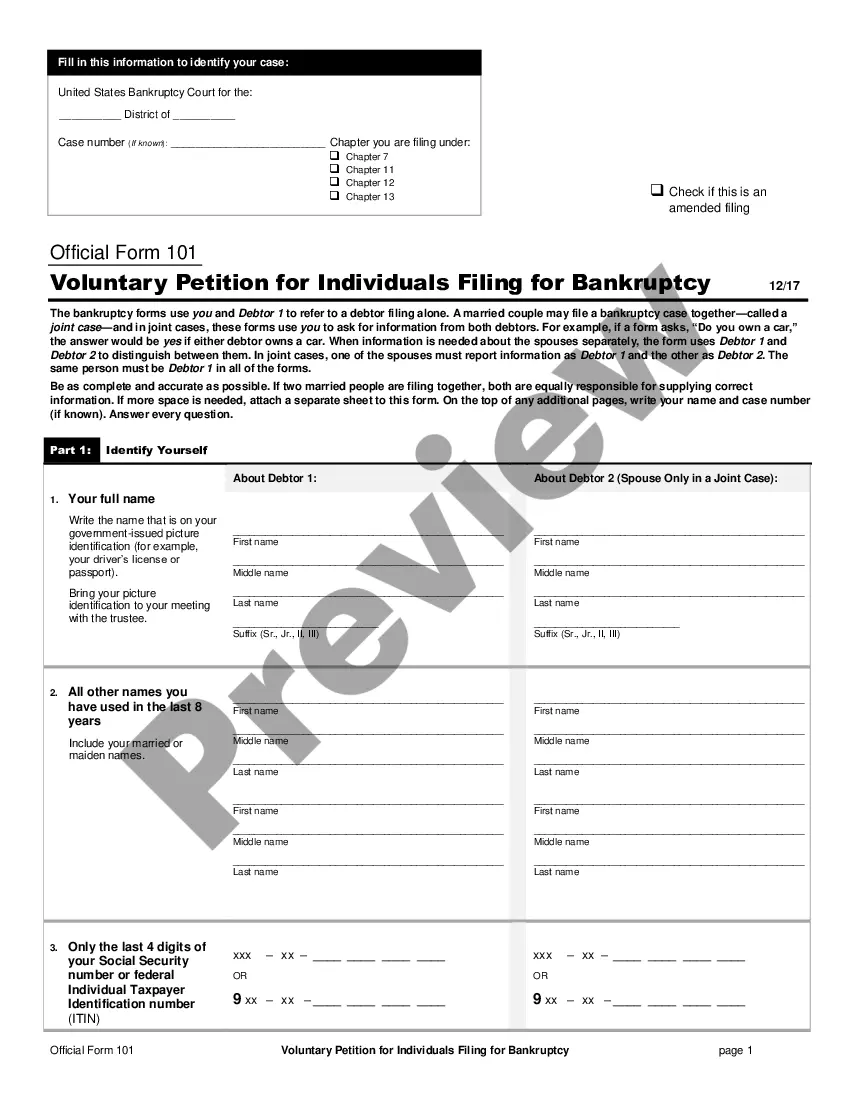

California Voluntary Petition - Form 1

Description

How to fill out Voluntary Petition - Form 1?

You are able to spend several hours on the web searching for the legitimate record template which fits the state and federal needs you want. US Legal Forms provides a huge number of legitimate forms that happen to be examined by experts. It is simple to obtain or produce the California Voluntary Petition - Form 1 from our support.

If you have a US Legal Forms accounts, it is possible to log in and then click the Download switch. Next, it is possible to full, revise, produce, or indicator the California Voluntary Petition - Form 1. Each and every legitimate record template you acquire is the one you have forever. To obtain yet another copy associated with a acquired type, go to the My Forms tab and then click the related switch.

If you use the US Legal Forms site initially, follow the straightforward recommendations listed below:

- Initially, make sure that you have selected the correct record template to the region/city of your choice. Read the type description to ensure you have selected the appropriate type. If available, use the Preview switch to check from the record template at the same time.

- If you wish to locate yet another version of your type, use the Research industry to obtain the template that fits your needs and needs.

- Once you have identified the template you would like, click on Acquire now to continue.

- Find the costs program you would like, type in your credentials, and sign up for an account on US Legal Forms.

- Complete the deal. You can use your charge card or PayPal accounts to cover the legitimate type.

- Find the file format of your record and obtain it to your product.

- Make adjustments to your record if possible. You are able to full, revise and indicator and produce California Voluntary Petition - Form 1.

Download and produce a huge number of record themes while using US Legal Forms web site, which provides the biggest selection of legitimate forms. Use professional and status-distinct themes to tackle your organization or person requires.

Form popularity

FAQ

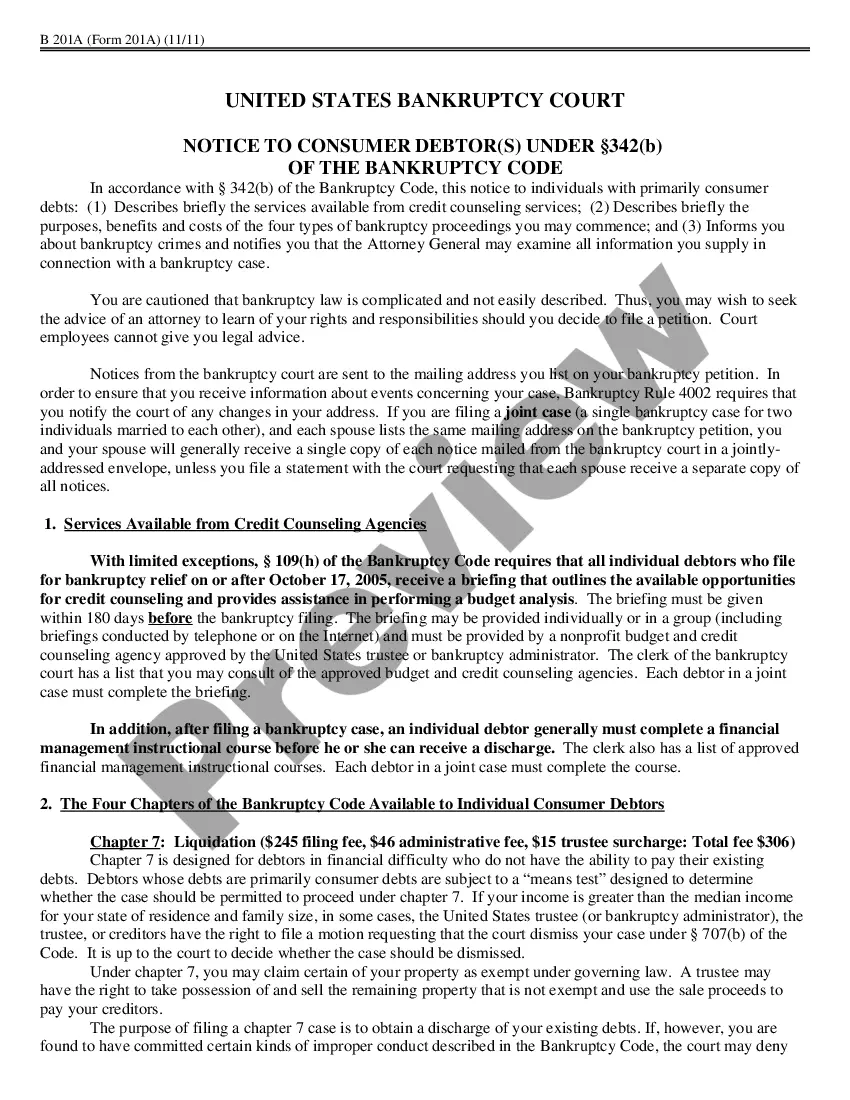

Usually, the trustee pays them in this order: secured debts first, followed by priority debts, and then unsecured debts. (Learn about secured, unsecured, and priority claims.) You may pay some of those debts in full through your plan, and others just pennies on the dollar.

It's a Long Term Commitment ? Filing Chapter 13 bankruptcy requires you to make a long-term commitment to the process. Tough To Get Credit or a Mortgage for 7 Years ? Other impacts include the inability to get credit cards at a good rate, and filing Chapter 13 makes it tough to get a mortgage.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or your car while also discharging unsecured debt.

Chapter 13 and debt Firstly, all Chapter 13 payment plans must repay all priority claims and administrative expenses in full. These types of debts include taxes, child support, alimony, attorneys' fees and court costs.

When you file Chapter 7 bankruptcy, you have to pay a fee of$338. But if your income is less than 150% of the federal income poverty guidelines, then you qualify to apply for a fee waiver. To see what these guidelines are, you can scroll down to the California Fee Waiver Eligibility table below.

In most cases you will only pay back a portion of the outstanding debt to creditors. In a Chapter 13 bankruptcy a 36 to 60-month payment plan is proposed to the court to repay your debt. A 36-month plan is proposed to the court if your gross income is below the median income for your state.