California Returned Items Report

Description

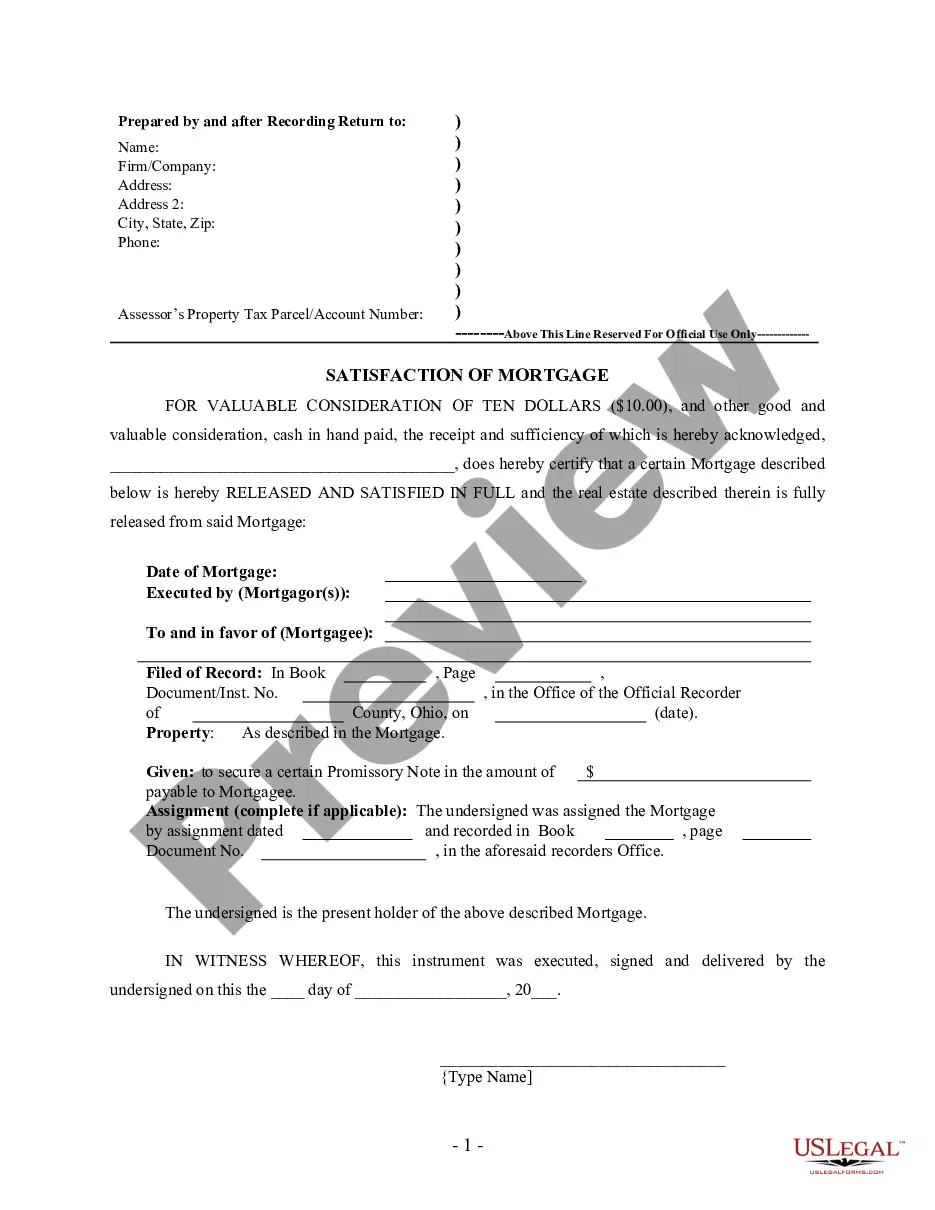

How to fill out Returned Items Report?

If you wish to obtain, download, or print lawful document templates, utilize US Legal Forms, the top selection of legal forms available online.

Take advantage of the site’s user-friendly search feature to locate the documents you require.

A range of templates for professional and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the California Returned Items Report in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the California Returned Items Report.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have selected the form for the correct city/state.

- Step 2. Use the Preview option to view the form’s content. Don’t forget to review the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other forms in the legal form template.

Form popularity

FAQ

File an amended return using Form 1040-X, Amended U.S. Individual Income Tax Return as soon as possible. Include any forms and/or schedules that you're changing and/or didn't include with the original return. Return the refund check with your amended return along with a letter of explanation.

Qualifying to Use Form 540 2EZTotal income includes wages, salaries, tips, taxable scholarship or fellowship grants, interest, dividends, pensions, and capital gains from mutual funds.

Simply complete Form 540 (if you're a resident) or Form 540NR and Schedule X (explanation of your amended return changes). Forms 540 and 540NR are Forms used for the Tax Return and Tax Amendment. Though you can prepare a 2021 California Tax Amendment Form on eFile.com, you cannot submit it electronically.

You will need to supply a copy of the information return you file to the recipient. Recipients use their copy to file their taxes.

If you are a business and paid any person or entity over $600 for services provided to the business, you must send them a 1099-Misc to show the total amount paid, and a 1096 to the Internal Revenue Service to summarize the 1099s filed. California does not require your business to file a 1099 or 1096 form in addition

You can now file Form 1040-X electronically with tax filing software to amend 2019 or 2020 Forms 1040 and 1040-SR.

How do I file Form 1099-NEC? Form 1099-NEC can be filed online or by mail. A version of the form is downloadable and a fillable online PDF format is available on the IRS website. You can complete the form using IRS Free File or a tax filing software.

The IRS will send information reported on Form 1099-NEC, Nonemployee Compensation, to California beginning with forms filed in 2022 for the 2021 year. As a result, you will not be required to send a copy of the Form 1099-NEC to the state of California.

What is the DE 9 Form? The Quarterly Contribution Return and Report of Wages or DE 9 Form is a form required of all employers by the California Employment Development Department (EDD). According to the EDD, the DE 9 Form reconciles reported wages and paid taxes for each quarter.

Complete the entire tax return. On a separate paper, explain all changes. Include the estate or trust name and FEIN with each item. Include an updated California Beneficiary's Share of Income, Deductions, Credits, etc.