California Equal Pay Checklist

Description

How to fill out Equal Pay Checklist?

Are you in a situation where you need documents for either business or specific purposes every single day.

There are numerous legal document templates available online, but finding versions you can trust is not simple.

US Legal Forms provides thousands of template layouts, such as the California Equal Pay Checklist, tailored to meet federal and state regulations.

Choose a convenient file format and download your copy.

Locate all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the California Equal Pay Checklist anytime if required. Just click on the needed form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the California Equal Pay Checklist template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to examine the form.

- Review the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search box to find the form that meets your needs and requirements.

- Once you find the correct form, click Get now.

- Choose the payment plan you desire, fill out the necessary information to create your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

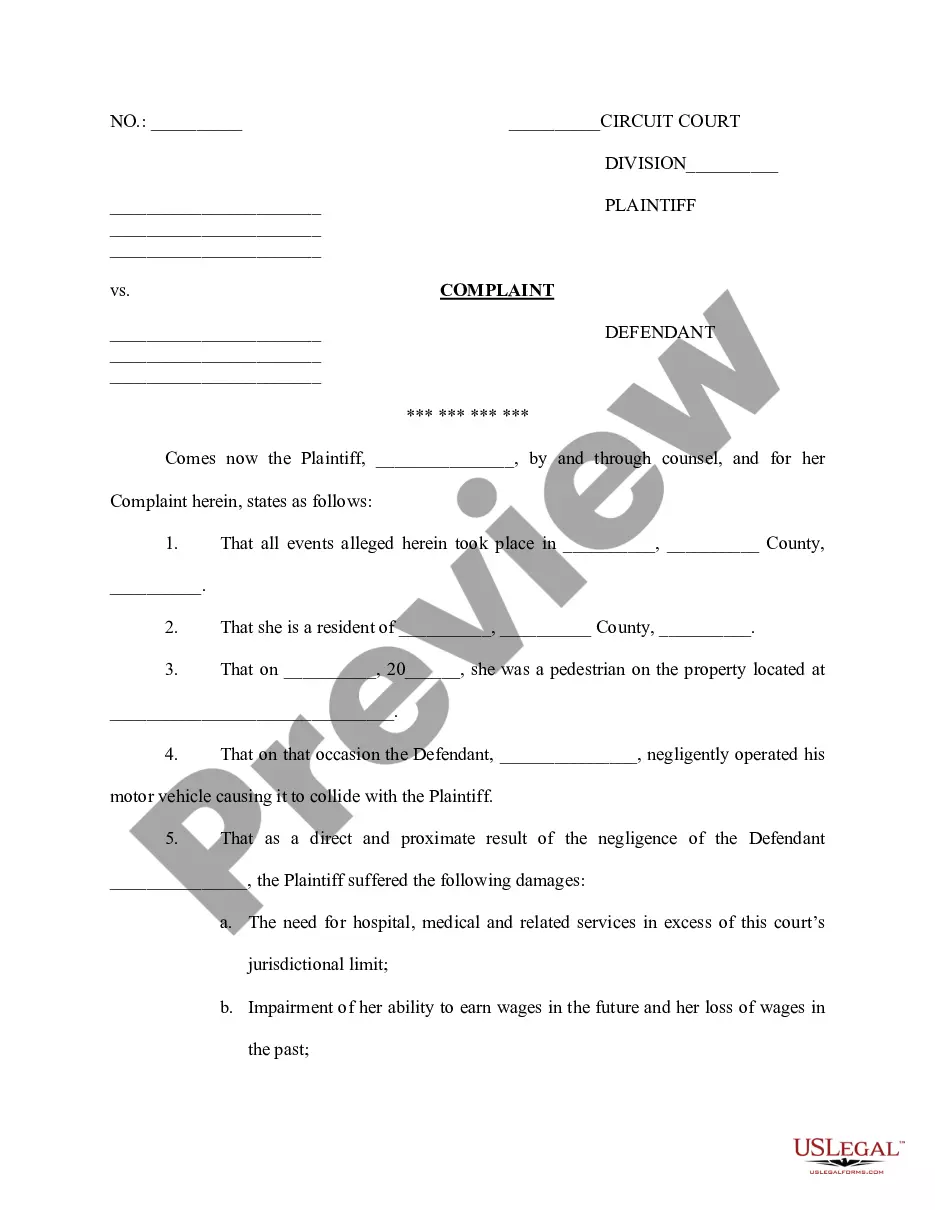

Filing a California wage claim involves submitting a claim form to the California Division of Labor Standards Enforcement (DLSE). You can complete this form online, by mail, or in person at a local office. After you file, an investigator will review your claim and may schedule a hearing to resolve the issue. Using a California Equal Pay Checklist can assist you in compiling the relevant details needed for a strong claim.

To file an EEO complaint in California, you need to start by contacting the California Department of Fair Employment and Housing (DFEH). You can submit a complaint online, by mail, or in person. After filing, the DFEH will investigate your claim, which may involve gathering evidence and interviewing witnesses. Utilizing a California Equal Pay Checklist can help ensure you gather all necessary information to support your case.

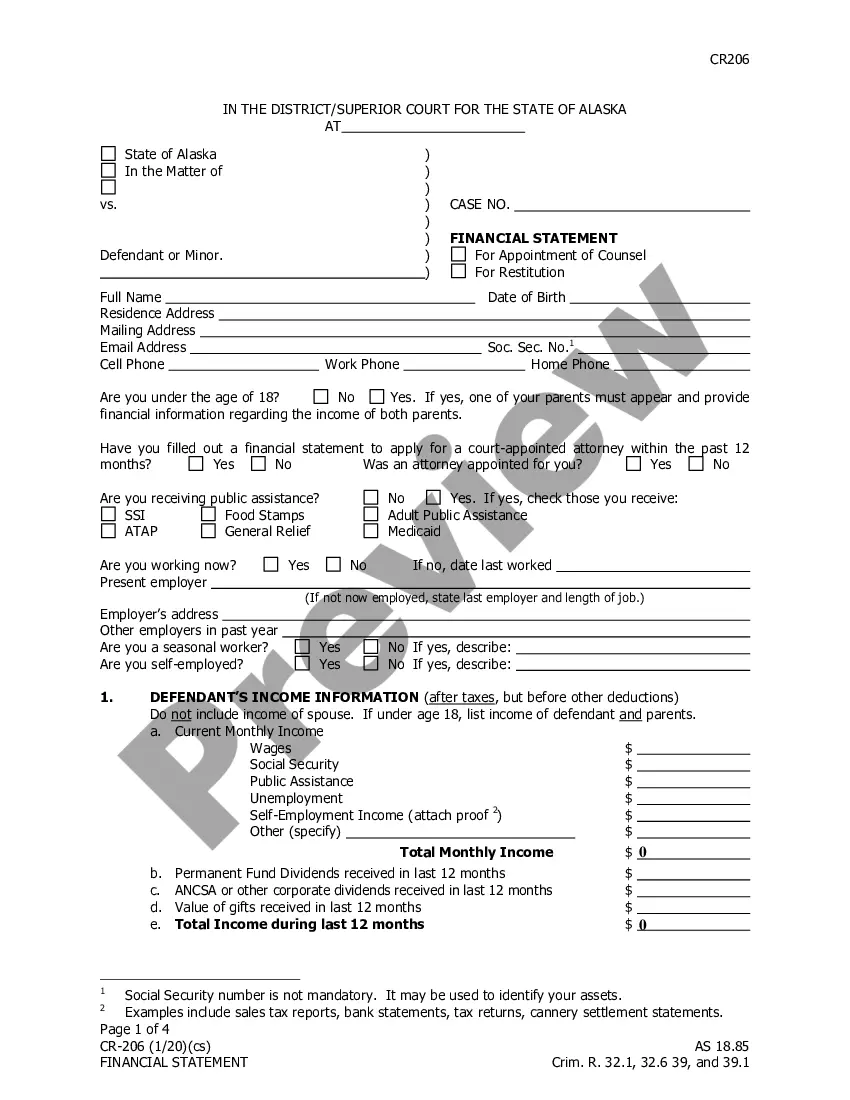

California law requires employers to report wage information regularly to ensure compliance with equal pay regulations. To facilitate compliance, the California Equal Pay Checklist serves as a vital tool for organizations, helping them systematically evaluate their pay structures. By following this checklist, businesses can identify potential discrepancies in wage reporting and promote fairness across all employee classifications. Additionally, staying informed about wage reporting laws can help employers avoid penalties and foster a culture of transparency.

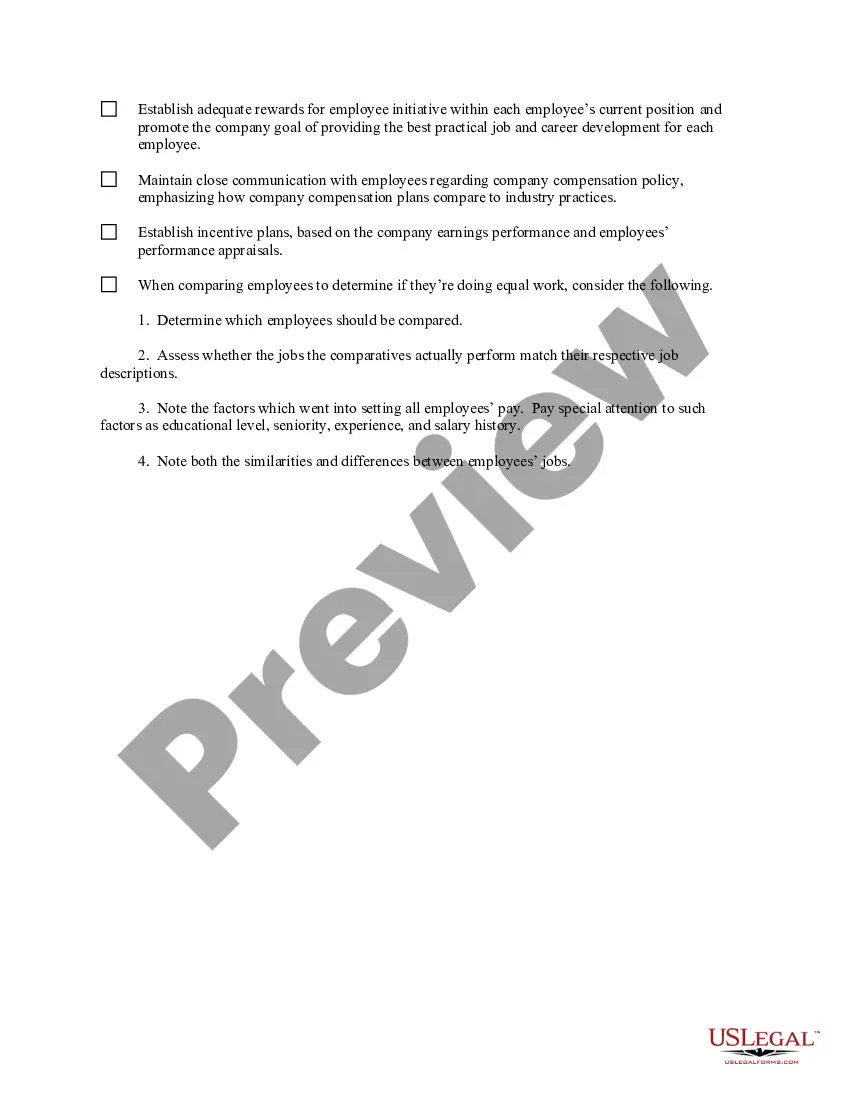

"Fair" in this context means wages must be comparable to what other companies in the same field pay, as well as what you are paying employees within your company doing the same job. Salaries must also correspond to the employee's sense of his worth, based on his efforts, education and experience.

Provides that an employer cannot prohibit workers from disclosing their wages, discussing the wages of others, or inquiring about others' wages; prohibits employers from relying on an employee's prior salary to justify the sex-, race-, or ethnicity- based pay difference.

The Equal Pay Act of 1963, amending the Fair Labor Standards Act, protects against wage discrimination based on sex. The Equal Pay Act (EPA) protects both men and women.

Fair compensation does not mean everyone at the company is paid the same amount. Rather, fair compensation is paying employees an appropriate amount according to their performance, experience, and job requirements.

Here are five ways you can ensure equal pay on your team:Prevent salary disparities before making new hires.Review employee compensation on a regular basis.Separate compensation reviews from performance reviews.Disclose salary ranges for different positions and levels.Advocate for your people.

Have An Honest Conversation.Stay On Top Of The Market.Utilize Salary Surveys And Research.Balance Expertise, Potential And Market Value.Ask And Individualize.Know What Matters To Them.Have A Clear Compensation Strategy.Pay What It's Worth To You.More items...?

The EPA's four affirmative defenses allow unequal pay for equal work when the wages are set "pursuant to (i) a seniority system; (ii) a merit system; (iii) a system which measures earnings by quantity or quality of production; or (iv)any other factor other than sex."