California Lab Worker Employment Contract - Self-Employed

Description

How to fill out Lab Worker Employment Contract - Self-Employed?

Have you ever found yourself in a scenario where you require documents for both business or personal purposes almost every time? There are countless legal document templates available online, but obtaining forms you can trust isn't easy.

US Legal Forms offers thousands of form templates, including the California Lab Worker Employment Contract - Self-Employed, that are crafted to meet state and federal requirements.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. After that, you can download the California Lab Worker Employment Contract - Self-Employed template.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can retrieve another copy of the California Lab Worker Employment Contract - Self-Employed at any time, if necessary. Just follow the required form to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

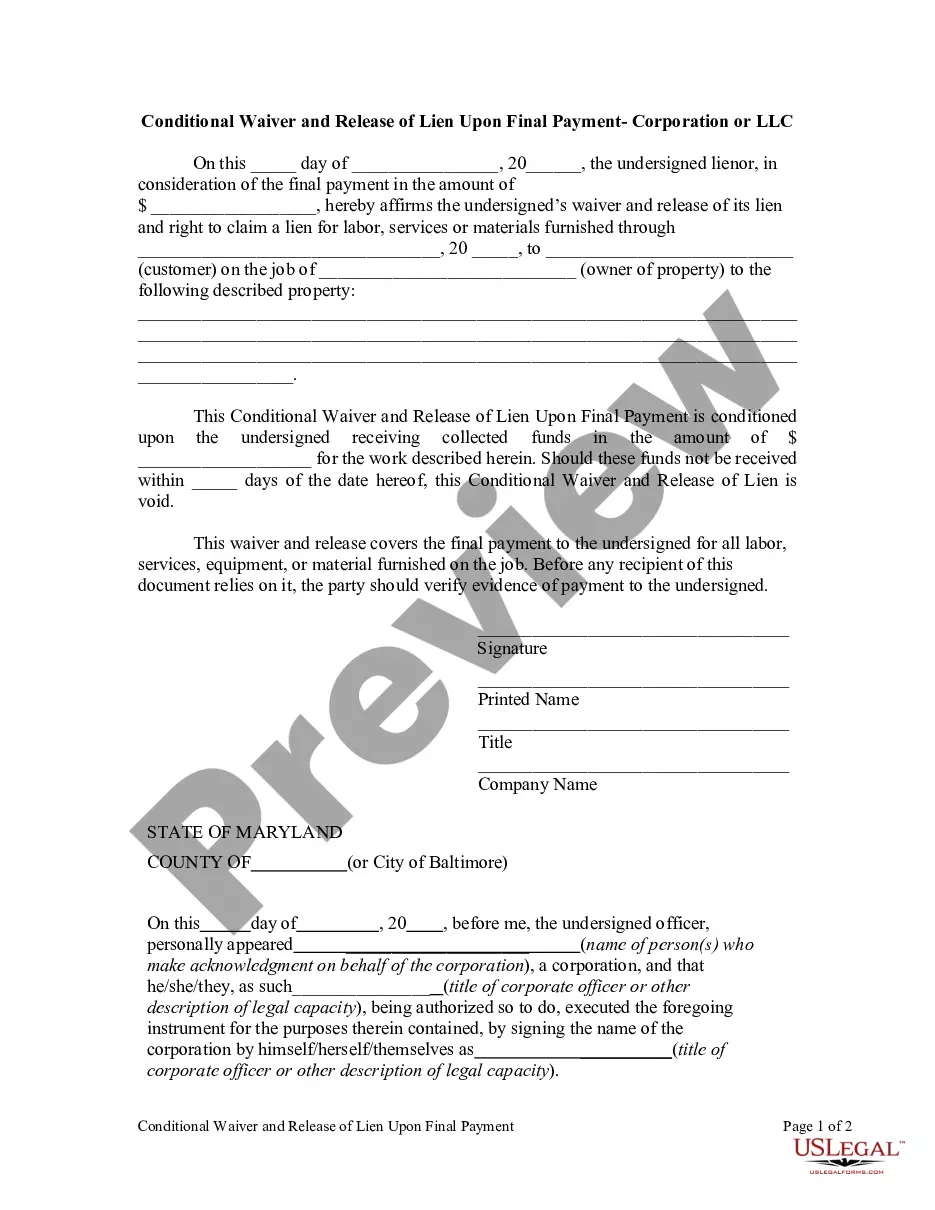

- Utilize the Preview button to review the form.

- Examine the description to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the appropriate form, simply click Buy now.

- Choose the pricing plan you want, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

Writing a contract for a 1099 employee, such as a self-employed California lab worker, involves clear structure and specific details. Start by including the names of both parties, the scope of work, and the payment terms. You should also address confidentiality, ownership of work, and termination conditions. To simplify the process, consider using US Legal Forms, which provides templates specifically for California Lab Worker Employment Contracts – Self-Employed.

Yes, you can absolutely be self-employed and have a contract. In fact, a California Lab Worker Employment Contract - Self-Employed solidifies your terms of engagement with clients. This contract protects your rights and outlines your responsibilities, ensuring clarity in your professional relationships. Utilizing tools from US Legal Forms can help you create a strong and legally sound contract.

Although both terms are often used interchangeably, saying 'self-employed' highlights your entrepreneurial spirit, while 'independent contractor' emphasizes your contractual arrangements. If your work falls under a California Lab Worker Employment Contract - Self-Employed, using the term 'independent contractor' may clarify your professional status to clients. Ultimately, choose the term that best fits your situation and resonates with your target audience.

Recent changes in California's regulations have affected self-employed individuals significantly, especially regarding worker classification and taxation. It is crucial to stay informed about these new rules to ensure your California Lab Worker Employment Contract - Self-Employed complies with current laws. Resources offered by platforms like US Legal Forms can provide the necessary insights and templates for compliance.

Creating a private contract with yourself is possible as a self-employed individual under a California Lab Worker Employment Contract - Self-Employed. While this may sound unusual, it can serve the purpose of outlining expectations and responsibilities. However, keep in mind that such an arrangement should still comply with state and federal regulations. Exploring the template options from US Legal Forms may simplify this process for you.

Yes, 1099 employees, or independent contractors, are legal in California, especially in situations involving a California Lab Worker Employment Contract - Self-Employed. These workers receive a 1099 form instead of a W-2 form because they are not classified as employees. As such, they are responsible for their own taxes and benefits. Understanding the difference can help streamline your employment arrangements.

In California, independent contractors, including those under a California Lab Worker Employment Contract - Self-Employed, generally do not need a specific license to operate. However, they may require certain permits or business licenses depending on the industry and the nature of their work. It is important to check local regulations to ensure compliance. Consulting resources like US Legal Forms can help you understand the requirements specific to your situation.

To provide proof of employment as an independent contractor, you can use documents such as your California Lab Worker Employment Contract - Self-Employed, invoices, or payment receipts from your clients. These documents help demonstrate your working relationship and the services you rendered. Additionally, maintaining a professional portfolio can further establish your credibility in the industry. Overall, keep organized records to easily prove your status as an independent contractor.

Yes, being self-employed often involves having contracts for various projects or clients. Contracts establish the framework of your working relationship and define critical terms like payment and deliverables. For lab workers in California, utilizing a California Lab Worker Employment Contract - Self-Employed can provide clarity and security in your business endeavors.

A contract employee may be considered self-employed or an independent contractor, depending on the agreement terms. This classification can significantly affect your tax responsibilities and benefits. It is wise to create a solid California Lab Worker Employment Contract - Self-Employed that outlines your status clearly.