California Employee Evaluation Form for Accountant

Description

How to fill out Employee Evaluation Form For Accountant?

You might spend numerous hours online attempting to locate the legal document template that meets the federal and state standards you require.

US Legal Forms provides an extensive collection of legal templates that are evaluated by experts.

You can effortlessly download or print the California Employee Evaluation Form for Accountant from the service.

If available, utilize the Review button to explore the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, edit, print, or sign the California Employee Evaluation Form for Accountant.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of a purchased form, navigate to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your preferred area/city.

- Review the form summary to confirm you have selected the right form.

Form popularity

FAQ

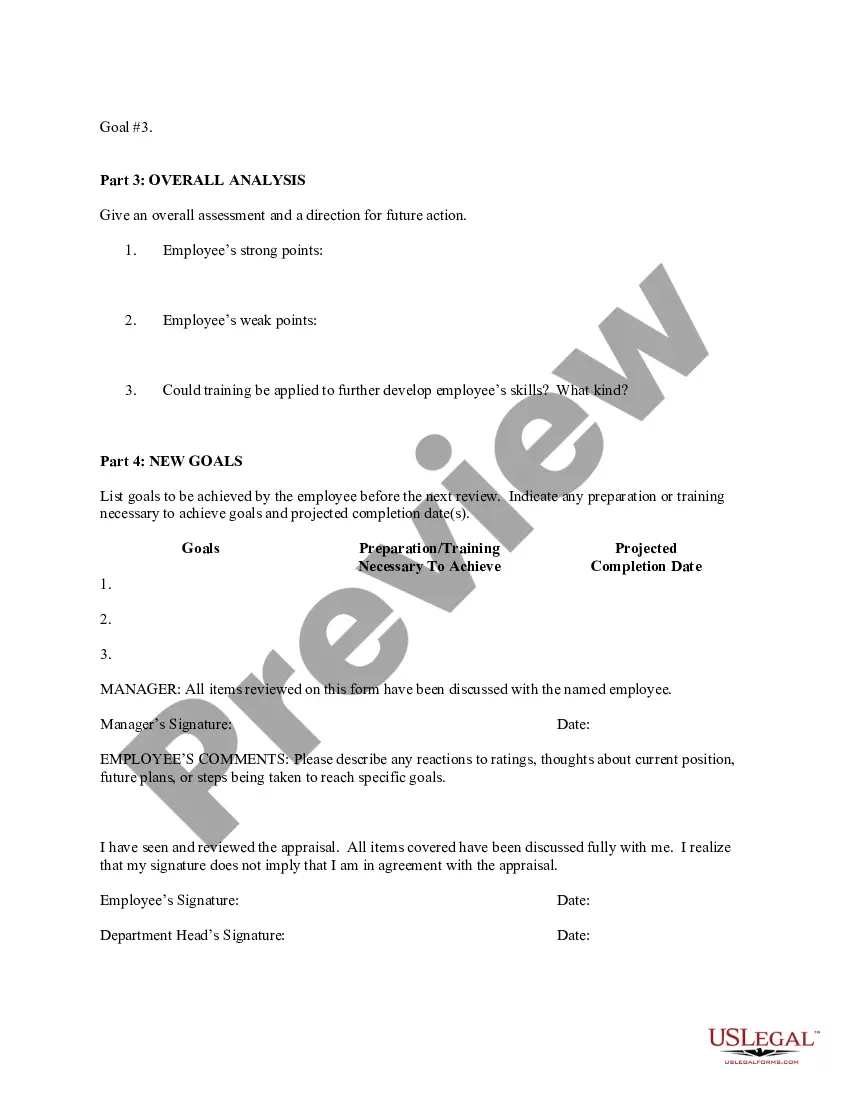

A performance review typically focuses on five key aspects: goals, feedback, accomplishments, areas for improvement, and future objectives. These elements guide the discussion about an employee’s contributions and potential growth. When using the California Employee Evaluation Form for Accountant, you can systematically address these points to ensure a comprehensive review process.

14 ways to use accounting to measure performanceGross profit margin = (total revenue - cost of goods sold) / revenue x 100.Net profit margin = (net profit / total revenue) x 100.Net profit margin = (revenue - cost of goods sold - operating and other expenses - interest - taxes) / revenue x 100.More items...?

How to write an employee evaluationReview the employee's job description. Get a current copy of each person's job description and review the requirements.Highlight areas of improvement.Compare strengths and weaknesses.Recommend actionable goals.Provide constructive feedback.Welcome employee input.

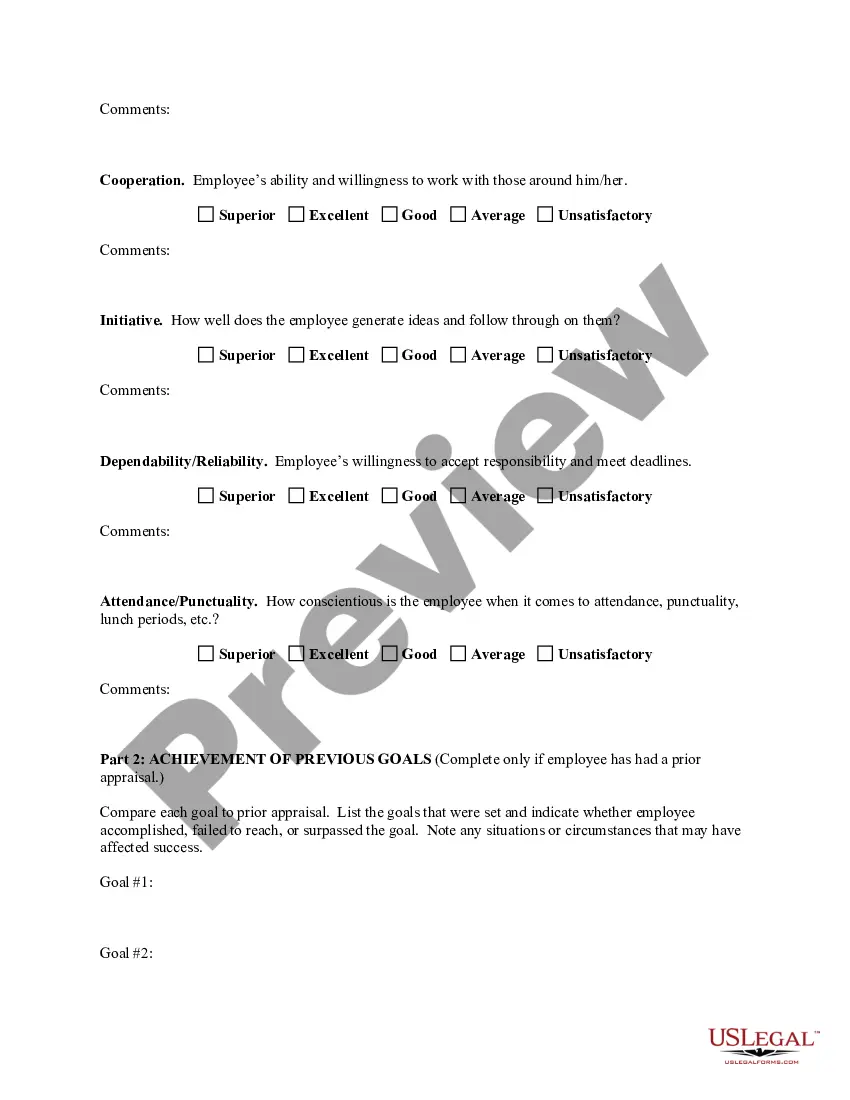

What to Include in an Employee Evaluation Form?Employee and reviewer information. The form must have basic information about both parties involved.Review period.An easy-to-understand rating system.Evaluation points.Goals.Extra space for comments.Signatures.Scorecard.More items...?

Like every other aspect of your job, the performance evaluation process must comply with federal and state anti-discrimination laws. If you suspect noncompliance, you should document your concerns and bring them to your supervisor's attention immediately.

Here are other key indicators that should be tracked, analyzed, and acted upon as needed.Operating Cash Flow.Working Capital.Current Ratio.Debt to Equity Ratio.LOB Revenue Vs.LOB Expenses Vs.Accounts Payable Turnover.Accounts Receivable Turnover.More items...

The Fair Labor Standards Act (FLSA) does not require performance evaluations. Performance evaluations are generally a matter of agreement between an employer and employee (or the employee's representative).

Summary. Generally, California law does not restrict private communications involving opinions, such as performance appraisals, particularly when those communications are truthful, reasonable, businesslike, and kept confidential between management and the employee.

No law requires companies to conduct job reviews, but businesses that do may have a better understanding of their employees. The information gained from performance reviews can be used to determine raises, succession plans and employee-development strategies.

Performance evaluations for accountants focus more on competencies and proficiency instead of leadership style and management skills, which are traditionally evaluated using 360-degree feedback. However, other appraisal methods are suitable to successfully evaluate the performance of an accountant.