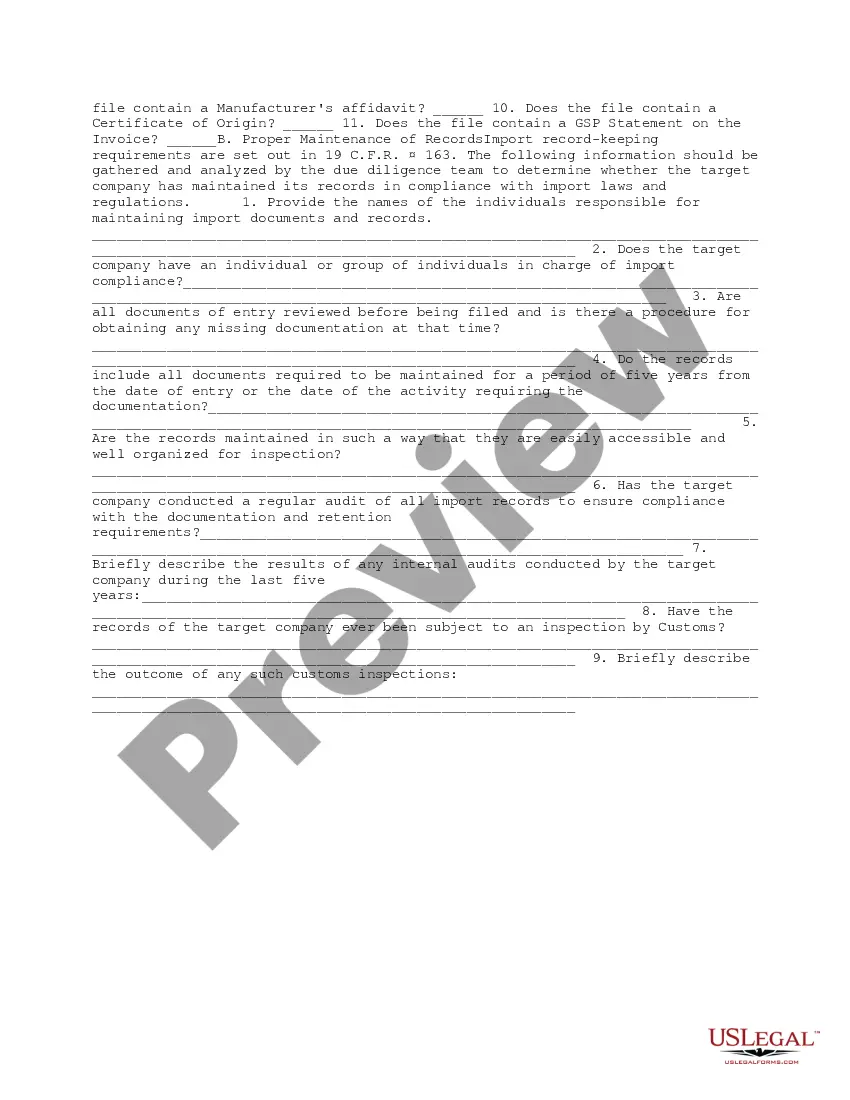

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

California Import Compliance and Records Review Due Diligence

Description

How to fill out Import Compliance And Records Review Due Diligence?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a extensive selection of legal form templates available for download or printing.

Through the website, you can discover thousands of forms for business and individual purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the California Import Compliance and Records Review Due Diligence in moments.

If you already possess a membership, sign in and download California Import Compliance and Records Review Due Diligence from your US Legal Forms collection. The Acquire button will show on every form you view. You have access to all previously obtained forms from the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make modifications. Complete, edit, and print and sign the acquired California Import Compliance and Records Review Due Diligence.

Every template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another version, simply navigate to the My documents section and click on the form you need.

Access the California Import Compliance and Records Review Due Diligence with US Legal Forms, one of the largest repositories of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and specifications.

- If this is your first time using US Legal Forms, here are simple instructions to get you started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to inspect the form's content.

- Examine the form description to confirm that you have selected the appropriate one.

- If the form doesn't meet your requirements, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

11 Documents Required for ExportingProforma Invoice.Commercial Invoice.Packing List.Certificates of Origin.Certificate of Free Sale.Shipper's Letter of Instruction.Inland Bill of Lading.Ocean Bill of Lading.More items...?

In most cases, a power of attorney (POA) provides the authorization to do clearance for an importer. The IOR must ensure all goods are appropriately documented and valued. Furthermore, the Importer of Record is the responsible party for the payment of duties, tariffs, and fees of the imported goods.

The procedure is summed into quick steps as below:Trade Enquiry.Procurement of Import License and Quota.Obtaining Foreign Exchange.Placing the Order.Dispatching a letter of Credit.Obtaining Necessary Documents.Customs Formalities and Clearing of Goods.Making the Payment.More items...

List of Documents required for Imports Customs ClearanceBill of Entry.Commercial Invoice.Bill of Lading or Airway Bill.Import License.Certificate of Insurance.Letter of Credit or LC.Technical Write-up or Literature (Only required for specific goods)Industrial License (for specific goods)More items...?

The Export.gov website is an amazing resource for finding people who can help you with import country requirements.

When importing a good or product, it is the responsibility of the importer of record to be compliant with import regulations.

You can check the status of export and import licences on the ICEGATE - e-commerce portal of the Central Board of Excise and Customs (CBEC). Exporters and importers may either enter their licence number or file name in the search space for checking the status.

The Canadian Food Inspection Agency (CFIA) is responsible for verifying that imported food, plants and animals meet Canadian requirements.

List of Documents required for Imports Customs ClearanceBill of Entry.Commercial Invoice.Bill of Lading or Airway Bill.Import License.Certificate of Insurance.Letter of Credit or LC.Technical Write-up or Literature (Only required for specific goods)Industrial License (for specific goods)More items...?17-Sept-2019

Import proceduresObtain IEC.Ensure legal compliance under different trade laws.Procure import licenses.File Bill of Entry and other documents to complete customs clearing formalities.Determine import duty rate for clearance of goods.