify your options and assist in regaining control over your property.

The IRS right of redemption allows a property owner to reclaim their property after a foreclosure by paying off the tax lien. This right is crucial for homeowners who face foreclosure and owe federal taxes. By submitting a Colorado Application for Release of Right to Redeem Property from IRS After Foreclosure, property owners can initiate the process to regain ownership. Understanding this right can empower you to take action and protect your investment.

If your real estate was seized and sold, you have redemption rights. You or anyone with an interest in the property may redeem your real estate within 180 days after the sale. This includes: your heirs, executors, administrators.

Equity of redemption (also termed right of redemption or equitable right of redemption) is a defaulting mortgagor's right to prevent foreclosure proceedings on the property and redeem the mortgaged property by discharging the debt secured by the mortgage within a reasonable amount of time (thereby curing the default).

The right of redemption allows homeowners to keep their homes if they pay back what they owe even after their lender starts the foreclosure process or puts the home up for sale at public auction.

Help Resources. Centralized Lien Operation ? To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.

If the IRS tax lien is junior to the mortgage being foreclosed, the IRS tax lien will be foreclosed through the judicial sale and the lien on the property will be extinguished after the judicial deed is issued.

When you pay off your full tax balance or when the IRS runs out of time to collect the balance, the IRS will automatically release your tax lien. This removes the lien from your property. If the lien isn't automatically released, you can write to the IRS to request the release certificate.

The most senior lien holder may redeem fifteen (15) to nineteen (19) business days after the sale, but no later than noon on the final day. Subsequent lien holders each have five (5) business days after the senior lien holder's period, but must redeem by noon on the final day.