California Cameraman Services Contract - Self-Employed

Description

How to fill out Cameraman Services Contract - Self-Employed?

Are you currently in a circumstance that requires documentation for either business or personal reasons almost all the time.

There are numerous legal document templates available online, but locating versions you can trust is not easy.

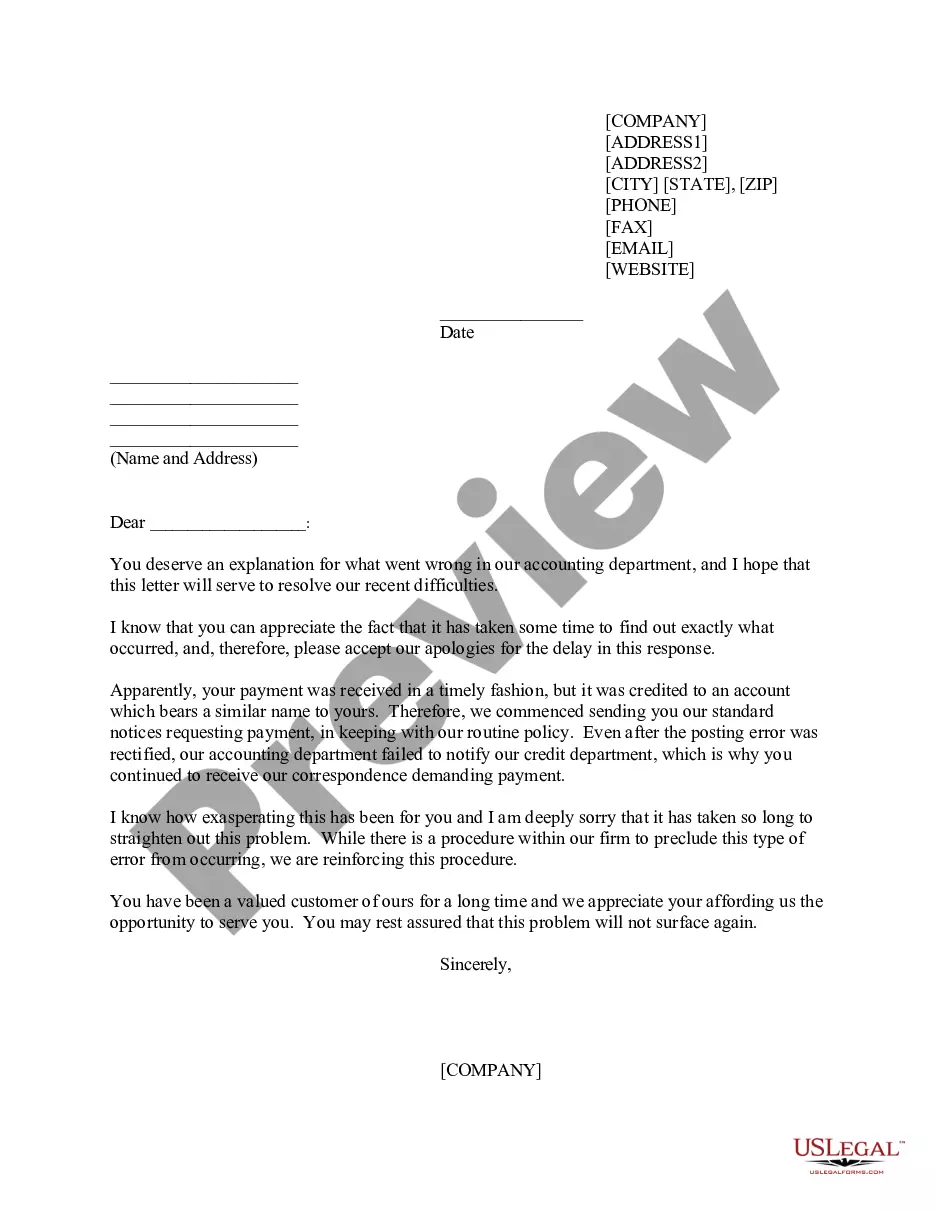

US Legal Forms offers a vast array of form templates, such as the California Cameraman Services Contract - Self-Employed, designed to comply with federal and state regulations.

Choose the pricing plan you desire, fill in the necessary information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Then, you can download the California Cameraman Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

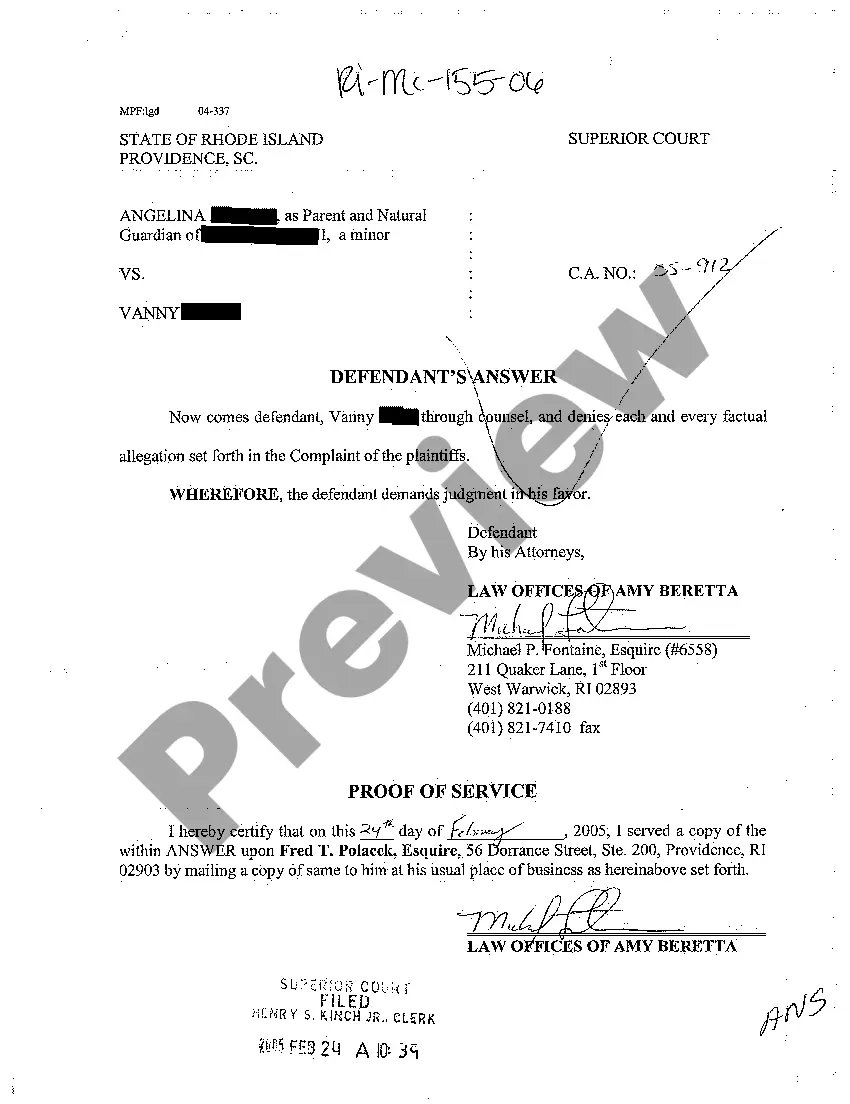

- Find the form you need and ensure it is for the correct region/state.

- Use the Preview button to review the form.

- Read the description to ensure you have selected the correct document.

- If the document is not what you are looking for, use the Search field to locate the form that fits your needs and requirements.

- Once you find the right form, click Get now.

Form popularity

FAQ

The upcoming freelance law in California, set to take effect in 2025, introduces new regulations that further clarify the status of freelancers. This law aims to enhance protections for those working under contracts, including the California Cameraman Services Contract - Self-Employed. It will formalize rights and responsibilities, ensuring fair compensation and better working conditions, fostering a supportive environment for all freelancers in the state.

AB5 significantly affects independent contractors by shifting the burden of proof to employers. This means, under a California Cameraman Services Contract - Self-Employed, employers must clearly demonstrate that a worker meets the criteria for independent status. With this change, many freelancers may now be entitled to benefits previously reserved for employees, such as unemployment insurance and workers' compensation.

California's Assembly Bill 5 (AB5) reshaped how independent contractors are classified in the state. The law requires a stricter test for determining if a worker is an independent contractor or an employee, affecting many freelancers, including those using a California Cameraman Services Contract - Self-Employed. This change emphasizes the importance of understanding your rights and hiring practices to avoid misclassification.

Recently, new federal regulations clarified the classification of independent contractors. These rules aim to provide consistency in determining who qualifies as an independent contractor under a California Cameraman Services Contract - Self-Employed. Notably, they address the issues surrounding control, autonomy, and the nature of the work relationship, ensuring that independent workers receive fair treatment and protections.

Independent contractors, including those working under a California Cameraman Services Contract - Self-Employed, must meet specific legal criteria. They must operate as an independent business, own their tools, and have the freedom to choose when and how to work. Additionally, they should submit invoices for payment and not receive employee benefits. Ensuring compliance protects both the contractor and the hiring party from legal complications.

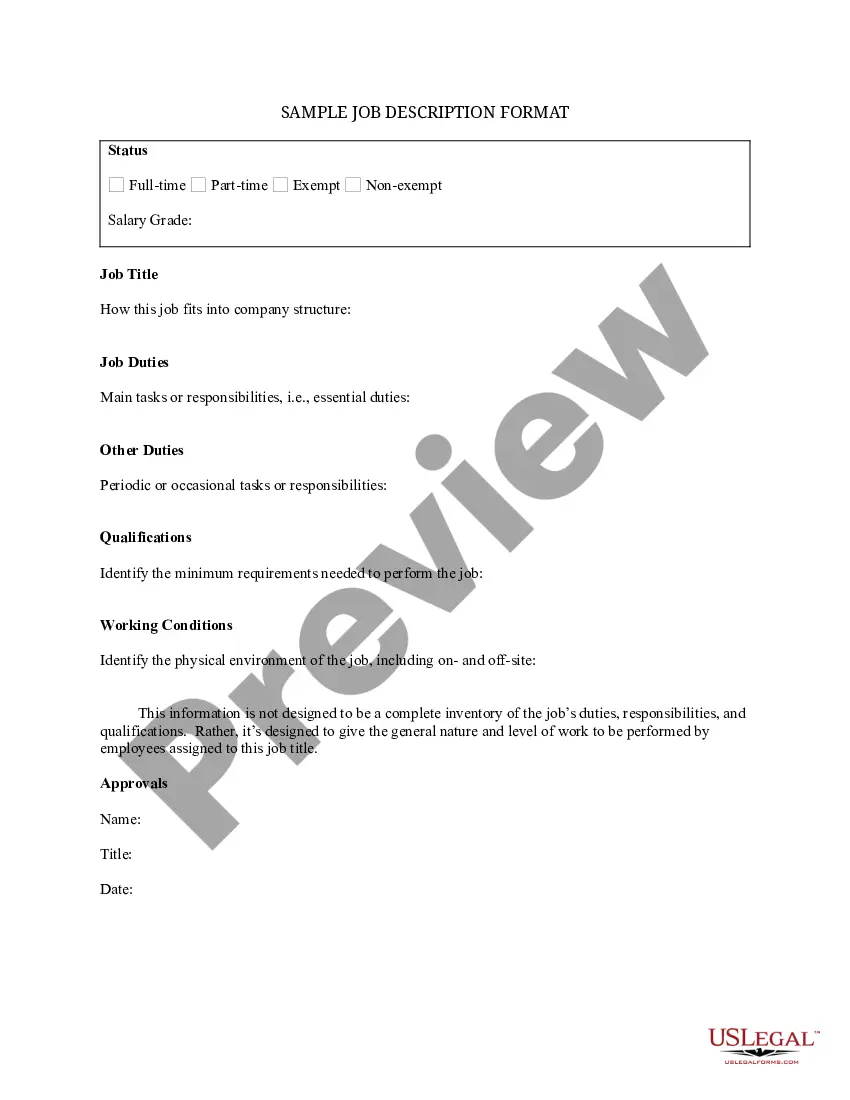

Start your self-employed contract by stating the parties involved, along with their obligations and rights. Clearly detail the services being provided, payment terms, and additional provisions like confidentiality. For ease of mind, look for California Cameraman Services Contract - Self-Employed templates on uslegalforms that can guide you through the essential components.

To write a self-employment contract, define your role, responsibilities, and payment structure clearly. Include key elements such as service descriptions, deadlines, and termination clauses. Consider using templates for California Cameraman Services Contract - Self-Employed available on uslegalforms to simplify the process.

Yes, you can write your own legally binding contract as long as it meets key elements like clarity, mutual agreement, and consideration. It should define the terms and conditions clearly to avoid misunderstandings. Utilize resources from platforms like uslegalforms to create a solid California Cameraman Services Contract - Self-Employed.

Yes, you can write your own photography contract. Start by detailing your services, payment terms, and expectations. Make sure the contract aligns with standard practices and legal requirements for your area, especially for California Cameraman Services Contract - Self-Employed.

When writing a contract for a 1099 employee, identify the nature of the work and the freelance relationship. Include payment details, deadlines, and any specific requirements for the work performed. A well-drafted California Cameraman Services Contract - Self-Employed will ensure clarity and protect both parties' interests.