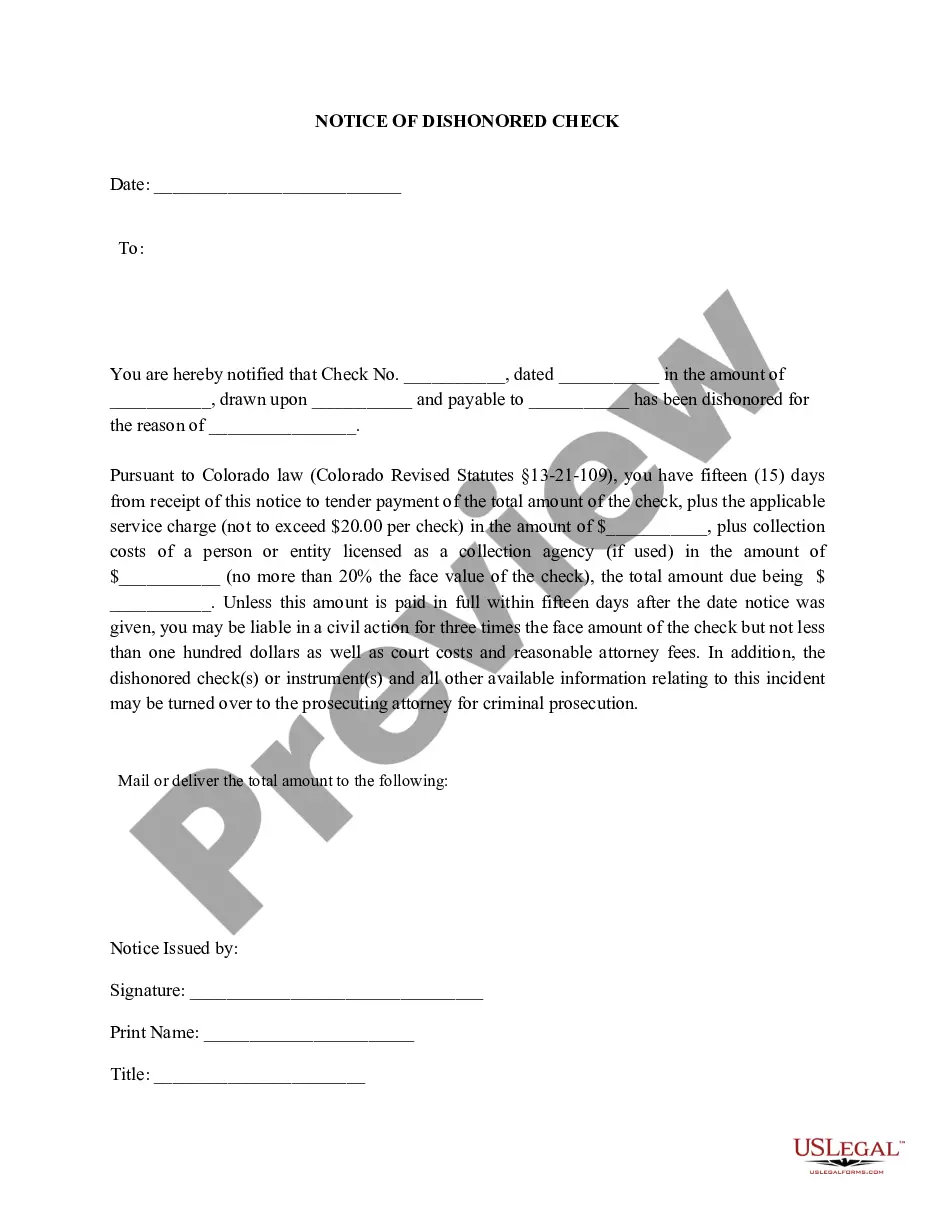

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Colorado Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

The greater the documentation you are required to produce - the greater your anxiety levels.

You can discover countless Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check templates online, yet it may be unclear which of them to trust.

Eliminate the frustration to simplify obtaining samples with US Legal Forms. Acquire expertly prepared forms designed to adhere to state regulations.

Provide the required information to create your account and finalize the payment using PayPal or credit card. Choose a convenient file format and obtain your copy. Access every document acquired in the My documents section. Just navigate there to produce a new copy of the Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. Even with professionally crafted templates, it’s still crucial to consider consulting a local attorney to ensure your documentation is accurately completed. Achieve more with less using US Legal Forms!

- If you currently hold a US Legal Forms subscription, sign in to your account, and you will find the Download option on the Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check’s page.

- If this is your first time using our site, complete the registration process by following these steps.

- Ensure the Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is applicable in your residing state.

- Verify your choice by reviewing the description or by utilizing the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and select a payment plan that aligns with your needs.

Form popularity

FAQ

The term 'bounced check' originates from the action of the check being 'bounced' back to the issuer by the bank. This occurs when the funds are lacking for the transaction to proceed. Knowing this terminology can be beneficial, especially when dealing with bad checks, and it highlights the importance of referencing the Colorado Notice of Dishonored Check - Civil for any legal implications.

Yes, a returned check is synonymous with a bounced check. In both cases, the bank does not process the check for reasons such as insufficient funds. If you find yourself dealing with a returned check situation, the Colorado Notice of Dishonored Check - Civil can guide you on the proper steps to take, ensuring you understand your rights regarding bad checks.

The terms 'bounced cheque' and 'dishonored cheque' essentially refer to the same situation; however, 'bounced cheque' is often used in everyday conversation. Both indicate that a check was not accepted by the bank due to issues like insufficient funds. Being aware of these terms can help you address issues with bounced checks effectively and leverage the Colorado Notice of Dishonored Check - Civil when necessary.

Another common name for a dishonored check is a bad check. This term highlights the implications for the issuer and the recipient. If you're navigating issues with bad checks, consider resources such as the Colorado Notice of Dishonored Check - Civil to understand your rights and obligations.

A dishonored check is often referred to as a bounced check because it 'bounces back' to the issuer when the bank refuses to honor it. This refusal typically occurs due to insufficient funds in the account. Understanding the term is key, especially when dealing with the legal aspects under Colorado Notice of Dishonored Check - Civil, particularly if you're managing bad checks or bounced checks.

A check may be returned for reasons such as insufficient funds, a closed account, or a request from the account holder to stop payment. These returns are typically noted on your bank statement, which can affect your financial standing. If you find yourself facing a bounced check, it is crucial to address the issue promptly. Using a platform like uslegalforms can guide you through the process of managing a Colorado Notice of Dishonored Check - Civil effectively, ensuring you take the right steps moving forward.

A bank can dishonor a check for several reasons, including if the account has insufficient funds, if the check has been altered, or if the signature does not match the account holder's records. Additionally, if the check is stale-dated or post-dated, the bank may refuse to honor it. Knowing the specific circumstances that lead to a bounced check can help you avoid these situations. Consider consulting resources like the Colorado Notice of Dishonored Check - Civil to gain further insights and protect your interests.

A check can be dishonored due to insufficient funds in the account, a closed account, or a stop payment order issued by the account holder. When a bank cannot process the check, it is marked as a bad check or bounced check. This situation can occur for various reasons, and it often leads to the need for a Colorado Notice of Dishonored Check - Civil, which can outline the necessary steps to resolve the issue. Understanding these causes can help you manage your finances better and prevent future problems.

A check might be returned or dishonored due to several circumstances. Common reasons include insufficient funds, wrong or mismatched signatures, or improper endorsements. Furthermore, if the account is closed, the bank will also refuse to honor the check. Understanding these scenarios can help you maintain proper financial practices and avoid a Colorado Notice of Dishonored Check - Civil.

When a check is dishonored, it signifies that the bank could not process it for payment. This can occur for multiple reasons, such as insufficient funds, a closed account, or incorrect details on the check. A dishonored check often leads to legal implications, including the issuance of a Colorado Notice of Dishonored Check - Civil. Being informed about these terms helps you navigate potential financial disputes effectively.