California Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc.

Description

How to fill out Proposal To Approve Adoption Of Stock Option And Long-Term Incentive Plan Of The Golf Technology Holding, Inc.?

Are you presently in a placement where you need to have papers for either business or personal uses virtually every day time? There are a lot of legitimate file themes available online, but getting ones you can depend on isn`t straightforward. US Legal Forms offers 1000s of type themes, much like the California Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc., that are created to meet federal and state demands.

When you are already familiar with US Legal Forms site and also have your account, simply log in. Afterward, you can acquire the California Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc. format.

Unless you provide an bank account and need to start using US Legal Forms, adopt these measures:

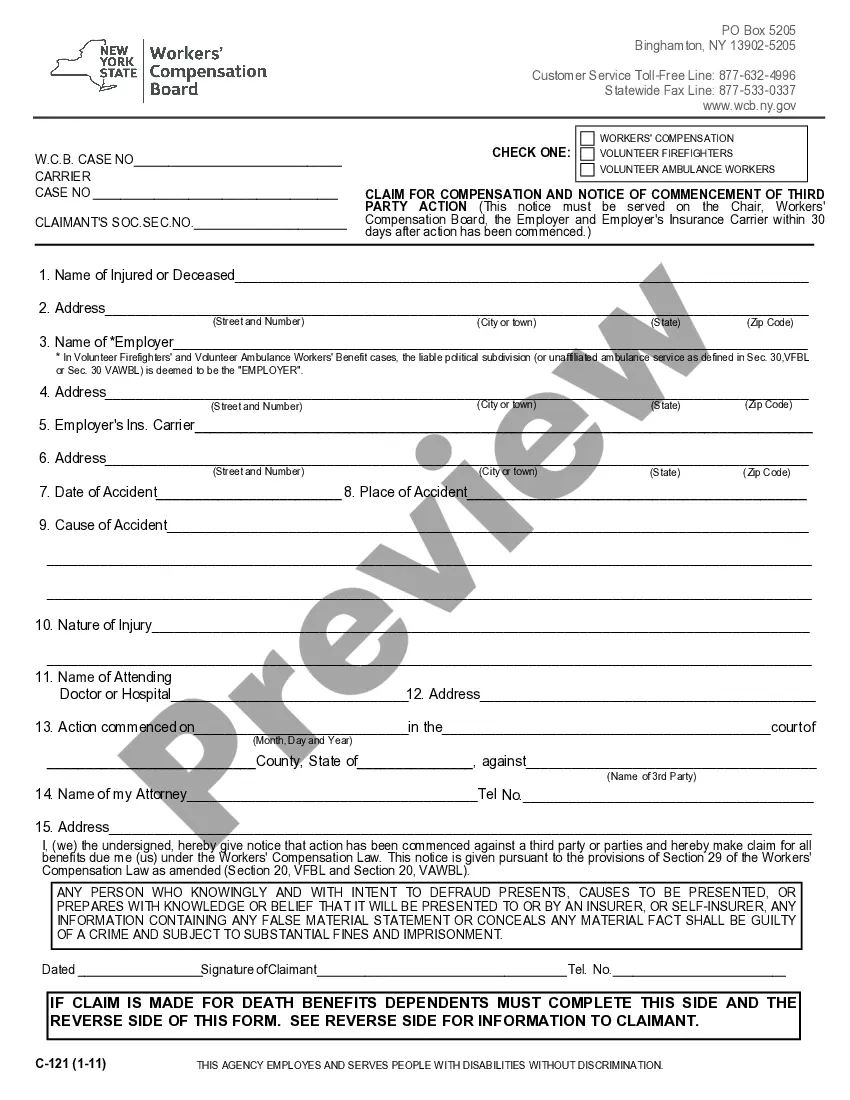

- Find the type you require and make sure it is for the correct area/county.

- Make use of the Review button to check the shape.

- Browse the information to actually have selected the correct type.

- If the type isn`t what you are searching for, utilize the Research field to obtain the type that meets your needs and demands.

- When you find the correct type, click Purchase now.

- Choose the rates program you need, complete the necessary info to generate your money, and pay money for the transaction utilizing your PayPal or bank card.

- Choose a practical file file format and acquire your duplicate.

Discover each of the file themes you might have bought in the My Forms menus. You can obtain a further duplicate of California Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc. anytime, if necessary. Just click on the needed type to acquire or printing the file format.

Use US Legal Forms, the most considerable selection of legitimate varieties, to save lots of some time and steer clear of blunders. The service offers appropriately created legitimate file themes that you can use for a range of uses. Create your account on US Legal Forms and begin making your daily life a little easier.

Form popularity

FAQ

The vesting period is the time it takes for an employee or co-founder to earn their full equity stake in the company. It is often over a four year vesting schedule, but it can be longer or shorter depending on the company.

To receive the incentive, you must hold (keep) ISOs for at least one year after exercise and two years after the grant date. If you hold your stock for at least a year after purchase, you will pay the lower capital gains tax rate on the increase in value.

Federal rules require full vesting within six years. Almost 30% of 401(k) plans use a graded five- or six-year schedule for their company match, ing to the PSCA survey.

To encourage loyalty among employees and also keep them engaged and focused on the company's success, such grants or options usually are subject to a vesting period during which they cannot be sold. A common vesting period is three to five years.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying asset?the company's stock?at a specified price for a finite period of time.

To encourage loyalty among employees and also keep them engaged and focused on the company's success, such grants or options usually are subject to a vesting period during which they cannot be sold. A common vesting period is three to five years.