California Assignment of Oil and Gas Leases with Reservation of Overriding Royalty Interest Before Payout, and A Back-In Working Interest After Payout

Description

How to fill out Assignment Of Oil And Gas Leases With Reservation Of Overriding Royalty Interest Before Payout, And A Back-In Working Interest After Payout?

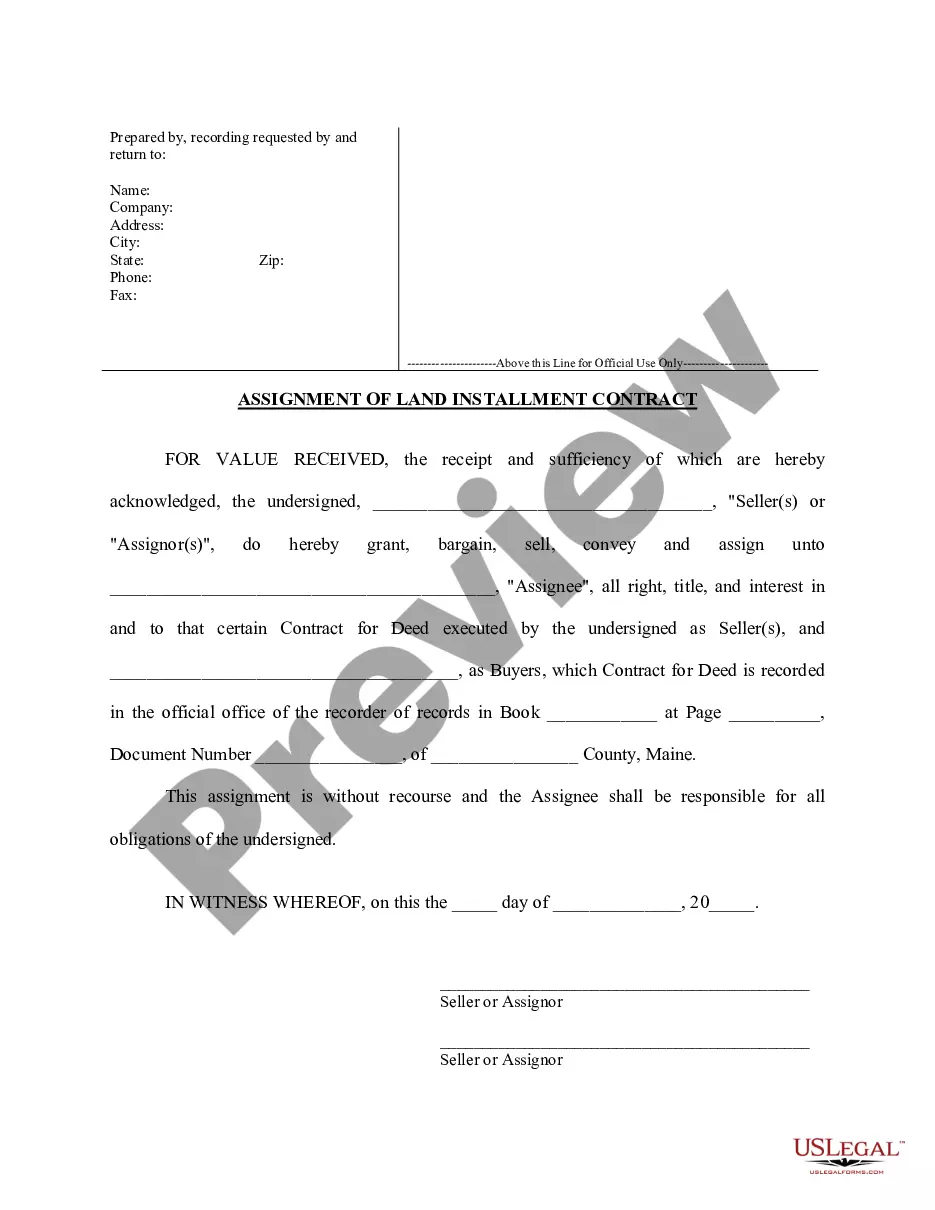

Have you been inside a situation that you need paperwork for both enterprise or personal reasons just about every working day? There are a variety of lawful record themes available on the Internet, but discovering kinds you can trust is not simple. US Legal Forms offers a large number of develop themes, much like the California Assignment of Oil and Gas Leases with Reservation of Overriding Royalty Interest Before Payout, and A Back-In Working Interest After Payout, that happen to be published to satisfy federal and state needs.

If you are presently knowledgeable about US Legal Forms web site and get your account, just log in. After that, you can obtain the California Assignment of Oil and Gas Leases with Reservation of Overriding Royalty Interest Before Payout, and A Back-In Working Interest After Payout design.

If you do not come with an accounts and want to start using US Legal Forms, follow these steps:

- Get the develop you want and make sure it is for that appropriate area/area.

- Utilize the Review option to analyze the shape.

- Browse the outline to ensure that you have chosen the proper develop.

- When the develop is not what you are searching for, take advantage of the Research area to find the develop that suits you and needs.

- When you obtain the appropriate develop, click Acquire now.

- Pick the prices prepare you want, fill out the specified information and facts to generate your account, and buy the order making use of your PayPal or bank card.

- Select a practical file formatting and obtain your backup.

Locate all of the record themes you possess purchased in the My Forms food selection. You can obtain a more backup of California Assignment of Oil and Gas Leases with Reservation of Overriding Royalty Interest Before Payout, and A Back-In Working Interest After Payout anytime, if possible. Just click the needed develop to obtain or produce the record design.

Use US Legal Forms, the most substantial variety of lawful forms, to conserve time and avoid mistakes. The support offers expertly created lawful record themes that can be used for a range of reasons. Create your account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

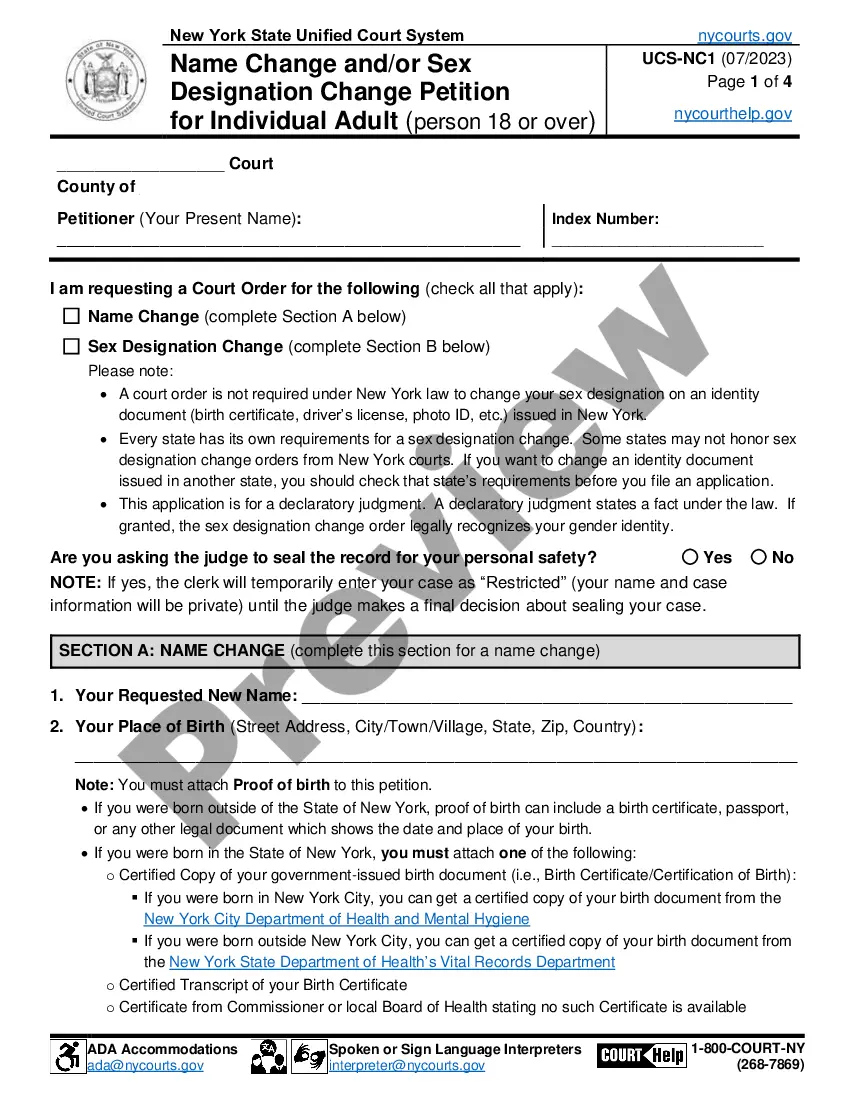

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.