California Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor

Description

How to fill out Jury Instruction - 10.10.3 Employee Vs. Self-Employed Independent Contractor?

US Legal Forms - one of the largest libraries of legal varieties in the United States - gives a wide range of legal record layouts you can download or print out. Using the site, you can get thousands of varieties for business and individual uses, categorized by classes, suggests, or keywords and phrases.You can find the most recent versions of varieties just like the California Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor within minutes.

If you currently have a subscription, log in and download California Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor in the US Legal Forms collection. The Acquire switch will appear on each develop you look at. You get access to all formerly downloaded varieties in the My Forms tab of the accounts.

If you would like use US Legal Forms for the first time, listed here are basic instructions to get you started out:

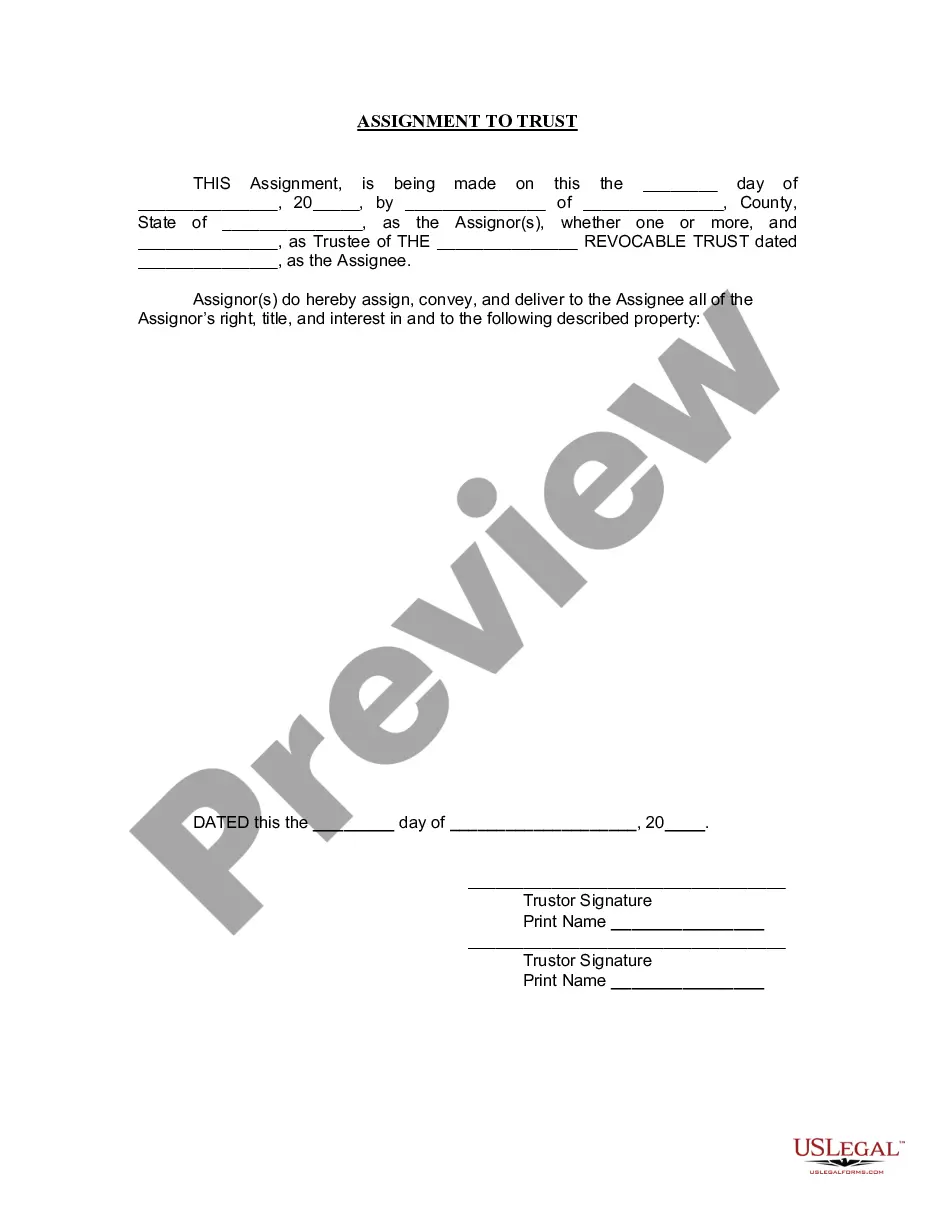

- Ensure you have selected the correct develop for your city/state. Click the Review switch to examine the form`s articles. Browse the develop outline to ensure that you have chosen the correct develop.

- If the develop doesn`t fit your needs, utilize the Lookup area towards the top of the monitor to obtain the one which does.

- Should you be pleased with the form, confirm your decision by clicking the Buy now switch. Then, select the prices program you favor and give your accreditations to sign up to have an accounts.

- Process the purchase. Make use of charge card or PayPal accounts to accomplish the purchase.

- Find the format and download the form on your own product.

- Make adjustments. Fill up, modify and print out and sign the downloaded California Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor.

Every single format you put into your bank account does not have an expiry particular date and is also yours eternally. So, in order to download or print out one more version, just check out the My Forms area and then click on the develop you want.

Obtain access to the California Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor with US Legal Forms, probably the most considerable collection of legal record layouts. Use thousands of expert and state-specific layouts that fulfill your business or individual needs and needs.