This is a financing agreement addendum to the software/services master agreement order form. It includes terms on interest and prepayments.

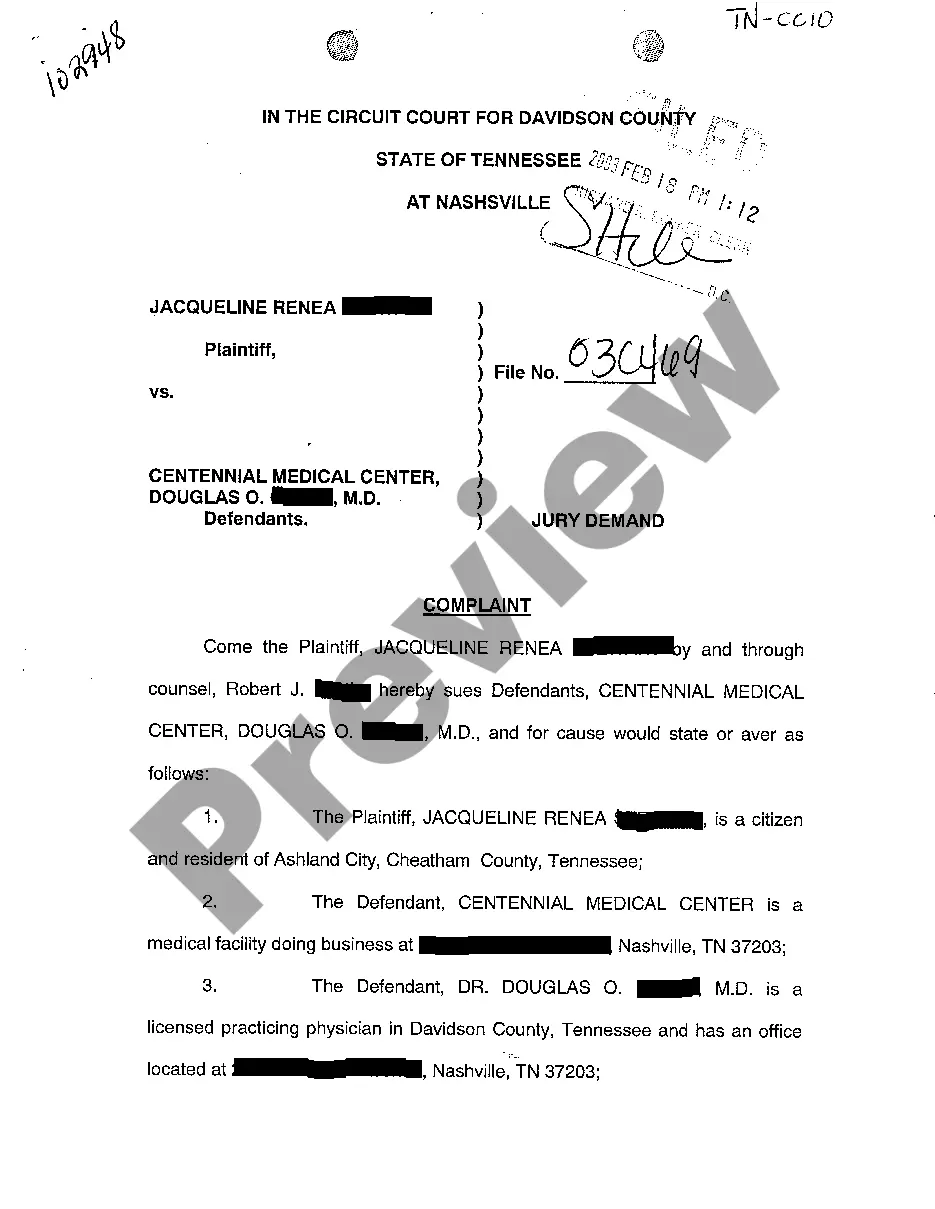

California Financing

Description

How to fill out Financing?

US Legal Forms - one of the largest libraries of legal varieties in the USA - offers a variety of legal document layouts you can down load or print. While using internet site, you will get a large number of varieties for company and specific reasons, categorized by groups, suggests, or key phrases.You can find the most recent variations of varieties such as the California Financing in seconds.

If you have a registration, log in and down load California Financing in the US Legal Forms collection. The Obtain switch will appear on every single develop you see. You gain access to all in the past saved varieties inside the My Forms tab of your respective bank account.

If you wish to use US Legal Forms for the first time, here are easy recommendations to help you get started:

- Make sure you have picked the proper develop to your town/state. Click on the Preview switch to analyze the form`s information. Look at the develop information to ensure that you have chosen the right develop.

- If the develop does not satisfy your specifications, take advantage of the Research industry at the top of the display to discover the one which does.

- In case you are content with the form, confirm your selection by simply clicking the Buy now switch. Then, opt for the pricing prepare you want and give your qualifications to sign up to have an bank account.

- Procedure the financial transaction. Make use of your credit card or PayPal bank account to finish the financial transaction.

- Select the file format and down load the form in your device.

- Make modifications. Complete, edit and print and indicator the saved California Financing.

Every single template you added to your bank account does not have an expiry date and it is your own permanently. So, if you wish to down load or print another backup, just proceed to the My Forms portion and click around the develop you require.

Gain access to the California Financing with US Legal Forms, by far the most substantial collection of legal document layouts. Use a large number of professional and express-specific layouts that meet your organization or specific demands and specifications.

Form popularity

FAQ

The new California legislation requires various consumer-friendly financial disclosures to be included in writing and separately signed for most non-bank commercial financings of personal property up to $500,000 with borrowers or lessees whose business is principally directed or managed from California.

California law provides a number of exemptions to this general licensure requirement. Historically, these exemptions included a "de minimis" provision that exempted from licensure any person who makes not more than one commercial loan in a 12-month period. Cal. Fin.

Requires the licensing and regulation of finance lenders and brokers making and brokering consumer and commercial loans, except as specified; prohibits misrepresentations, fraudulent and deceptive acts in connection with making and brokering of loans; and provides administrative, civil (injunction and ancillary relief) ...

The Truth in Lending Act (TILA) ensures that key information about consumer credit transactions is disclosed to consumers. TILA preempts State disclosure laws only if they are ?inconsistent? with it.

The Truth in Lending Act (TILA) ensures that key information about consumer credit transactions is disclosed to consumers. TILA preempts State disclosure laws only if they are ?inconsistent? with it.

The law prohibits various acts in making covered loans, including the following: Failing to consider the financial ability of a borrower to repay the loan. Financing specified types of credit insurance into a consumer loan transaction.

Requires the licensing and regulation of finance lenders and brokers making and brokering consumer and commercial loans, except as specified; prohibits misrepresentations, fraudulent and deceptive acts in connection with making and brokering of loans; and provides administrative, civil (injunction and ancillary relief) ...

In general commercial financing providers can expect to have to disclose, among other things, the total amount of funds provided, the total dollar cost of the financing, the term or estimated term, the method, frequency, and amount of payments, a description of prepayment policies, and (until January 1, 2024) the total ...