Pennsylvania Form of Revolving Promissory Note

Description

How to fill out Form Of Revolving Promissory Note?

If you wish to comprehensive, acquire, or produce legitimate papers themes, use US Legal Forms, the most important variety of legitimate kinds, which can be found on the Internet. Utilize the site`s basic and handy look for to get the documents you require. A variety of themes for enterprise and individual functions are categorized by types and states, or keywords and phrases. Use US Legal Forms to get the Pennsylvania Form of Revolving Promissory Note in a couple of clicks.

When you are previously a US Legal Forms consumer, log in for your accounts and then click the Down load key to obtain the Pennsylvania Form of Revolving Promissory Note. You can even accessibility kinds you formerly acquired in the My Forms tab of your respective accounts.

If you are using US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for that appropriate area/land.

- Step 2. Take advantage of the Preview option to look through the form`s content material. Don`t forget to read through the description.

- Step 3. When you are unsatisfied using the form, use the Look for field on top of the monitor to locate other types of your legitimate form format.

- Step 4. When you have located the shape you require, select the Purchase now key. Pick the rates plan you favor and add your credentials to sign up to have an accounts.

- Step 5. Process the purchase. You can use your credit card or PayPal accounts to finish the purchase.

- Step 6. Find the structure of your legitimate form and acquire it in your device.

- Step 7. Total, revise and produce or indication the Pennsylvania Form of Revolving Promissory Note.

Every legitimate papers format you acquire is your own property eternally. You have acces to each form you acquired in your acccount. Select the My Forms segment and choose a form to produce or acquire yet again.

Remain competitive and acquire, and produce the Pennsylvania Form of Revolving Promissory Note with US Legal Forms. There are millions of expert and state-distinct kinds you may use to your enterprise or individual requirements.

Form popularity

FAQ

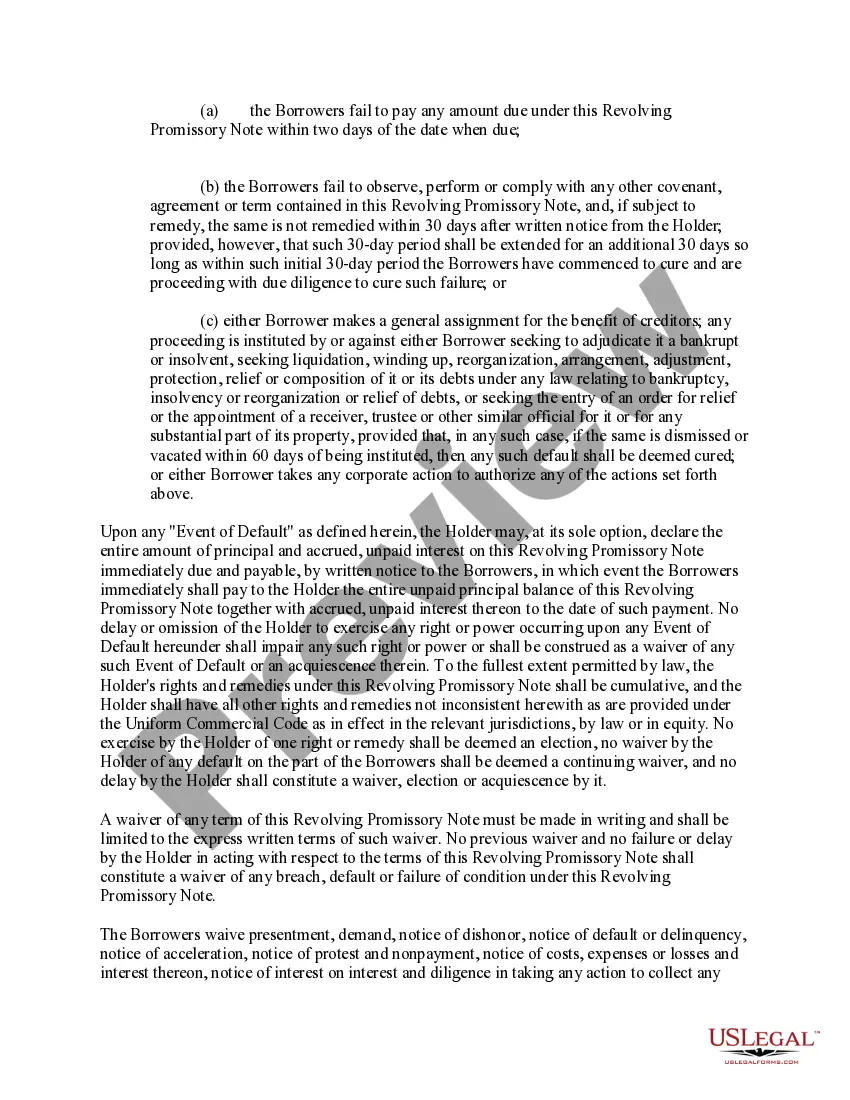

The promissory note could be declared invalid if it doesn't reveal the amount that the borrower owes the lender, or what installments are due. If there are multiple installments, then include each installment's due date.

A promissory note is a written agreement between a borrower and a lender saying that the borrower will pay back the amount borrowed plus interest. The promissory note is issued by the lender and is signed by the borrower (but not the lender).

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

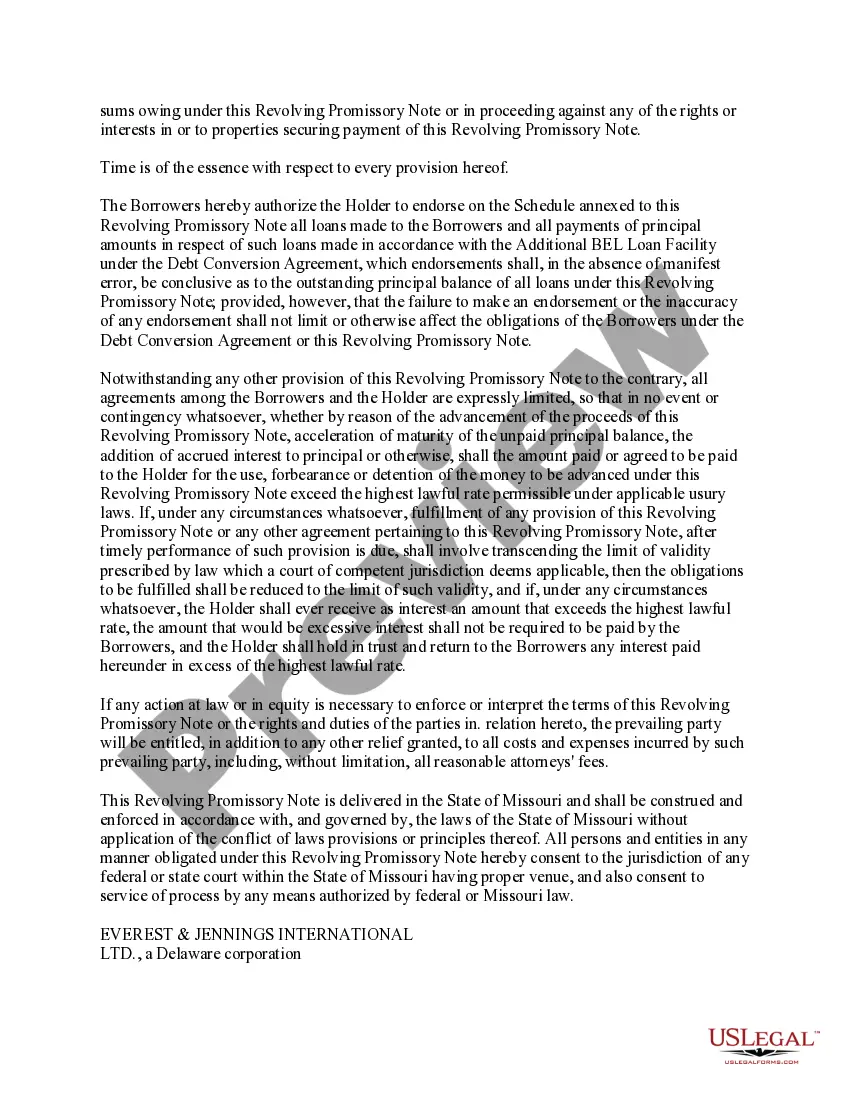

A promissory note is a legally binding promise to repay a debt. These agreements could be used for personal loans, student loans, mortgages and more. Promissory note laws vary by state, but they typically include the loan amount, loan terms and signatures from both the lending and borrowing party.

A promissory note cannot be valid unless it contains details about the nature of credit, the means to repay it along with the duration given for the repayment, the signatures of all parties, the conditions agreed in the sanction of the loan, the rate of interest and all related terms.

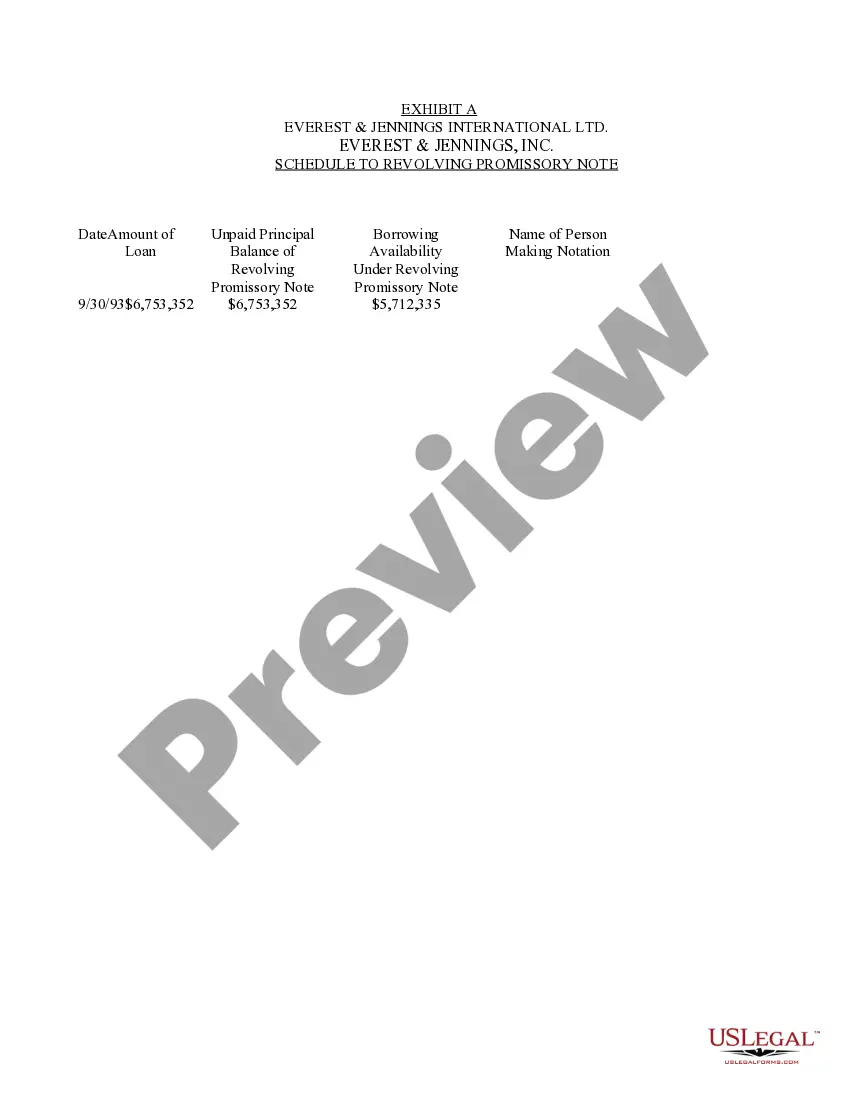

A revolving promissory note is a form of business financing that allows the company to borrow more money when needed. The process starts with an initial loan and then can be used as collateral for future loans that are paid back over time.

There are a number of other different types of promissory notes, including investment promissory notes, take-back mortgages, and student loan promissory notes.

Types of Promissory Notes Simple Promissory Note. ... Student Loan Promissory Note. ... Real Estate Promissory Note. ... Personal Loan Promissory Notes. ... Car Promissory Note. ... Commercial Promissory note. ... Investment Promissory Note. ... Installment Payments.