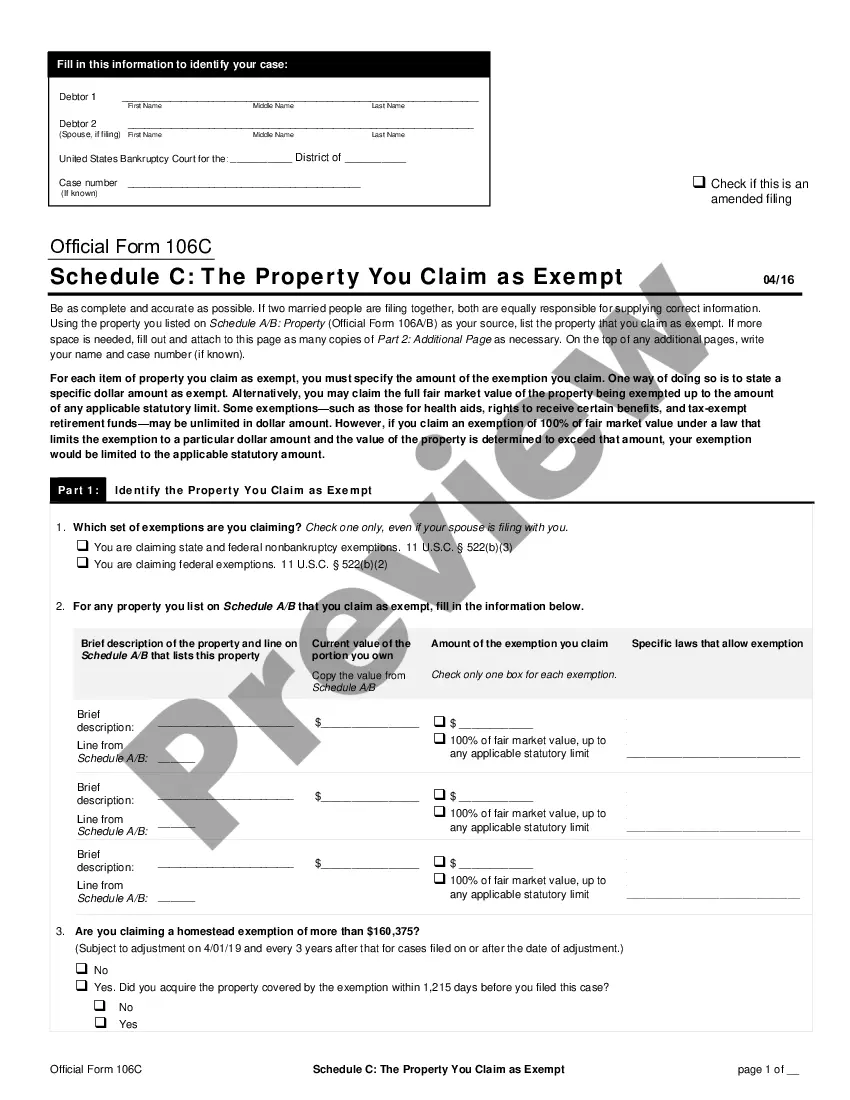

California Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

You may spend time on the Internet trying to find the legitimate record design which fits the federal and state requirements you require. US Legal Forms offers thousands of legitimate varieties which are analyzed by experts. It is simple to acquire or produce the California Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 from the support.

If you have a US Legal Forms bank account, you may log in and click the Download button. Afterward, you may complete, edit, produce, or signal the California Property Claimed as Exempt - Schedule C - Form 6C - Post 2005. Each and every legitimate record design you get is the one you have forever. To get one more backup associated with a purchased type, visit the My Forms tab and click the related button.

If you work with the US Legal Forms internet site the very first time, stick to the simple recommendations beneath:

- Initial, make certain you have chosen the proper record design for the area/town of your choice. Browse the type information to ensure you have picked the correct type. If accessible, use the Preview button to search throughout the record design at the same time.

- In order to get one more edition from the type, use the Research area to find the design that meets your needs and requirements.

- Upon having located the design you need, click Purchase now to carry on.

- Choose the costs program you need, type your credentials, and register for a free account on US Legal Forms.

- Complete the transaction. You should use your credit card or PayPal bank account to fund the legitimate type.

- Choose the formatting from the record and acquire it in your device.

- Make alterations in your record if needed. You may complete, edit and signal and produce California Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

Download and produce thousands of record web templates while using US Legal Forms website, that provides the greatest collection of legitimate varieties. Use specialist and state-particular web templates to deal with your small business or person requirements.

Form popularity

FAQ

(Official Form 106C) lists the property that you believe you are entitled to keep. If you do not claim the property on this form, it will not be exempted, despite your rights under the law. Before filling out this form, you have to decide whether you will use your state exemptions or the federal exemptions.

These limits, adjusted annually for inflation, have increased the 2023 bankruptcy homestead exemption to $678,391 in San Diego County for those who qualify. A chapter 7 trustee can sell a debtor's non-exempt property to pay creditors.

The State Controller's Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria, including at least 40 percent equity in the home and an annual household income of $49,017 or less ...

Lower My Property Taxes Decline In Value / Prop 8. Calamity / Property Destroyed. Disabled Veterans' Exemption. Homeowners' Exemption. Nonprofit Exemptions. Transfers Between Family Members. Transfer of Base Year Value to Replacement Dwelling. Assessment A?p?peal.

California offers an automatic homestead exemption to every homeowner who occupies their home, whether it is a single-family dwelling, mobile home, or even a boat. As of January 1, 2021, the California homestead exemption is a minimum of 300,000 dollars, but can be as high as 600,000 dollars.