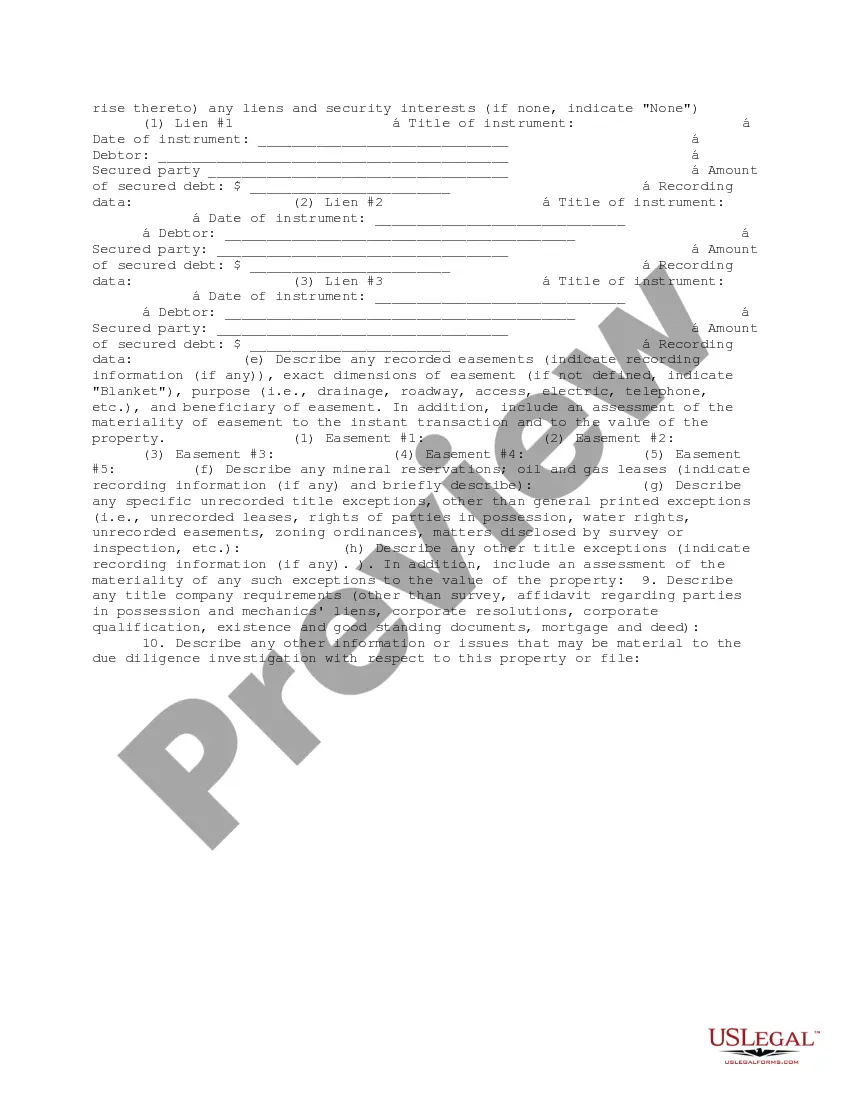

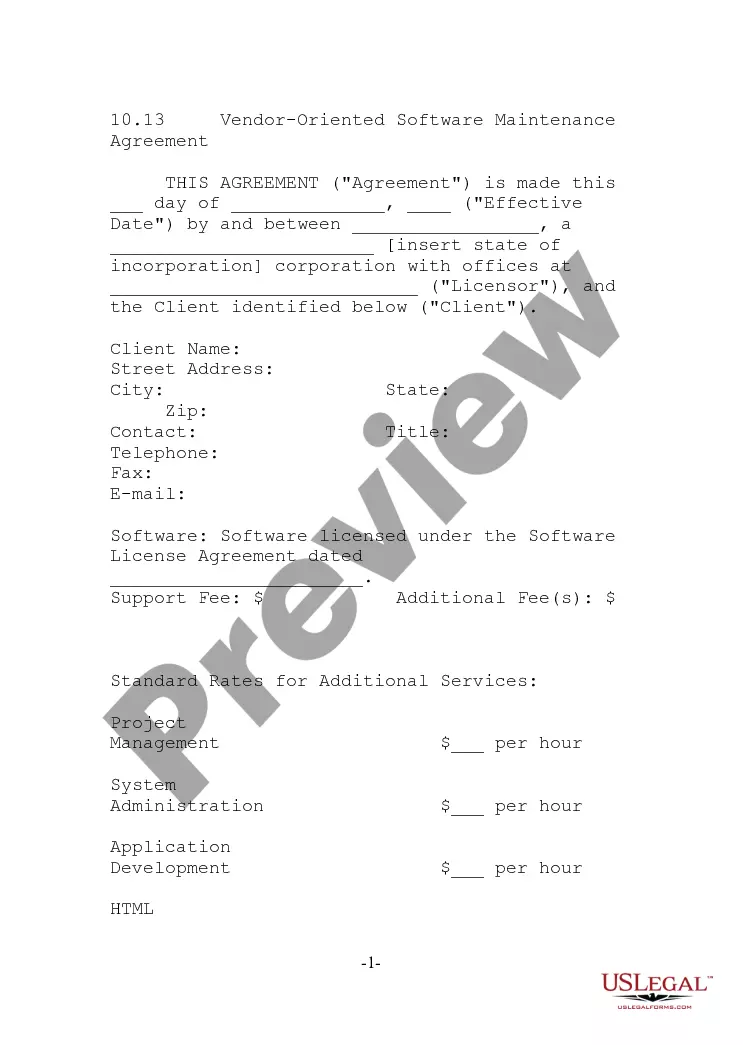

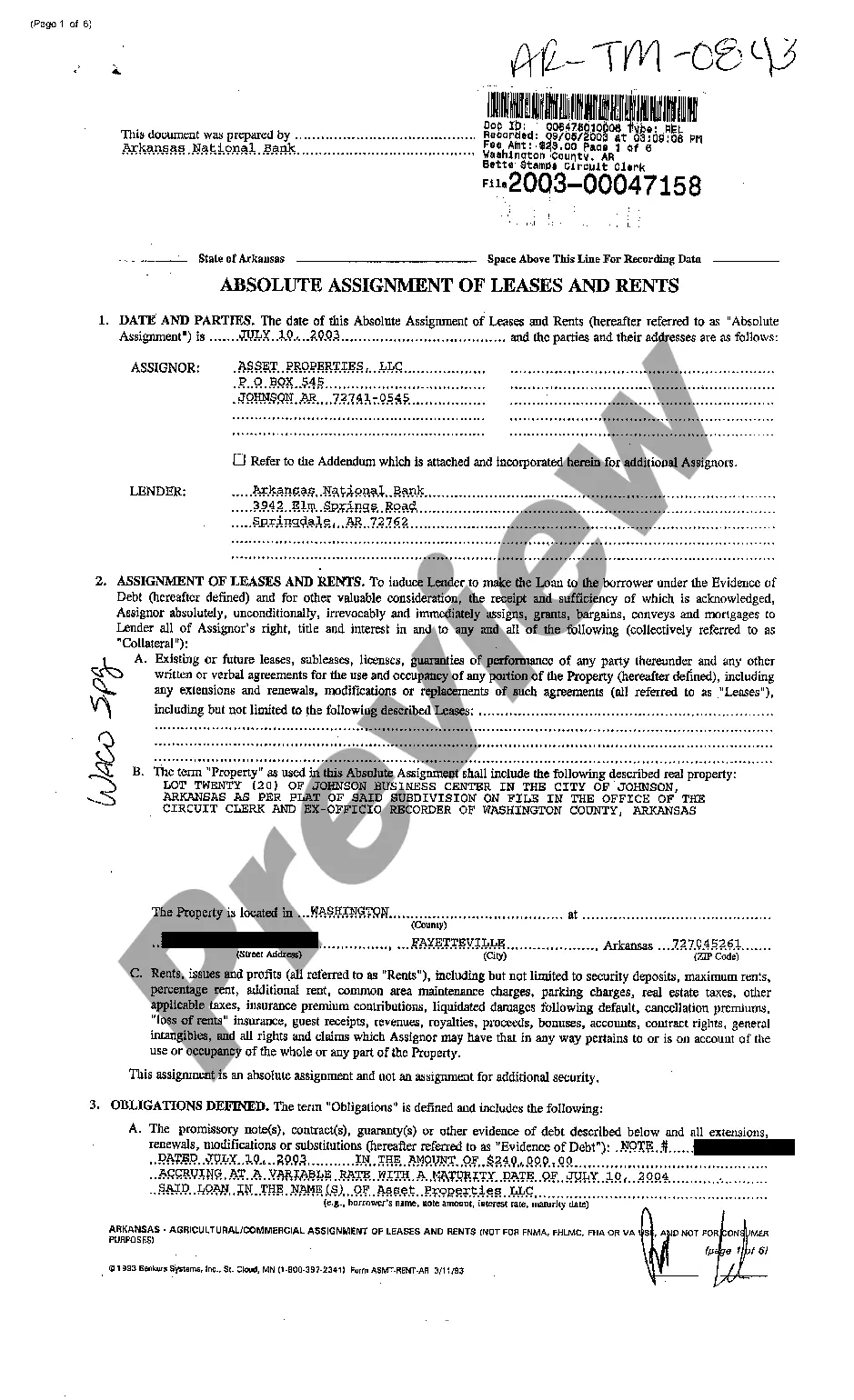

This due diligence workform is used to review property information and title commitments and policies in business transactions.

California Fee Interest Workform

Description

How to fill out Fee Interest Workform?

It is feasible to invest time on the web searching for the valid document template that meets the federal and state requirements you need.

US Legal Forms offers numerous valid forms that are reviewed by professionals.

You can obtain or print the California Fee Interest Workform from our platform.

Review the form description to confirm that you have selected the correct form. If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- Then, you can complete, modify, print, or sign the California Fee Interest Workform.

- Every valid document template you obtain is yours permanently.

- To get another copy of the purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- Firstly, ensure that you have selected the right document template for the state/city of your choice.

Form popularity

FAQ

In California, the maximum interest rate allowed by law is generally 10% per annum, as specified under the California Civil Code. This regulation ensures that borrowers are not charged excessively high rates. However, certain types of loans may have different caps, so reviewing the California Fee Interest Workform can provide clarity. Always consider consulting with a legal expert to understand your specific situation.

Investment expenses that qualify for deduction typically include fees for managing your investments, as well as interest on borrowed funds used for investments. Accurate reporting on the California Fee Interest Workform will help you determine which expenses can be deducted. Ensuring your records are organized will make it easier to identify all eligible deductions.

There have been discussions about implementing an exit tax for individuals leaving California, but as of now, no formal legislation has been passed. However, staying informed about any changes is crucial, especially when considering how such policies could impact your financial situation and tax responsibilities, including the California Fee Interest Workform.

Form 3526 is the California Fee Interest Workform used to calculate the limitations on business interest expense deductions. By completing this form, you provide essential information to ensure that your tax return is accurate and compliant with California regulations. Utilizing this form effectively can help avoid potential tax issues.

Yes, California taxes interest income as part of its state income tax system. This means any interest earned, whether from savings accounts or other investments, must be reported on your California Fee Interest Workform. It's important to keep track of your interest income to ensure accurate reporting and compliance with state tax laws.

The 3.8% investment tax may apply to net investment income for certain high-income individuals. This can impact how you report income on the California Fee Interest Workform. Understanding how this tax interacts with your overall tax situation ensures you can make informed decisions regarding investments in California.

California Form 3526 is designed to report and calculate business interest expense limitations for taxpayers in California. When utilizing the California Fee Interest Workform, businesses must complete Form 3526 to ensure compliance with state tax regulations. Properly filing this form is crucial for maximizing allowable deductions while avoiding penalties.

Yes, California has specific rules regarding the deduction of business interest expenses. Under the California Fee Interest Workform guidelines, businesses must comply with limitations to ensure they can accurately claim their interest expenses. This helps prevent businesses from claiming excessive deductions that may not reflect their actual financial situation.

As of now, California is not waiving the LLC fee for business entities. However, it is essential to stay updated on any changes in legislation that could affect this fee. Filing the California Fee Interest Workform accurately can ensure you remain compliant and avoid penalties. Regularly check the California Secretary of State's website for updates regarding LLC fees.

Yes, California allows you to deduct mortgage interest, which can significantly lower your taxable income. You must file the appropriate forms, including the California Fee Interest Workform, to claim this deduction. Keep records of your mortgage payments and interest statements to substantiate your claim. This deduction can benefit homeowners, particularly those with larger mortgage balances.