California Acceptance of Investor Relations Agreement assisting in obtaining new investors in company stock

Description

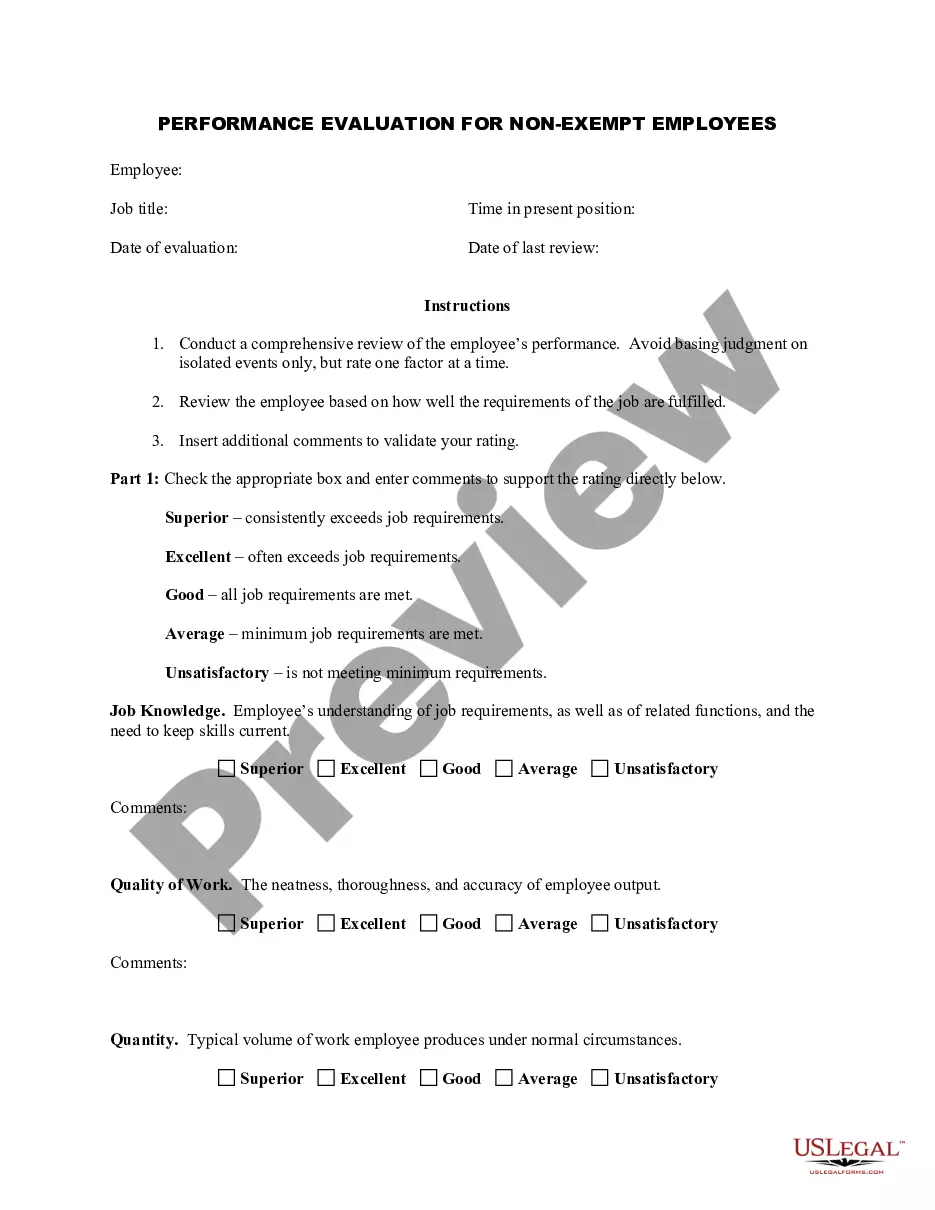

How to fill out Acceptance Of Investor Relations Agreement Assisting In Obtaining New Investors In Company Stock?

Choosing the right legitimate record web template could be a struggle. Needless to say, there are plenty of themes available online, but how can you obtain the legitimate kind you will need? Use the US Legal Forms internet site. The service provides a large number of themes, for example the California Acceptance of Investor Relations Agreement assisting in obtaining new investors in company stock, that you can use for company and personal needs. All of the forms are examined by specialists and meet up with federal and state specifications.

When you are presently authorized, log in for your bank account and then click the Obtain key to find the California Acceptance of Investor Relations Agreement assisting in obtaining new investors in company stock. Make use of bank account to appear with the legitimate forms you possess ordered previously. Visit the My Forms tab of your respective bank account and obtain another duplicate from the record you will need.

When you are a new customer of US Legal Forms, listed here are simple recommendations that you should follow:

- Very first, be sure you have chosen the appropriate kind for the area/region. You are able to examine the form using the Preview key and read the form description to guarantee this is the best for you.

- When the kind will not meet up with your requirements, make use of the Seach industry to discover the appropriate kind.

- Once you are positive that the form is suitable, go through the Get now key to find the kind.

- Select the costs prepare you desire and enter the needed information and facts. Build your bank account and pay for an order making use of your PayPal bank account or bank card.

- Pick the data file file format and download the legitimate record web template for your gadget.

- Complete, modify and print out and signal the acquired California Acceptance of Investor Relations Agreement assisting in obtaining new investors in company stock.

US Legal Forms will be the largest catalogue of legitimate forms that you can see different record themes. Use the service to download expertly-produced papers that follow express specifications.

Form popularity

FAQ

Checking your company documents These rules provide that the directors of your company must offer new shares to existing shareholders before offering them to a third party. This is known as a right of first refusal. As such, a board of directors may need to approve the issue of new shares prior to selling them.

For example, the articles may state that new shares can only be issued to existing shareholders and their family members. If your company has only one class of share a director can allot shares of that existing class without prior shareholder approval, provided that the articles do not prohibit such an action.

When companies issue additional shares, it increases the number of common stock being traded in the stock market. For existing investors, too many shares being issued can lead to share dilution. Share dilution occurs because the additional shares reduce the value of the existing shares for investors.

The documentation required for issuance of securities differs depending on the type of security. If the security is stock, then the documentation would include board approval and a fully executed stock purchase agreement.

Rules enacted by the NYSE, the NASD, and the American Stock Exchange require a vote at the share- holders' meeting when a listed corporation issues an amount of new common shares exceeding 20% of the outstanding ones, if the issuance is not made through a public offer for cash. '

While it may sound unusual, a company can own shares in itself.

Key elements of an investment agreement #1 Introduction and background information. This section provides a comprehensive description of the investment contract, including the names and legal entities of the parties involved. ... #4 Investment amount and payment terms. ... #7 Termination and exit provisions.

Issuing new shares typically requires approval from the company's shareholders. This may involve holding a vote at a shareholder meeting or obtaining written consent from a majority of shareholders. The approval process will depend on the company's bylaws and state laws governing the issuance of new shares.