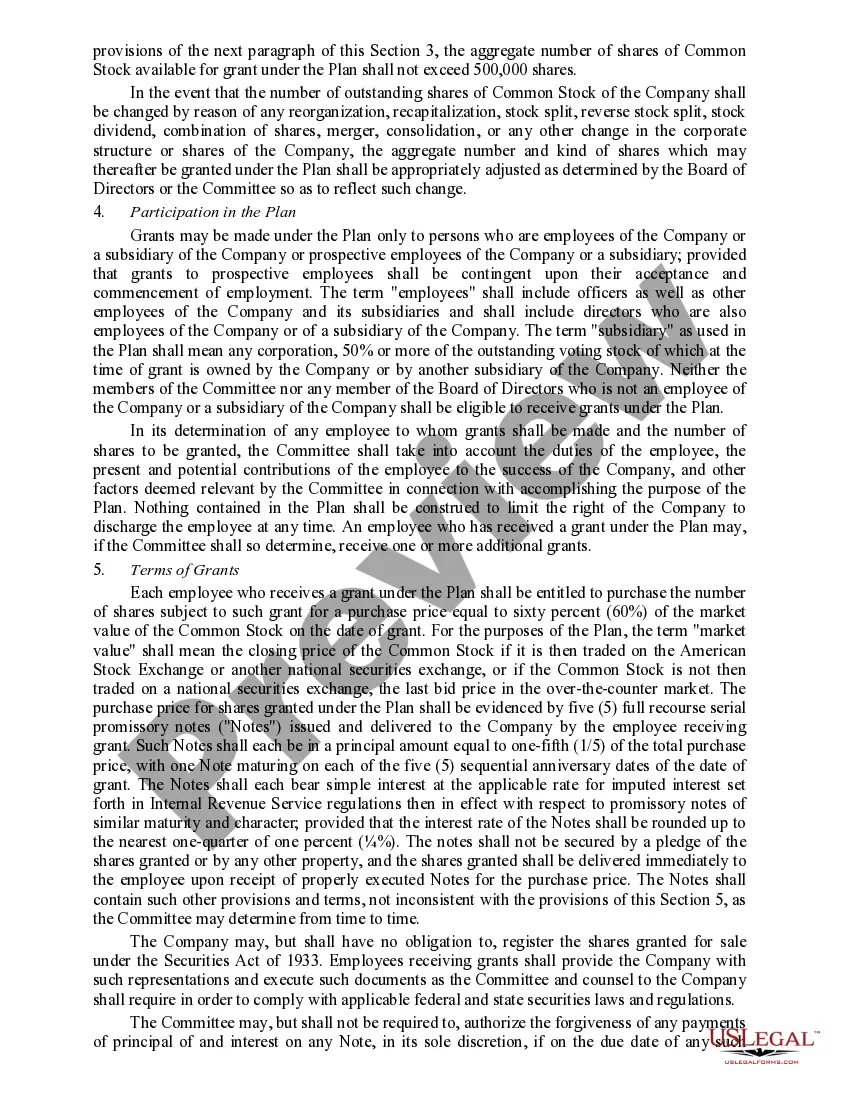

California Management Stock Purchase Plan

Description

How to fill out Management Stock Purchase Plan?

You are able to commit time online looking for the authorized papers web template that suits the federal and state specifications you will need. US Legal Forms supplies a large number of authorized kinds which can be evaluated by experts. You can easily download or printing the California Management Stock Purchase Plan from our support.

If you already possess a US Legal Forms accounts, you can log in and click the Obtain switch. After that, you can comprehensive, change, printing, or indication the California Management Stock Purchase Plan. Each and every authorized papers web template you get is yours eternally. To obtain yet another duplicate of any bought form, check out the My Forms tab and click the related switch.

If you use the US Legal Forms site initially, adhere to the easy instructions below:

- First, be sure that you have chosen the right papers web template to the region/area that you pick. See the form information to ensure you have picked out the appropriate form. If readily available, take advantage of the Review switch to search with the papers web template too.

- In order to locate yet another variation of your form, take advantage of the Lookup field to discover the web template that meets your needs and specifications.

- When you have found the web template you desire, click on Buy now to move forward.

- Choose the pricing program you desire, type your credentials, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You should use your bank card or PayPal accounts to cover the authorized form.

- Choose the format of your papers and download it for your product.

- Make modifications for your papers if needed. You are able to comprehensive, change and indication and printing California Management Stock Purchase Plan.

Obtain and printing a large number of papers layouts while using US Legal Forms web site, that offers the largest assortment of authorized kinds. Use professional and express-specific layouts to handle your business or personal needs.

Form popularity

FAQ

Disadvantages of Employee Stock Purchase Plans Ensuring the ESPP follows security and tax law guidelines can be challenging. A large amount of HR functions goes into administering the stock purchase plan. There are legal, tax, and administrative issues that go into setting up the plan.

The Bottom Line. Employee stock options can be a valuable part of your compensation package, especially if you work for a company whose stock has been soaring of late. In order to take full advantage, make sure you exercise your rights before they expire.

The ESOP vs 401K Plan With a 401(k), the employer's contributions are tax-deferred, meaning that the money is taken out of each paycheck before taxes, and those wages are not taxed until withdrawal. Whereas with an ESOP, employees also do not pay taxes on the shares in their account until distribution.

Employees who elect to participate in a qualified ESPP are typically able to take advantage of some tax benefits, as the discount is not recognized as taxable income until the stock is sold. When you sell the stock, the discount you received when you bought it may be taxable as income.

An ESPP discount is nice, but it ultimately comes down to whether or not you believe the stock price will appreciate. A 5% discount on shares that depreciate 10% is still a loss.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.

How is the $25,000 limit calculated? The basic rule is that each employee cannot purchase more than $25,000 per year, valued using the fair market value on the date he/she enrolled in the current offering.

Qualifying disposition: You sold the stock at least two years after the offering (grant date) and at least one year after the exercise (purchase date). If so, a portion of the profit (the ?bargain element?) is considered compensation income (taxed at regular rates) on your Form 1040.