Tennessee Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

How to fill out Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

Are you presently in a situation where you need documents for potential business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms provides a wide array of form templates, including the Tennessee Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, designed to comply with federal and state regulations.

Once you find the correct form, click Buy now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card. Select a convenient file format and download your copy. You can access all the document templates you've purchased in the My documents section. You can obtain an additional copy of the Tennessee Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase at any time if needed. Just select the desired form to download or print the template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and minimize mistakes. The service offers expertly crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Tennessee Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

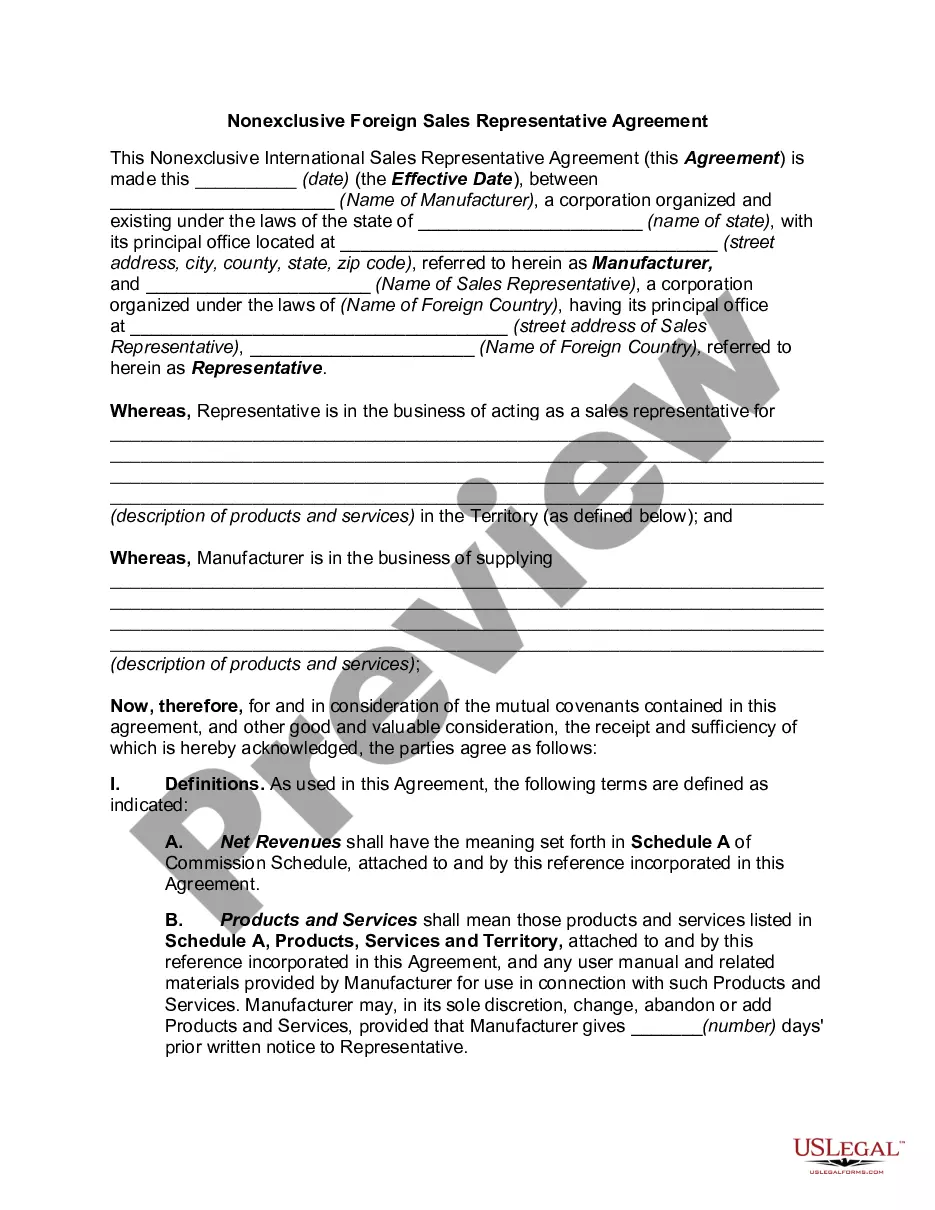

- Use the Preview button to examine the form.

- Review the description to confirm you have selected the right form.

- If the form does not meet your needs, utilize the Search field to find the form that fits your requirements.

Form popularity

FAQ

Starting a small business in Tennessee involves several key steps, including registering your business name, obtaining a business license, and understanding tax obligations, such as those related to rental income. If you're considering a Tennessee Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, seeking advice from platforms like uslegalforms can guide you in drafting the necessary agreements and navigating legal requirements.

Manufacturing equipment typically falls under taxable items in Tennessee. However, specific exemptions may apply if the equipment meets certain criteria. When establishing a Tennessee Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, it's vital to evaluate any tax benefits or exemptions that apply to your equipment.

Tennessee exempts various services from sales tax, including certain professional services like legal guidance, which can be valuable when dealing with leases. If you're entering into a Tennessee Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, knowing which services are taxable can help you manage costs effectively.

Tennessee does impose sales tax on certain out-of-state purchases, particularly if the items are brought into the state for use. If you're leasing equipment from out of state and utilizing it in Tennessee, especially under a Tennessee Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, you may need to consider sales tax implications.

In Tennessee, rental income from equipment leases is taxable. This includes equipment leased under a Tennessee Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. To ensure compliance, it's advisable to keep records of all rental transactions and consult with a tax professional regarding your specific situation.

Yes, rental income is generally subject to taxation in Tennessee. This tax applies to any income received from leasing equipment or property. If you're utilizing a Tennessee Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, it's essential to account for this income when filing your taxes.

In Tennessee, certain items are exempt from sales tax, including some types of equipment under a Tennessee Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. Typically, goods intended for resale or specific agricultural and manufacturing equipment may also qualify. Understanding these exemptions can enhance your leasing strategies.