California Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans

Description

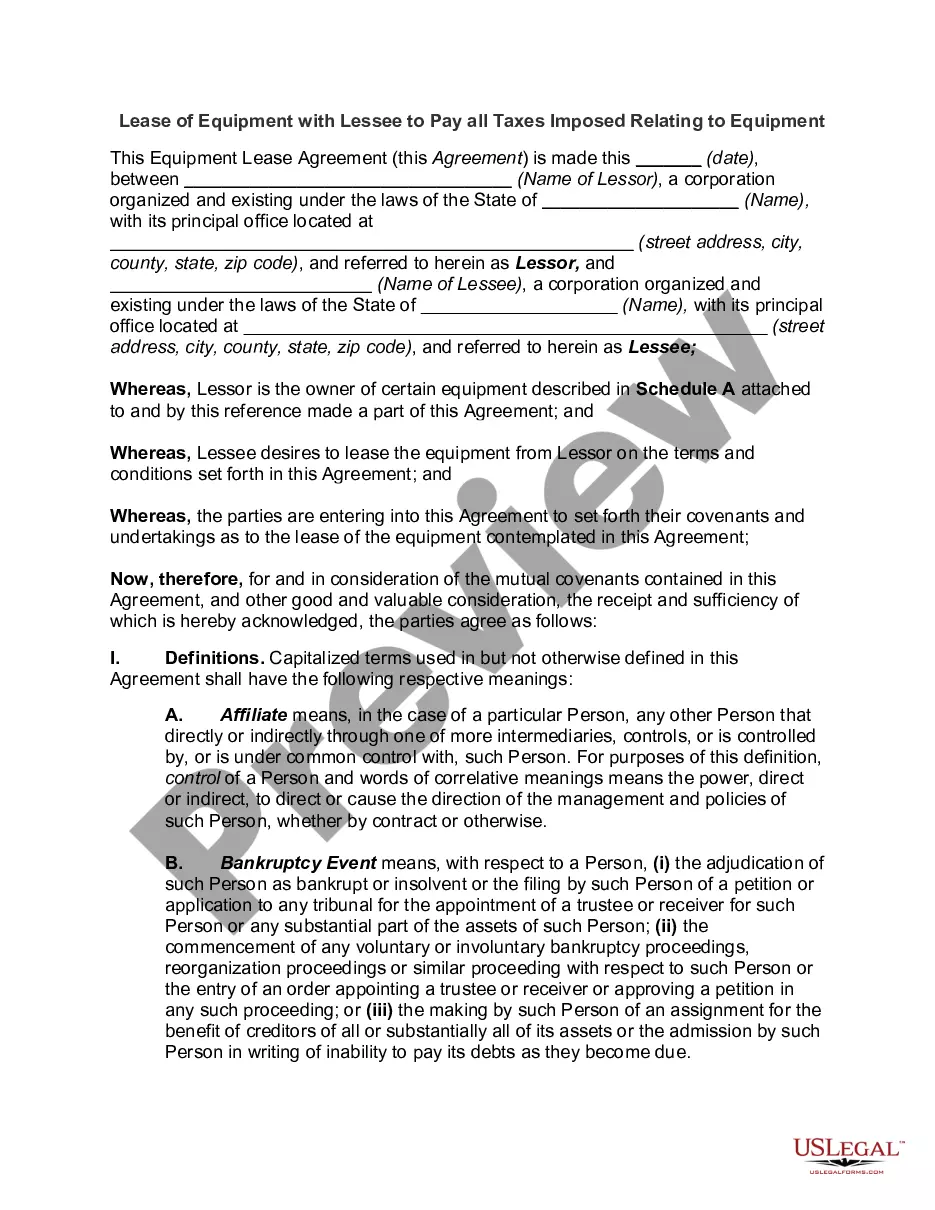

How to fill out Subsequent Transfer Agreement Between MLCC Mortgage Investors, Inc. And Bankers Trust Of CA, N.A. Regarding Consummation For Purchase And Sale Of Mortgage Loans?

You may invest hours on the web looking for the authorized record format that fits the state and federal specifications you want. US Legal Forms offers a large number of authorized types that happen to be analyzed by specialists. It is simple to down load or print out the California Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans from my support.

If you already possess a US Legal Forms account, you may log in and then click the Download button. Afterward, you may total, change, print out, or indication the California Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans. Every authorized record format you purchase is the one you have eternally. To have an additional duplicate of any purchased type, proceed to the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms web site for the first time, keep to the easy recommendations below:

- Initially, make sure that you have chosen the best record format to the county/town of your liking. Browse the type outline to make sure you have chosen the right type. If accessible, take advantage of the Review button to look throughout the record format too.

- If you wish to get an additional version of your type, take advantage of the Research field to get the format that meets your needs and specifications.

- After you have found the format you would like, simply click Acquire now to move forward.

- Find the prices program you would like, type in your qualifications, and sign up for your account on US Legal Forms.

- Full the financial transaction. You should use your Visa or Mastercard or PayPal account to purchase the authorized type.

- Find the format of your record and down load it to your device.

- Make modifications to your record if possible. You may total, change and indication and print out California Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans.

Download and print out a large number of record layouts utilizing the US Legal Forms website, that provides the greatest variety of authorized types. Use specialist and state-specific layouts to deal with your business or person demands.