This form is used when the Lessor and Lessee desire to amend the description of the Lands subject to the Lease by dividing the Lands into separate tracts, with each separate tract being deemed to be covered by a separate and distinct oil and gas lease even though all of the lands are described in the one Lease.

California Amendment to Oil and Gas Lease to Reduce Annual Rentals

Description

How to fill out Amendment To Oil And Gas Lease To Reduce Annual Rentals?

Are you in the placement in which you require papers for sometimes enterprise or personal reasons almost every day time? There are a variety of legitimate file templates accessible on the Internet, but discovering types you can rely on isn`t simple. US Legal Forms gives a large number of kind templates, much like the California Amendment to Oil and Gas Lease to Reduce Annual Rentals, which are composed in order to meet state and federal requirements.

If you are presently acquainted with US Legal Forms web site and also have your account, just log in. Following that, it is possible to download the California Amendment to Oil and Gas Lease to Reduce Annual Rentals design.

Unless you provide an profile and wish to begin to use US Legal Forms, abide by these steps:

- Get the kind you want and make sure it is for your correct city/region.

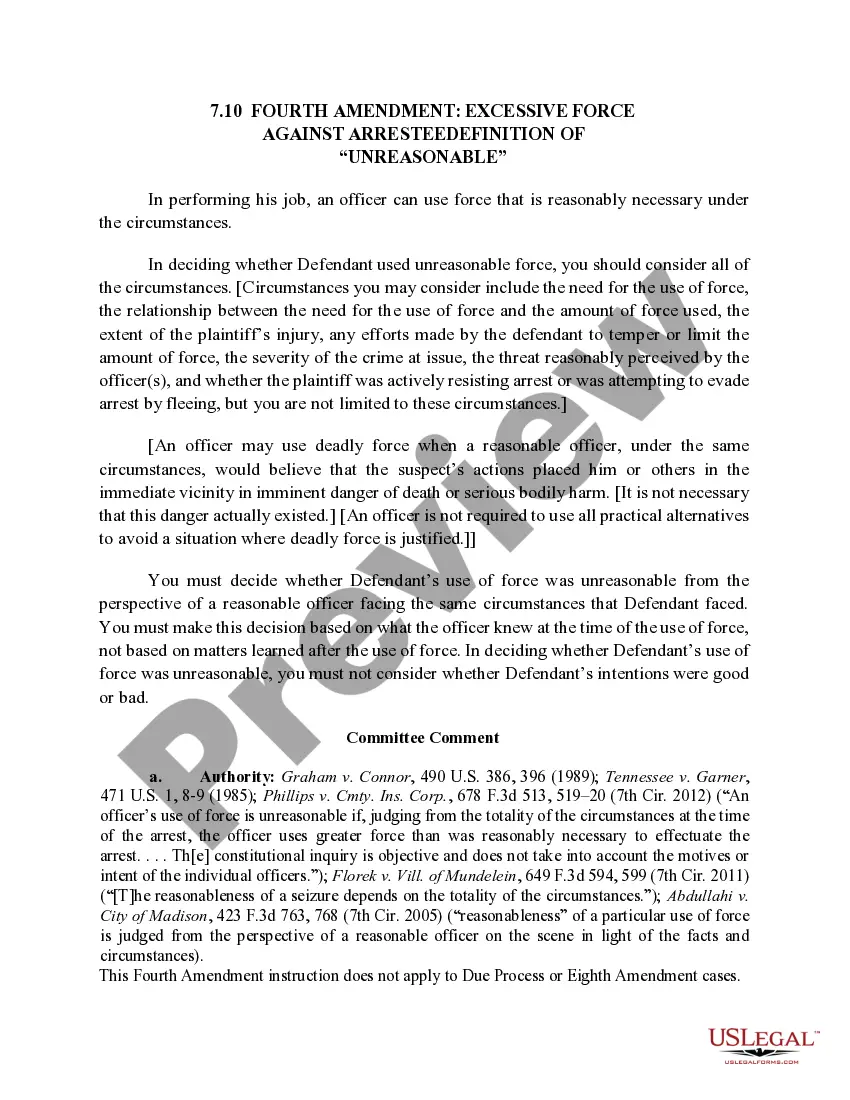

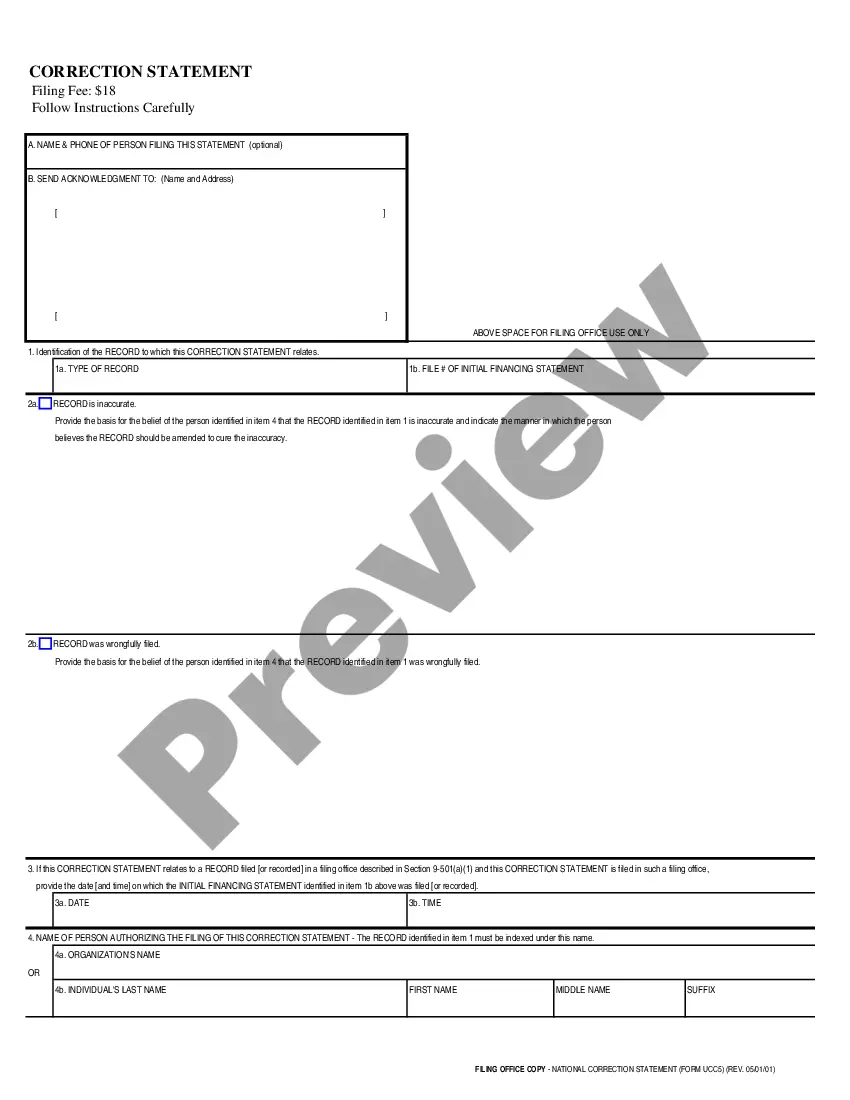

- Use the Preview button to check the shape.

- See the information to actually have selected the proper kind.

- When the kind isn`t what you`re looking for, make use of the Lookup discipline to obtain the kind that suits you and requirements.

- Once you discover the correct kind, simply click Purchase now.

- Pick the pricing program you desire, submit the specified information to generate your account, and pay money for an order with your PayPal or Visa or Mastercard.

- Choose a handy data file format and download your backup.

Discover every one of the file templates you may have purchased in the My Forms food list. You may get a further backup of California Amendment to Oil and Gas Lease to Reduce Annual Rentals any time, if necessary. Just click on the needed kind to download or print out the file design.

Use US Legal Forms, the most extensive selection of legitimate forms, to conserve efforts and avoid errors. The assistance gives expertly made legitimate file templates that can be used for a selection of reasons. Produce your account on US Legal Forms and commence generating your life easier.

Form popularity

FAQ

On December 21, 1987, Congress enacted the Federal onshore oil and Gas Leasing and Reform Act. The new amendments make three fundamental changes in the Mineral Leasing Act. The first and most important change is that all land offered for leasing must first be offered competitively.

Delay Rent means the amount, if any, by which (a) the rent and other charges, including but not limited to any penalty for holding over beyond the Existing Lease Expiration Date, under the Existing Lease for the Delay Period exceeds (b) the rent and other charges payable by Tenant under the Existing Lease immediately ...

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

The Federal onshore oil and gas rate is 16.67% for leases issued after August 16, 2022. However, there are a few exceptions, including different royalty rates on older leases, reduced royalty rates on certain oil leases with declining production, and increased royalty rates for reinstated leases.

A drilling-delay rental clause is a provision in an oil-and-gas lease that allows the lessee to maintain the lease by paying delay rentals instead of starting drilling operations during the primary term.

Is there more than one type of oil and gas lease? Yes, there are three types: a surface use lease, a non-surface use lease, and a dual purpose lease.

Within the lease, a Delay Rental is a yearly payment made to the lessor by the lessee during the primary term of the lease to compensate for drilling that is going to be delayed. This differs from drilling being suspended indefinitely, as discussed previously with Rental payments.