California Material Return Record

Description

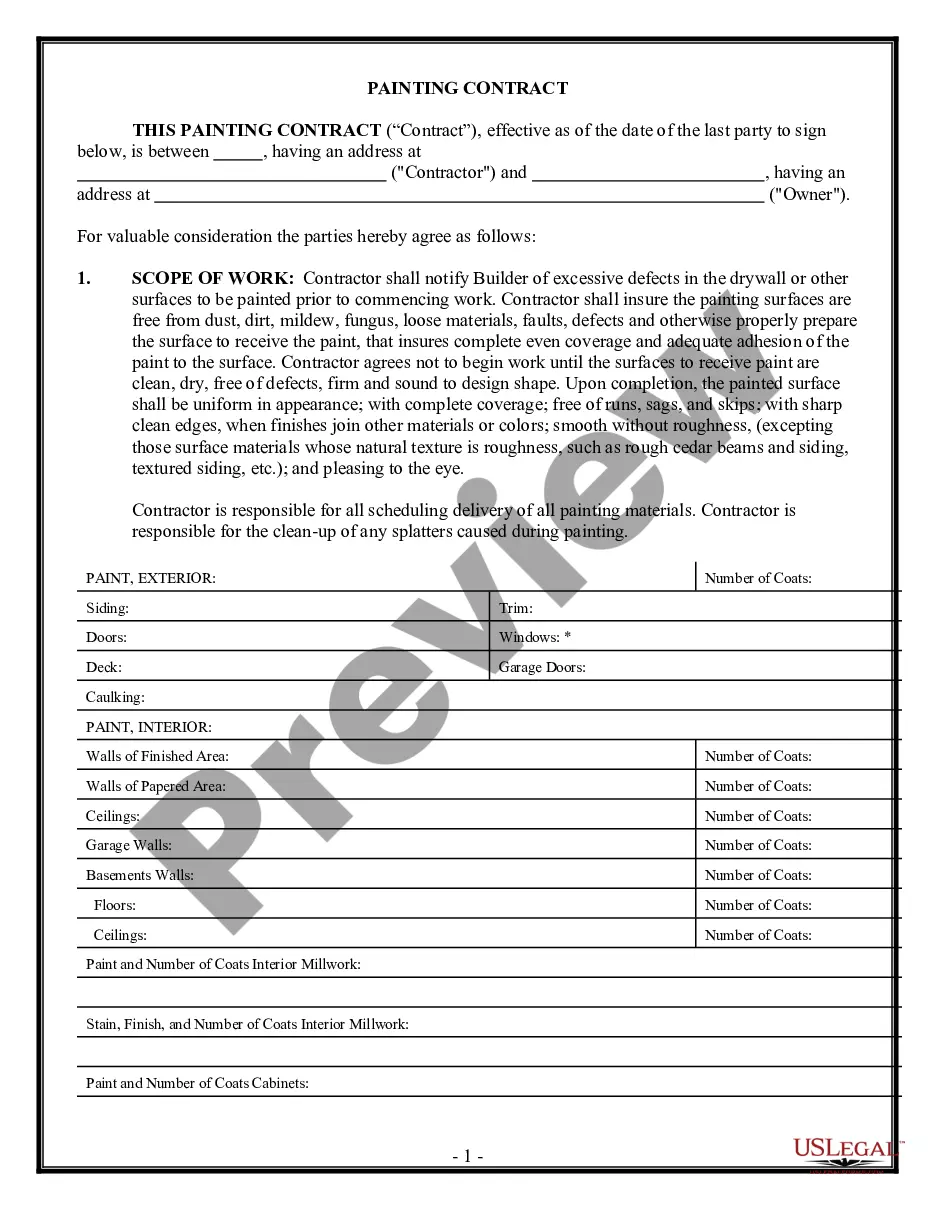

How to fill out Material Return Record?

US Legal Forms - one of the most prominent collections of legal templates in the United States - offers a variety of legal document formats that you can download or print.

Through the website, you can access thousands of forms for business and personal needs, categorized by type, state, or keywords. You can find the latest versions of forms such as the California Material Return Record within moments.

If you are already a member, Log In and download the California Material Return Record from the US Legal Forms collection. The Download button will appear on every form you view. You can access all of your previously saved forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, amend, print, and sign the downloaded California Material Return Record. Each template you add to your account has no expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the California Material Return Record with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal requirements.

- To use US Legal Forms for the first time, follow these simple steps.

- Ensure you have chosen the correct form for your city/state.

- Click the Preview button to review the document's details.

- Examine the document summary to make sure you have selected the right form.

- If the form does not suit your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Choose the subscription plan you wish to follow and provide your details to register for an account.

Form popularity

FAQ

However, unlike the federal government, California does not require an annual tax report from those who made less than the minimum filing requirement or had no income at all. Individuals who earned less than the minimum filing requirement do not have to file.

Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

If you have a tax liability for 2021 or owe any of the following taxes for 2021, you must file Form 540. Tax on a lump-sum distribution.

Willful failure to file a tax return is a crime, which could lead to your arrest, prosecution, and, if you are convicted, penalties including jail time and tens of thousands of dollars in fines. You will also gain a criminal record, which could have untold damage to your career and reputation.

Column B and Column C Subtractions and Additions Use these columns to enter subtractions and additions to the federal amounts in column A that are necessary because of differences between California and federal law. Enter all amounts as positive numbers unless instructed otherwise.

Purpose. Use Schedule CA (540), California Adjustments Residents, to make adjustments to your federal adjusted gross income and to your federal itemized deductions using California law.

Purpose. Use Schedule CA (540), California Adjustments Residents, to make adjustments to your federal adjusted gross income and to your federal itemized deductions using California law.

Generally, you must file an income tax return if you're a resident , part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in California. Have income above a certain amount....Home.file.personal.do you need to file.

Requests to obtain copies of the CDTFA's public records may be made in writing and addressed to our Disclosure Office via email, fax or mail. See CDTFA-854-F, Access to California Department of Tax and Fee Administration Records, for more information.

If you have a tax liability for 2021 or owe any of the following taxes for 2021, you must file Form 540. Tax on a lump-sum distribution. Tax on a qualified retirement plan including an Individual Retirement Arrangement (IRA) or an Archer Medical Savings Account (MSA).