California IRS 20 Quiz to Determine 1099 vs Employee Status

Description

How to fill out IRS 20 Quiz To Determine 1099 Vs Employee Status?

Are you presently in the location where you will require documentation for various businesses or individuals nearly every working day.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't easy.

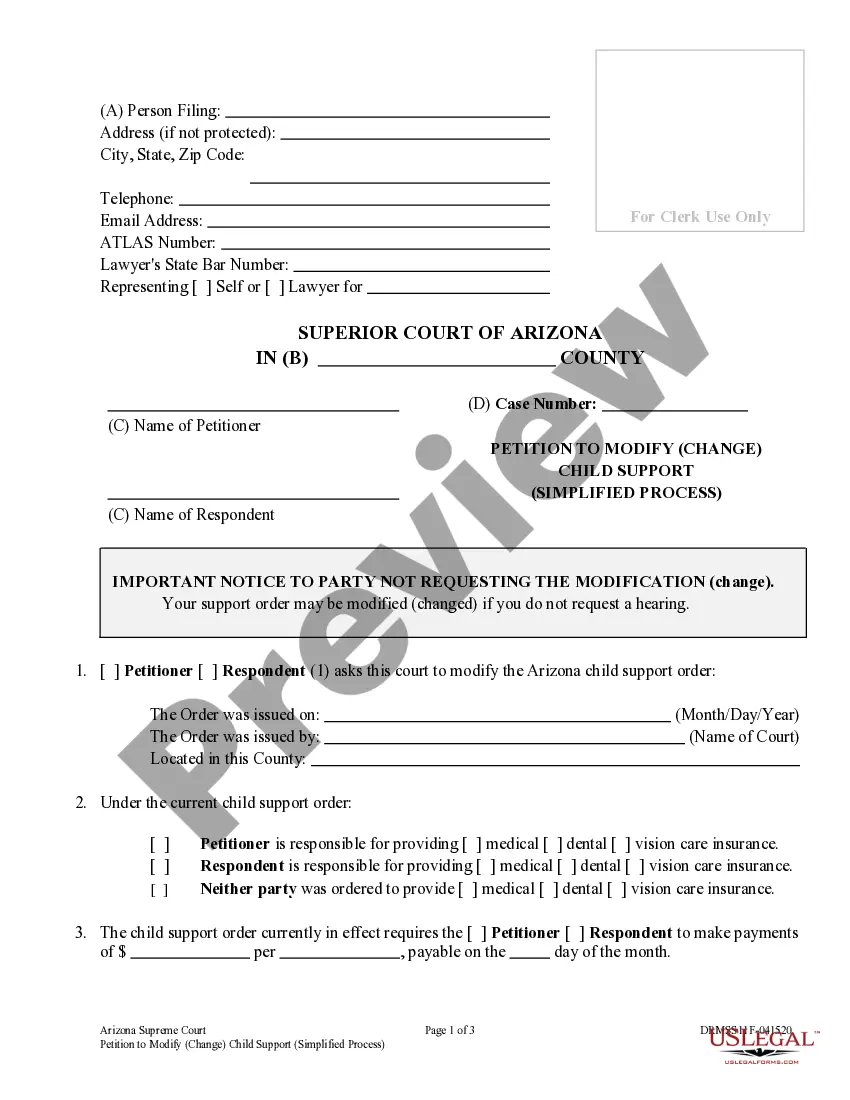

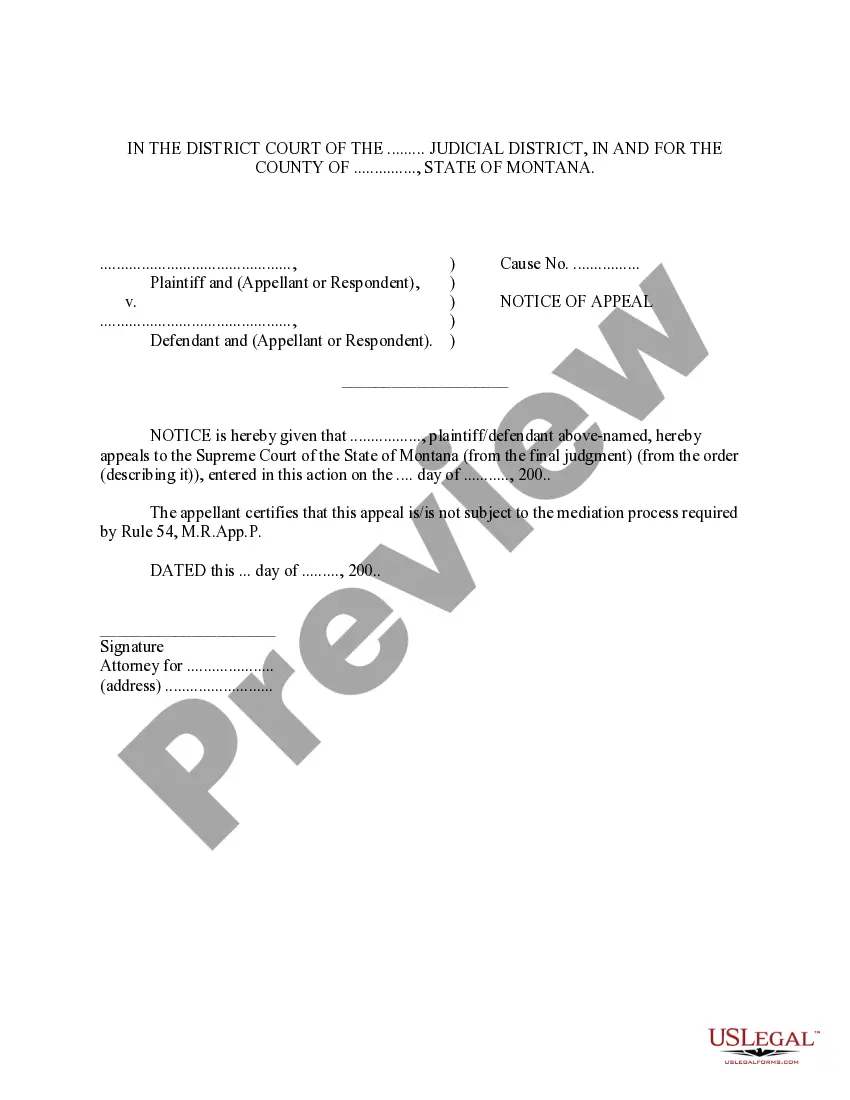

US Legal Forms provides a vast array of form templates, such as the California IRS 20 Quiz to Determine 1099 vs Employee Status, designed to meet state and federal guidelines.

Once you obtain the correct form, click on Purchase now.

Select the pricing plan you want, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you will be able to download the California IRS 20 Quiz to Determine 1099 vs Employee Status template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

- Use the Review button to evaluate the form.

- Check the description to confirm you have chosen the right form.

- If the form isn't what you are looking for, utilize the Search field to locate the form that fits your needs and criteria.

Form popularity

FAQ

The IRS determines independent contractor status through a detailed examination of various factors, including the degree of control and independence in work arrangements. The IRS 20 factor test helps clarify these relationships by evaluating the nature and extent of the work performed. You can further use the California IRS 20 Quiz to Determine 1099 vs Employee Status to navigate these IRS guidelines confidently.

The determination between an employee and an independent contractor hinges on behavioral control, financial arrangements, and the nature of the working relationship. Factors like who provides tools, how payments are made, and how much control the employer has influence this classification. The California IRS 20 Quiz to Determine 1099 vs Employee Status can simplify this complex process for you.

Common questions to determine independent contractor status include inquiries about the level of control over work, tools and equipment provided, and the payment structure. Assessing these elements can clarify the relationship dynamics and ensure proper classification. Using the California IRS 20 Quiz to Determine 1099 vs Employee Status will navigate you through these important questions.

To determine if someone is an independent contractor in California, consider factors such as the level of autonomy in work execution and the absence of employer control. The state uses the ABC test to simplify this classification process. The California IRS 20 Quiz to Determine 1099 vs Employee Status will assist you in navigating these criteria to accurately classify workers.

The three tests to determine if someone is an employee include the common law test, the economic realities test, and the IRS 20 factor test. Each test looks at different aspects of the work relationship to ascertain the nature of the employment. Utilizing the California IRS 20 Quiz to Determine 1099 vs Employee Status can clarify these tests and help you ensure proper classification.

The 20 factor test in IRS revenue ruling 87-41 helps classify workers as independent contractors or employees. This test assesses areas like behavioral control, financial control, and the type of relationship between the parties. Understanding this test is essential to navigating the California IRS 20 Quiz to Determine 1099 vs Employee Status, allowing you to make informed decisions regarding worker classifications.

To determine whether a person is an employee or an independent contractor, you should focus on the level of control you have over their work and the relationship established. The California IRS 20 Quiz to Determine 1099 vs Employee Status can provide guidance by examining factors such as supervision, provision of equipment, and the ability to make independent decisions. Generally, if you have significant control over how the work is performed, the individual may be classified as an employee.