California Florist Services Contract - Self-Employed

Description

How to fill out Florist Services Contract - Self-Employed?

If you desire to be thorough, obtain, or create valid document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site’s user-friendly and convenient search function to locate the documents you require. A range of templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to acquire the California Florist Services Contract - Self-Employed with just a few clicks.

Each legal document template you purchase is yours forever. You have access to every form you acquired in your account. Click on the My documents section and select a form to print or download again.

Finish and download, and print the California Florist Services Contract - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the California Florist Services Contract - Self-Employed.

- You can also access forms you have previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

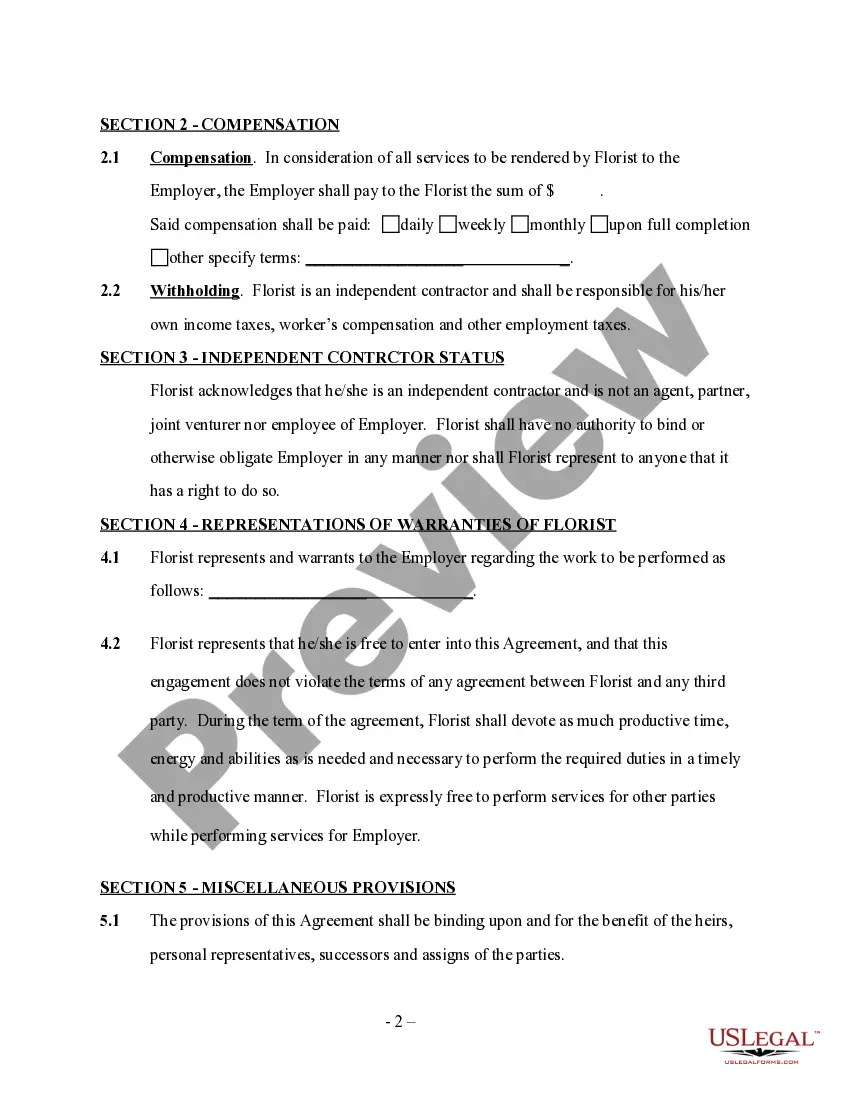

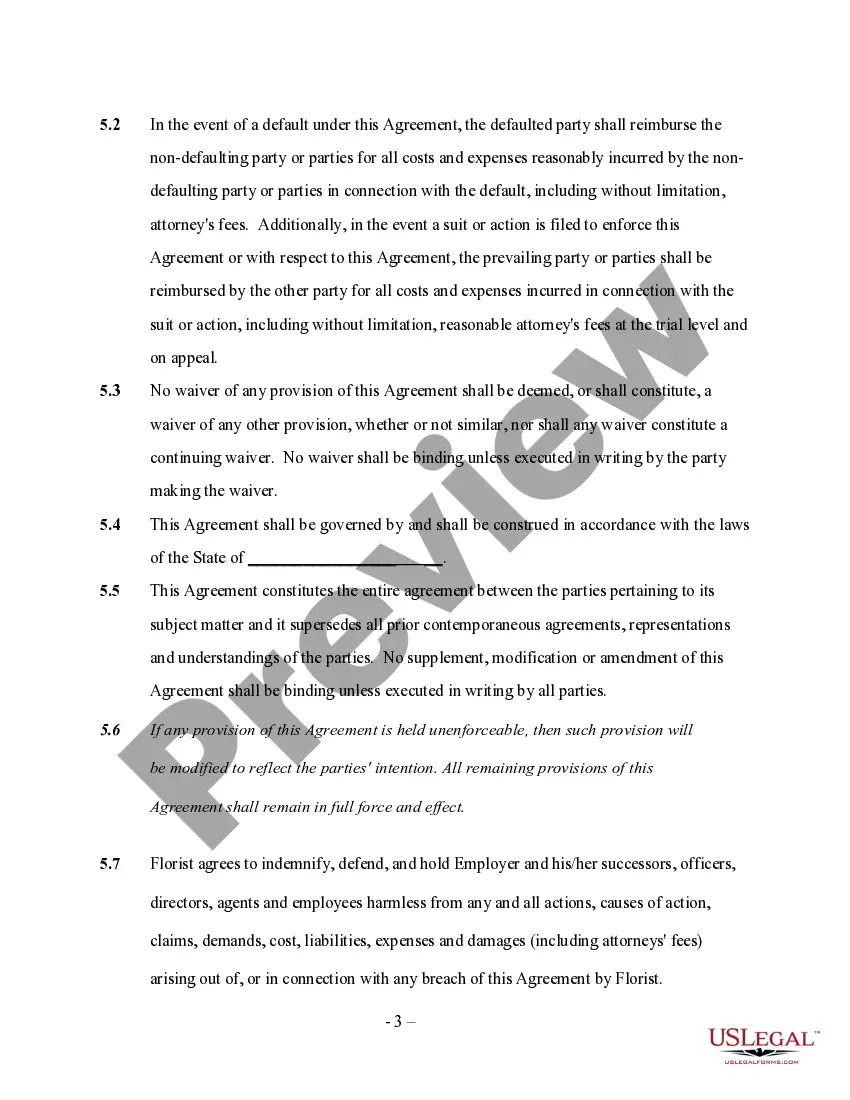

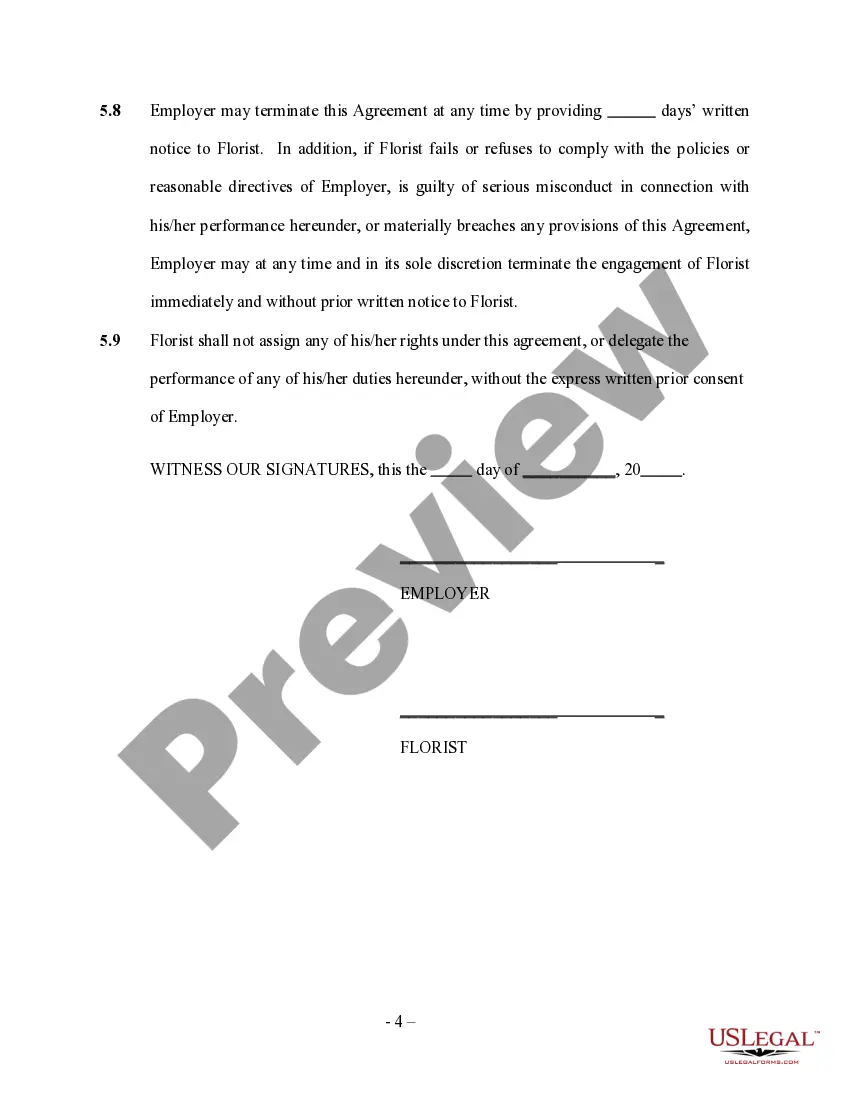

- Step 2. Use the Preview feature to review the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you want, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to process the payment.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the California Florist Services Contract - Self-Employed.

Form popularity

FAQ

The golden ratio, often found in nature, is a principle that promotes design harmony in floral arrangements. It suggests that the most appealing proportions appear when the longer section divided by the shorter section equals the same ratio as the whole divided by the longer section, typically around 1.618. Florists working under a California Florist Services Contract - Self-Employed can utilize this principle to create stunning, well-balanced arrangements that resonate with beauty and elegance.

The -8 rule in floristry is a guideline used to enhance the balance and proportion of floral arrangements. It suggests that the total height of the arrangement should be eight times the height of the shortest stem. This rule helps florists, including those under a California Florist Services Contract - Self-Employed, create visually pleasing designs that catch the eye and convey harmony in flower placement.

In California, a florist license is not required for self-employed florists; however, local regulations may vary. It's essential to check with your city's requirements to ensure compliance. Having a California Florist Services Contract - Self-Employed can help you navigate any local laws effectively, protecting your business as it grows.

The 8 rule in flower arranging refers to using a combination of short and long stems to create depth. This technique encourages variety in your arrangements, making them visually appealing. Experimenting with this technique, along with a California Florist Services Contract - Self-Employed, can help you develop a signature style while protecting your business interests.

The 7 rule in flower arrangements suggests using an odd number of stems to create a more dynamic composition. Arrangements with five, seven, or nine pieces tend to look more interesting and balanced. This technique can define your style, and implementing it alongside a California Florist Services Contract - Self-Employed can ensure you maintain quality and consistency.

The golden ratio in flower arrangements is often considered to be .618, which creates visually appealing displays. Using this ratio helps in distributing flowers evenly and drawing the viewer's eye naturally across the arrangement. When you incorporate this principle with a California Florist Services Contract - Self-Employed, you enhance both your designs and your business credibility.

The golden rule of floristry is balance and harmony in flower arrangements. This principle emphasizes the importance of proportion and variety in your designs. Whether you're preparing for an event or everyday arrangements, following this rule can enhance your floral artistry. A California Florist Services Contract - Self-Employed can help clarify your project specifications related to this rule.

Certain flowers do not pair well due to their differing chemical properties and scent profiles. For example, avoid mixing lilacs with daffodils as they can produce toxic fumes. Proper knowledge of flower compatibility ensures a safer and more aesthetically pleasing arrangement, making a California Florist Services Contract - Self-Employed beneficial for maintaining standards.

To become a self-employed florist, begin by gaining experience in flower arrangement and understanding the floral industry. You may want to take courses to learn about floral design and business management. It is vital to have a solid business plan and consider using a California Florist Services Contract - Self-Employed for legal protection and clear guidelines.

A florist may receive a 1099 if they operate as an independent contractor and earn over $600. Receiving this form is a standard part of reporting income on taxes. If you are providing services under a California Florist Services Contract - Self-Employed, make sure to keep transparent communication with clients about the need for issuing a 1099, as this ensures everyone is on the same page regarding tax obligations.