California Self-Employed Drywall Services Contract

Description

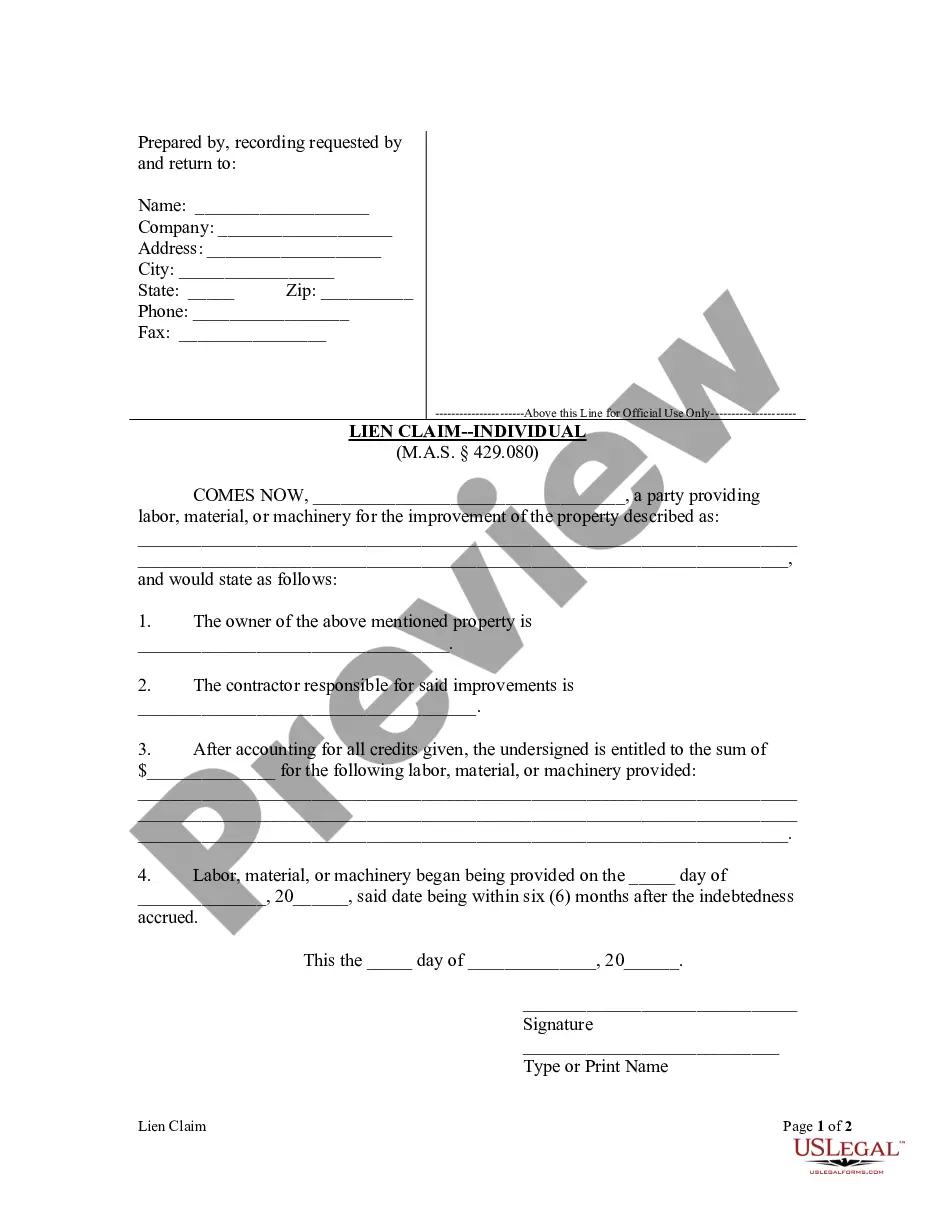

How to fill out Self-Employed Drywall Services Contract?

Are you presently in a role that requires paperwork for both commercial or particular purposes nearly every day.

There are numerous authentic document templates accessible online, but finding versions you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the California Self-Employed Drywall Services Contract, that are crafted to comply with state and federal regulations.

Utilize US Legal Forms, one of the most extensive collections of legitimate documents, to save time and avoid mistakes.

The service offers professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the California Self-Employed Drywall Services Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Review option to examine the form.

- Check the summary to confirm that you have selected the right form.

- If the form is not what you are seeking, use the Research section to find the form that fits your needs and requirements.

- Once you have the appropriate form, click Purchase now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- Choose a convenient file format and download your document.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the California Self-Employed Drywall Services Contract at any time, if desired. Click the required form to download or print the document template.

Form popularity

FAQ

Yes, a drywall contractor is required to have a license in California. This licensing is part of state regulations aimed at ensuring quality and safety in construction services. If you are planning to enter into a California Self-Employed Drywall Services Contract, obtaining the right license is crucial for compliance and professionalism. Uslegalforms offers a variety of resources to assist drywall contractors in understanding and fulfilling these licensing requirements.

Yes, you need a license to operate as an independent contractor in California. This requirement ensures that contractors meet specific standards and regulations, protecting both the contractor and the clients. For professionals involved in drywall services, having the appropriate license is essential for legally executing a California Self-Employed Drywall Services Contract. You can find resources and forms through platforms like uslegalforms to help you navigate this process.

Yes, you need a license to start a drywall business in California if you plan to exceed the $500 threshold for labor and materials. Obtaining the proper license not only complies with state laws but also enhances your credibility in the industry. A California Self-Employed Drywall Services Contract will solidify your professional standing. For assistance with licensing, consider using platforms like US Legal Forms.

California's new law, known as AB 5, redefines who qualifies as an independent contractor. This law requires that many workers meet specific criteria to be classified as independent contractors. Understanding these regulations is crucial when drafting a California Self-Employed Drywall Services Contract. Consulting legal resources can help ensure compliance with this law.

Yes, registering your business as an independent contractor is essential in California. This registration helps you establish legitimacy and protect your rights under a California Self-Employed Drywall Services Contract. Additionally, it allows you to operate legally and access various business benefits. Platforms like US Legal Forms can help you navigate the registration process seamlessly.

Absolutely, drywall contractors in California must have a valid contractor's license. This requirement ensures that contractors meet specific standards of professionalism and safety. If you are entering into a California Self-Employed Drywall Services Contract, having a license protects you and your clients. Always check the California Contractors State License Board for more information.

Yes, you need a license to perform drywall services in California if the job exceeds $500 in material and labor. A California Self-Employed Drywall Services Contract ensures that you comply with state regulations. Without a proper license, you risk facing legal and financial consequences. Therefore, always verify your licensing status before starting any drywall project.

In California, contractors generally need a license to perform work that exceeds $500 in labor and materials. If you are considering a California Self-Employed Drywall Services Contract, make sure you hold the necessary license. Working without a license can lead to penalties and fines. It's advisable to consult with legal resources or platforms like US Legal Forms for guidance.

Yes, in California, it is essential for a contractor to have a written contract, especially when providing services like drywall installation. A California Self-Employed Drywall Services Contract helps clarify the responsibilities and expectations for both parties involved. It protects your interests and offers legal backing in case disputes arise. By using a well-structured contract, you ensure that your project runs smoothly and that all terms are clearly defined.

To write a contract as an independent contractor, start by clearly defining the scope of work and the services you will provide, ensuring that it aligns with the California Self-Employed Drywall Services Contract. Include essential details such as payment terms, deadlines, and responsibilities of both parties. It’s also important to outline conditions for changes or termination of the contract. Utilizing platforms like uslegalforms can simplify this process by offering templates tailored for California self-employed contractors.