California Self-Employed Independent Contractor Pyrotechnician Service Contract

Description

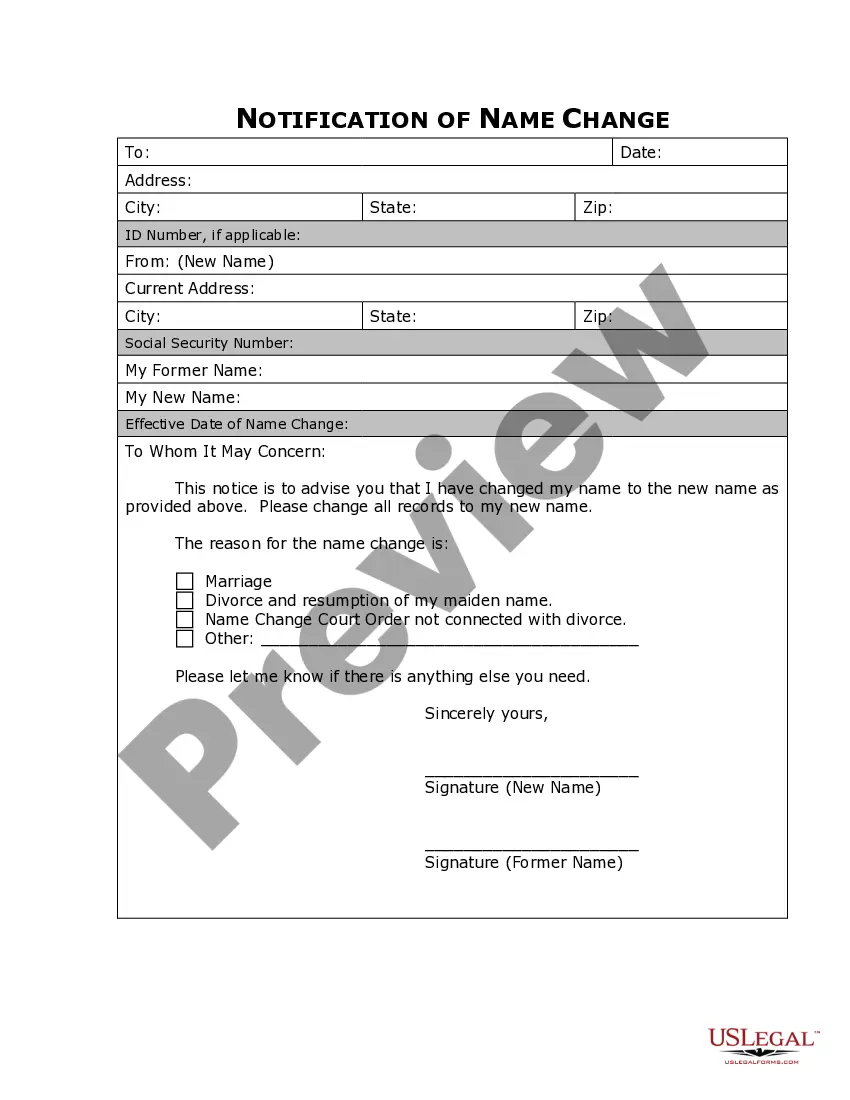

How to fill out Self-Employed Independent Contractor Pyrotechnician Service Contract?

You can spend hours online looking for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal forms that can be reviewed by experts.

You can actually obtain or print the California Self-Employed Independent Contractor Pyrotechnician Service Contract from the service.

If available, use the Review button to examine the document template as well. If you wish to find another version of the form, use the Search section to locate the template that suits your needs and requirements. Once you have found the template you want, click on Get now to proceed. Choose the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the legal form. Select the format of your document and download it to your system. Make modifications to your document if necessary. You can fill out, edit, sign, and print the California Self-Employed Independent Contractor Pyrotechnician Service Contract. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you may sign in and click the Download button.

- Then, you may fill out, modify, print, or sign the California Self-Employed Independent Contractor Pyrotechnician Service Contract.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of a purchased form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the form outline to confirm you have selected the right template.

Form popularity

FAQ

To be authorized as a self-employed independent contractor, you must first obtain any necessary licenses or permits for your specific trade, such as pyrotechnics. Additionally, review the requirements in your state and local area to comply with regulations. By utilizing a California self-employed independent contractor pyrotechnician service contract, you can formalize the relationship with clients and protect your rights. This contract serves as a solid foundation for your independent work.

Filing taxes as a California self-employed independent contractor pyrotechnician requires you to report your earnings accurately. You should track all income and expenses throughout the year. At tax time, use Schedule C to detail your profit or loss from your business. Don't forget to also complete Schedule SE to calculate your self-employment tax, ensuring you comply with federal and state guidelines.

As a 1099 employee, you can be terminated, but the process must align with the terms of your contract. Unlike traditional employees, independent contractors operate under specific agreements like the California Self-Employed Independent Contractor Pyrotechnician Service Contract. If your contract stipulates conditions, it’s important to follow them closely during termination. A clear communication of reasons can also help maintain professional relationships.

To perform services as an independent contractor in the US, you typically need to register your business, obtain necessary permits, and ensure tax obligations are met. For those focusing on a California Self-Employed Independent Contractor Pyrotechnician Service Contract, specific licensing may be required based on your services. It can be beneficial to research industry requirements and consult resources like uslegalforms for a comprehensive understanding. Proper authorization ensures compliance and builds trust with clients.

Creating an independent contractor contract requires clarity on deliverables, compensation, and obligations. A well-structured California Self-Employed Independent Contractor Pyrotechnician Service Contract should outline the scope of work, payment terms, and expectations. You can use templates available on platforms like uslegalforms to ensure compliance with state laws and regulations. Always consider having your contract reviewed by a legal professional for added protection.

Yes, you can fire an independent contractor in California, but it should be done in accordance with the terms set in your contract. Ensure that the reasons for dismissal are valid and documented, especially in the context of a California Self-Employed Independent Contractor Pyrotechnician Service Contract. Open communication can help prevent misunderstandings and potential disputes. Utilizing contractual guidelines will also aid in a smoother termination process.

Terminating an independent contractor in California involves clear communication and adherence to the terms of the contract. Refer to your California Self-Employed Independent Contractor Pyrotechnician Service Contract for specific termination clauses. It's best to document any reasons for termination to avoid potential disputes. Always conduct the termination meeting respectfully and professionally to maintain a positive relationship.

The new law in California, known as AB 5, reclassifies many independent contractors as employees, affecting their rights and benefits. However, those operating under a California Self-Employed Independent Contractor Pyrotechnician Service Contract may qualify for exemptions. This law primarily impacts gig workers in various sectors, emphasizing the importance of understanding your contractor status. If you're unsure, consider consulting legal resources or platforms like uslegalforms for guidance.