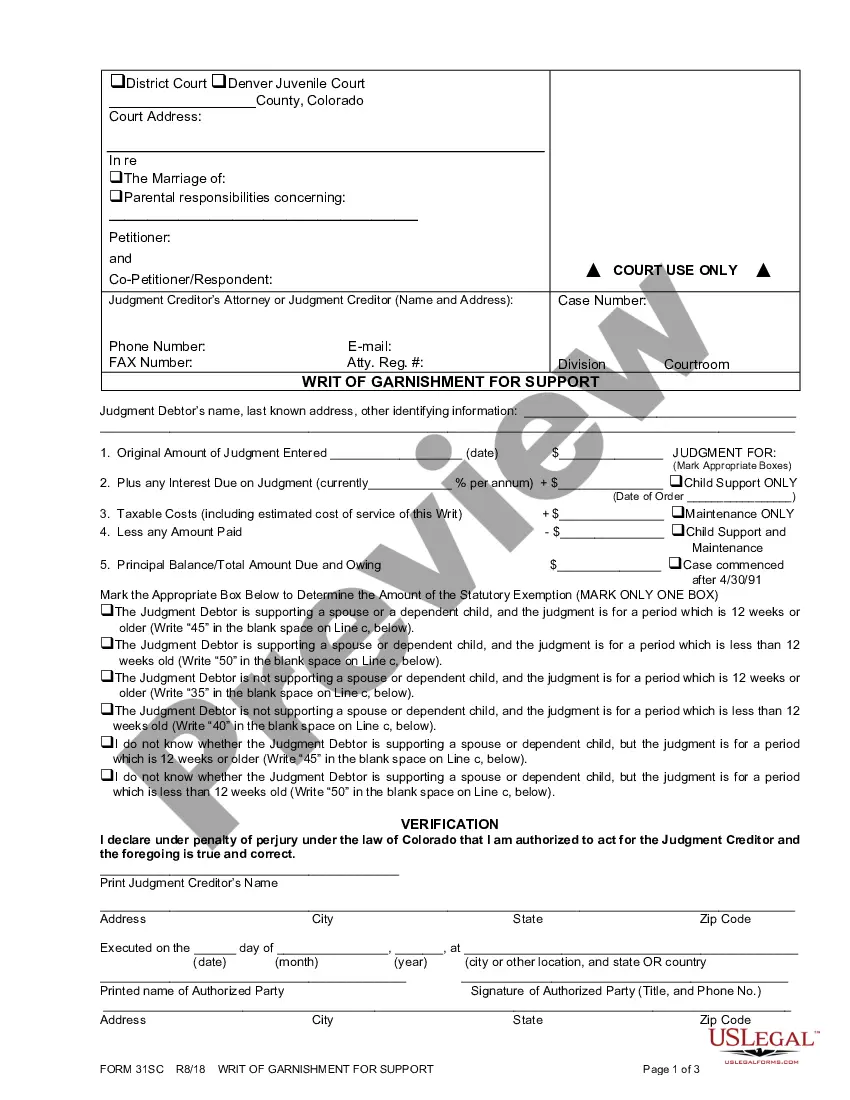

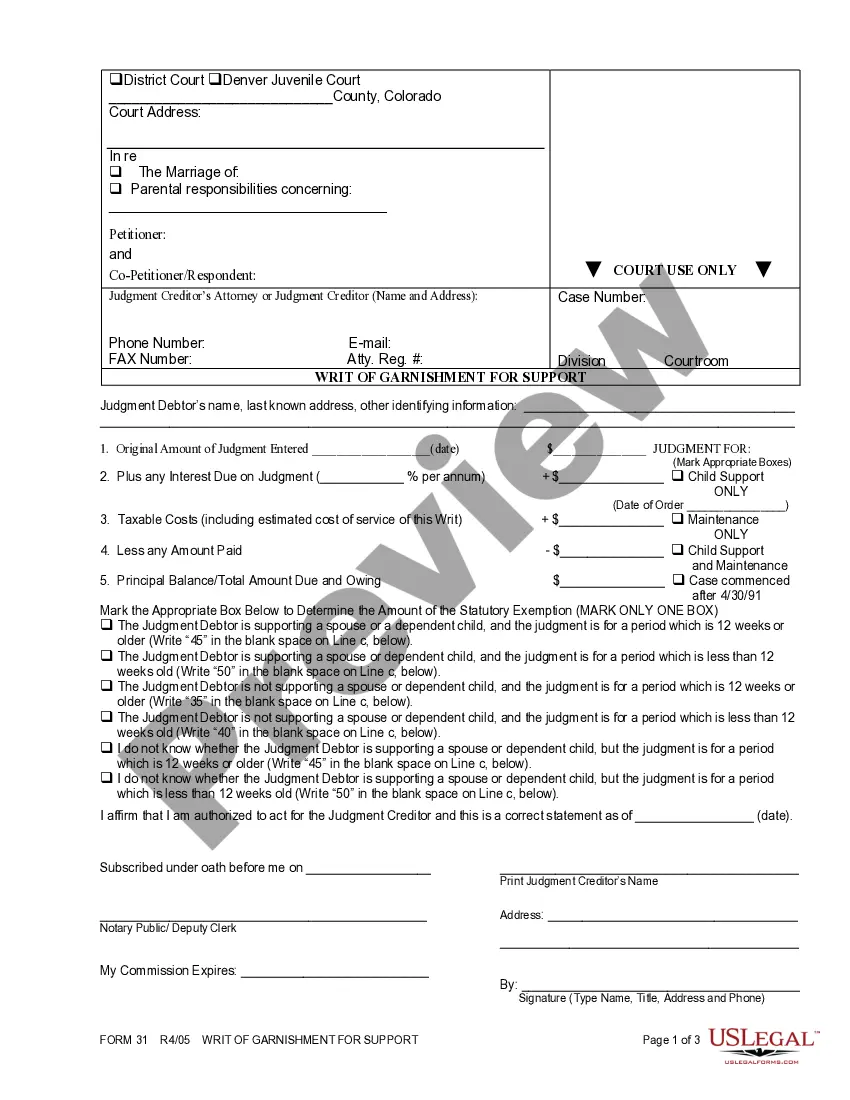

This is an official form from the Colorado State Judicial Branch, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Colorado statutes and law.

Colorado Instructions for Collecting a Judgment and Completing a Writ of Garnishment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Colorado Instructions For Collecting A Judgment And Completing A Writ Of Garnishment?

The more documents you are required to generate - the more uneasy you become.

You can discover countless Colorado Guidelines for Acquiring a Judgment and Finalizing a Writ of Garnishment templates online, yet you remain unsure which ones to trust.

Eliminate the inconvenience and simplify locating examples by utilizing US Legal Forms.

Fill in the required details to create your account and settle the payment via PayPal or credit card. Choose a convenient document format and download your copy. Access each document you download in the My documents section. Just go there to produce a new version of the Colorado Guidelines for Acquiring a Judgment and Finalizing a Writ of Garnishment. Even when using properly composed documents, it is still advisable to consider consulting your local attorney to review the completed template to ensure that your document is accurately filled. Achieve more for less with US Legal Forms!

- If you already possess a US Legal Forms subscription, sign in to your account, and you will see the Download option on the Colorado Guidelines for Acquiring a Judgment and Finalizing a Writ of Garnishment’s page.

- If you have not utilized our website before, complete the registration process with the following steps.

- Ensure that the Colorado Guidelines for Acquiring a Judgment and Finalizing a Writ of Garnishment is applicable in your state.

- Verify your choice by reviewing the description or by utilizing the Preview feature if it's available for the selected document.

- Click Buy Now to initiate the registration process and select a pricing plan that fits your needs.

Form popularity

FAQ

In Colorado, the maximum amount that can be garnished from your check is generally 25% of your disposable earnings or the amount by which your earnings exceed 30 times the federal minimum wage, whichever is less. Understanding this limitation is crucial for managing your finances effectively. Referencing the Colorado Instructions for Collecting a Judgment and Completing a Writ of Garnishment helps clarify your rights. If you have questions, consider using uslegalforms for reliable legal guidance.

To stop a wage garnishment in Colorado, you may file a motion with the court that issued the garnishment. Provide justifiable reasons for your request, such as financial hardship. Utilizing the Colorado Instructions for Collecting a Judgment and Completing a Writ of Garnishment can guide you through this process. It may also be beneficial to seek assistance from uslegalforms, which offers resources tailored to your situation.

Yes, your bank account can be garnished in Colorado if a court order allows it. Creditors can seek a writ of garnishment to access funds from your account. Understanding the Colorado Instructions for Collecting a Judgment and Completing a Writ of Garnishment can help you navigate this process. If you believe a mistake has occurred, consult with an attorney to explore your options.

To fill out a challenge to garnishment form, first obtain the proper documentation from the court or your attorney. Clearly state your reasons for challenging the garnishment, including any relevant details. Make sure to include your personal information and the case number. By following the Colorado Instructions for Collecting a Judgment and Completing a Writ of Garnishment, you can ensure that your challenge is correctly processed.

To dissolve a Writ of garnishment in Colorado, you first need to file a motion with the court that issued the writ. It's essential to provide a valid reason for the dissolution, such as a payment being made or a legal error in the initial garnishment process. Once you file the motion, the court will schedule a hearing, where you can present your case. Following the hearing, if the court agrees, they will issue an order dissolving the writ, guiding you through the Colorado Instructions for Collecting a Judgment and Completing a Writ of Garnishment.

Rule 69 in Colorado pertains to the enforcement of judgments through writs of execution. It outlines procedures for seizure of property and collection efforts. Understanding Rule 69 is essential for anyone involved in collecting a judgment, and the Colorado Instructions for Collecting a Judgment and Completing a Writ of Garnishment can shed light on how this rule applies to your situation. This knowledge can empower you in your efforts to enforce a judgment.

Yes, judgments do expire in Colorado; typically, they last for six years. After this period, you may need to renew the judgment to continue enforcement actions. The Colorado Instructions for Collecting a Judgment and Completing a Writ of Garnishment provides valuable information regarding the renewal process and any applicable statutes. Staying informed ensures you can pursue your rightful claims without delay.

To enforce a judgment in Colorado, you typically need to file a request with the court for a writ of execution or garnishment. Following the Colorado Instructions for Collecting a Judgment and Completing a Writ of Garnishment will guide you through the necessary steps. It is essential to act promptly and accurately to secure your rights and ensure compliance. Your diligence can lead to a successful judgment collection.

In Colorado, you cannot go to jail simply for not paying a judgment. However, failing to comply with a court order can lead to legal consequences, including potential civil contempt. It is crucial to understand your obligations and follow the guidelines outlined in the Colorado Instructions for Collecting a Judgment and Completing a Writ of Garnishment. Being informed helps you avoid unnecessary legal troubles.

In Colorado, personal property that can be seized includes bank accounts, wages, and other assets that you own. However, certain exemptions may apply, protecting some of your property from seizure. To better understand what can be seized, refer to the Colorado Instructions for Collecting a Judgment and Completing a Writ of Garnishment for detailed guidance. This information empowers you to protect your essential belongings.