California Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd.

Description

How to fill out Form Of Security Agreement Between Everest And Jennings International, Ltd., Everest And Jennings, Inc., And BIL, Ltd.?

If you need to total, download, or printing legitimate papers templates, use US Legal Forms, the largest variety of legitimate kinds, that can be found on the Internet. Use the site`s basic and convenient look for to find the paperwork you will need. Various templates for business and individual reasons are sorted by types and states, or keywords and phrases. Use US Legal Forms to find the California Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd. in just a handful of clicks.

Should you be currently a US Legal Forms consumer, log in to your profile and click on the Acquire button to have the California Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd.. You can also gain access to kinds you previously delivered electronically from the My Forms tab of your profile.

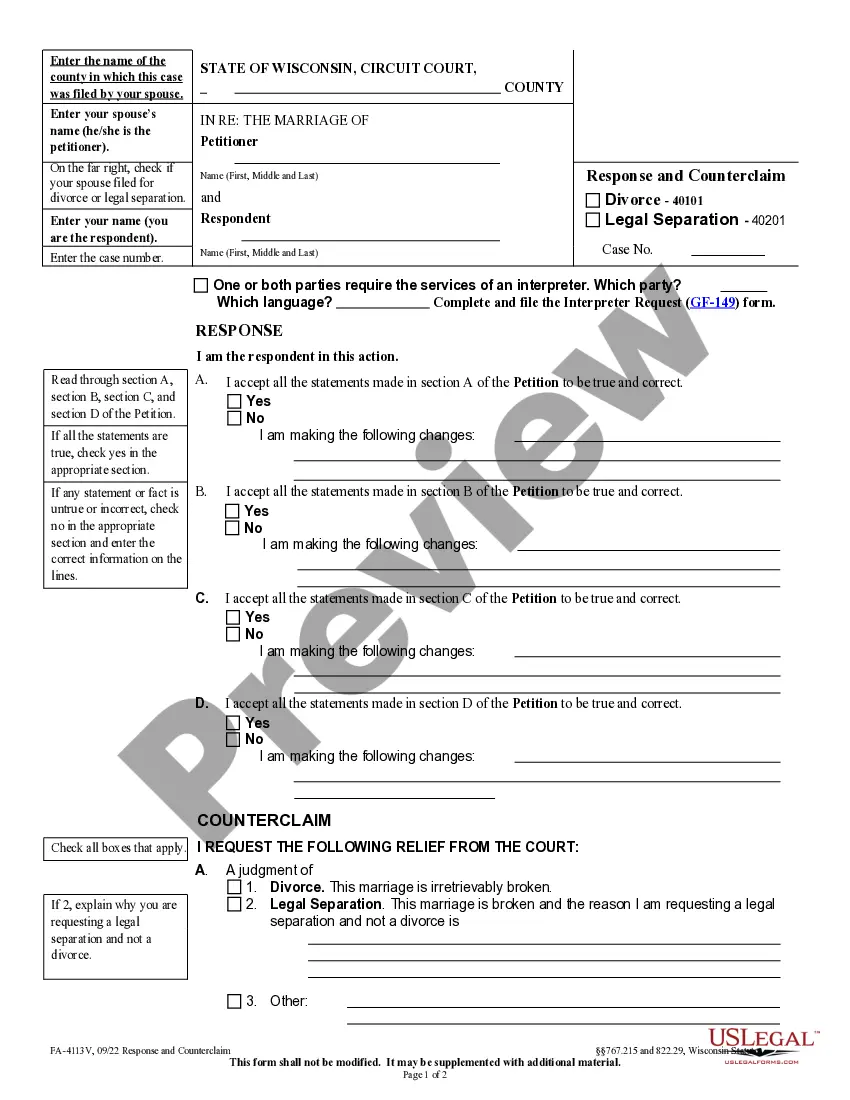

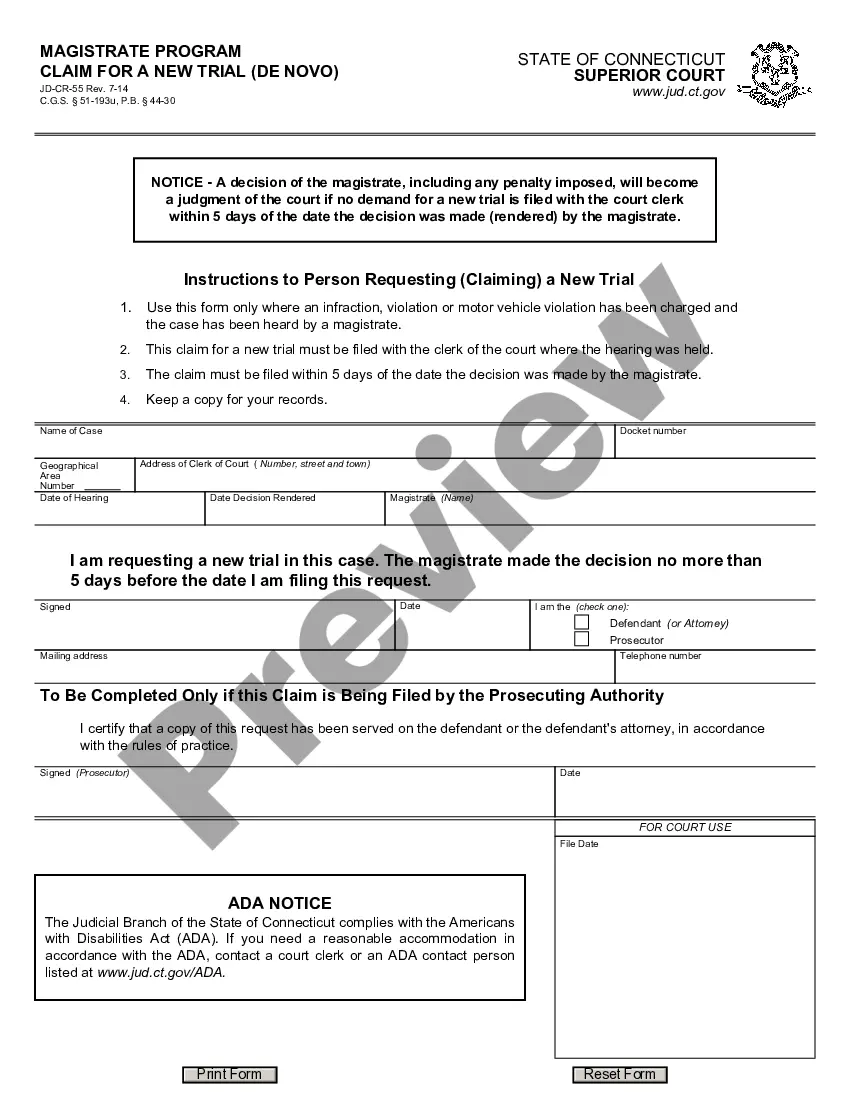

If you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have selected the form for that proper area/nation.

- Step 2. Utilize the Preview method to examine the form`s content material. Never neglect to see the information.

- Step 3. Should you be not happy together with the develop, use the Research discipline at the top of the screen to discover other variations in the legitimate develop template.

- Step 4. Once you have found the form you will need, click the Acquire now button. Choose the costs plan you prefer and put your qualifications to sign up for the profile.

- Step 5. Approach the deal. You can utilize your Мisa or Ьastercard or PayPal profile to complete the deal.

- Step 6. Choose the format in the legitimate develop and download it on the device.

- Step 7. Full, modify and printing or sign the California Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd..

Each and every legitimate papers template you buy is yours permanently. You might have acces to each develop you delivered electronically within your acccount. Select the My Forms section and choose a develop to printing or download yet again.

Compete and download, and printing the California Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd. with US Legal Forms. There are millions of specialist and condition-distinct kinds you may use for the business or individual needs.