California Discounts, Credits & Tubulars

Description

How to fill out Discounts, Credits & Tubulars?

US Legal Forms - one of the largest libraries of legal kinds in the USA - offers a variety of legal file themes it is possible to download or print out. Using the web site, you will get a large number of kinds for enterprise and personal functions, categorized by types, says, or keywords and phrases.You will discover the most recent versions of kinds much like the California Discounts, Credits & Tubulars within minutes.

If you have a monthly subscription, log in and download California Discounts, Credits & Tubulars from the US Legal Forms local library. The Obtain key will appear on every develop you view. You gain access to all earlier delivered electronically kinds within the My Forms tab of your respective account.

If you want to use US Legal Forms the very first time, listed below are simple instructions to help you started off:

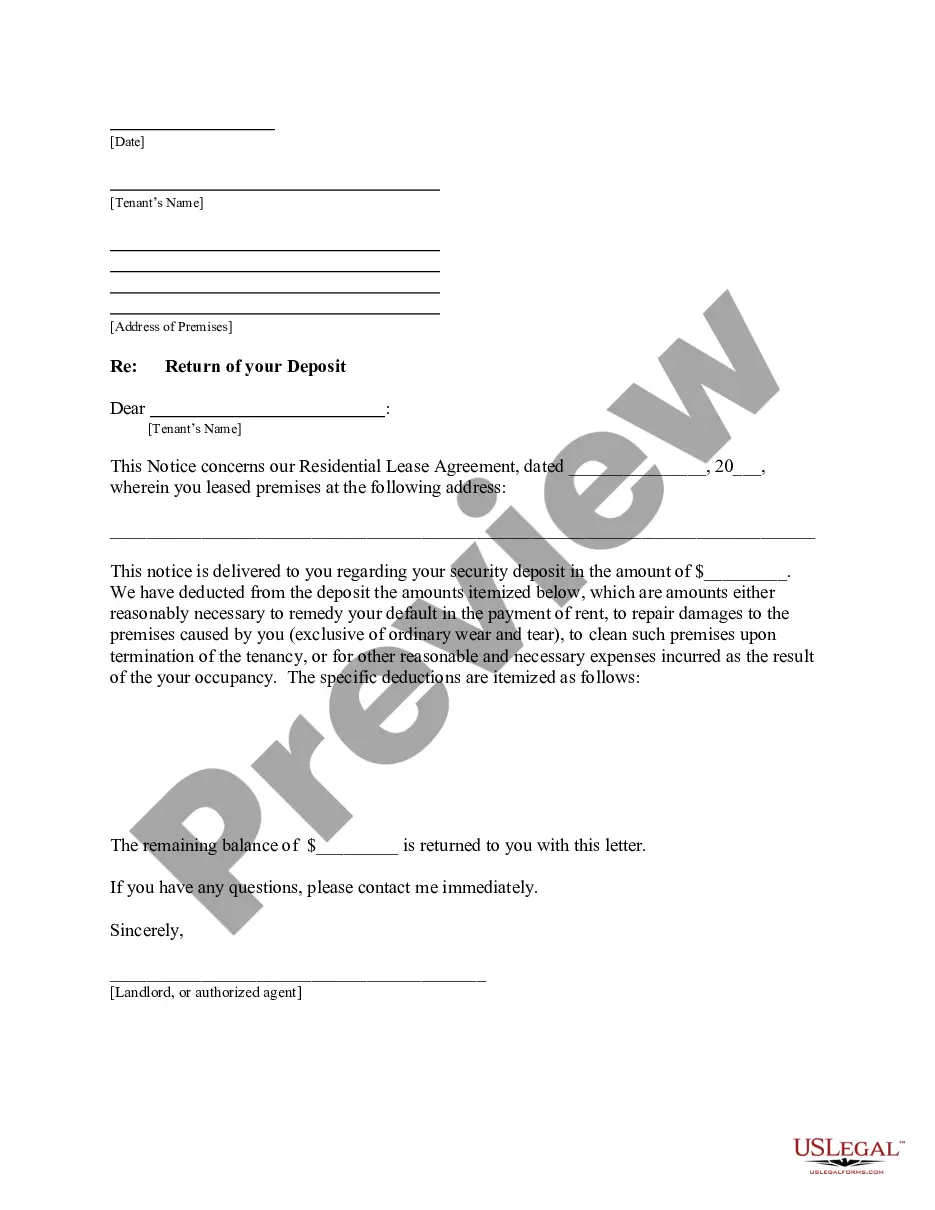

- Be sure to have chosen the correct develop for your personal city/area. Go through the Review key to check the form`s articles. Browse the develop explanation to actually have selected the right develop.

- In the event the develop doesn`t match your requirements, take advantage of the Look for industry near the top of the monitor to discover the one that does.

- When you are content with the form, confirm your decision by visiting the Get now key. Then, choose the prices plan you prefer and give your qualifications to register on an account.

- Procedure the financial transaction. Use your Visa or Mastercard or PayPal account to accomplish the financial transaction.

- Pick the structure and download the form in your product.

- Make adjustments. Fill out, edit and print out and sign the delivered electronically California Discounts, Credits & Tubulars.

Each format you put into your bank account does not have an expiry particular date and is yours eternally. So, if you wish to download or print out one more duplicate, just check out the My Forms portion and click on in the develop you want.

Gain access to the California Discounts, Credits & Tubulars with US Legal Forms, by far the most comprehensive local library of legal file themes. Use a large number of expert and status-particular themes that meet up with your company or personal demands and requirements.

Form popularity

FAQ

Purchase discounts These discounts are not included in your total taxable sales because they are based on the number of products you purchase, not the number of products sold.

Because discounts are generally offered directly by the retailer and reduce the amount of the sales price and the cash received by the retailer, the sales tax applies to the price after the discount is applied.

Markup: the amount above the price that the store paid for an item. Sales Tax: a tax (fee) charged on the sale of an item or a service provided. Wholesale Cost/Price: price the store paid for an item.

But if you think you need to report these rewards on your tax return, you'll be happy to know that it isn't necessary in most cases. For most of these rewards that are given to consumers, the IRS treats them as discounts rather than income.

When the customer purchases a discounted product, the customer's invoice lists the selling price less the amount of the manufacturer's discount. The amount of the discount is subject to tax.

The discount amount is included in your total taxable sales.

Coupons, rebates and discounts work this way in Ohio: If the coupon comes from an outside source - such as a manufacturer in the case of a coupon in a store - then the sales tax is calculated on the full amount, because the state considers that a discount after the sale.

The Pennsylvania Supreme Court agreed with the DOR's position that under Pennsylvania regulations, ?sales tax is owed on the full purchase price? (disregarding any coupons) unless an invoice or receipt (1) separately states and identifies the amount of the taxable item and the coupon and (2) provides a description of ...