California Sample Letter for Insufficient Amount to Reinstate Loan

Description

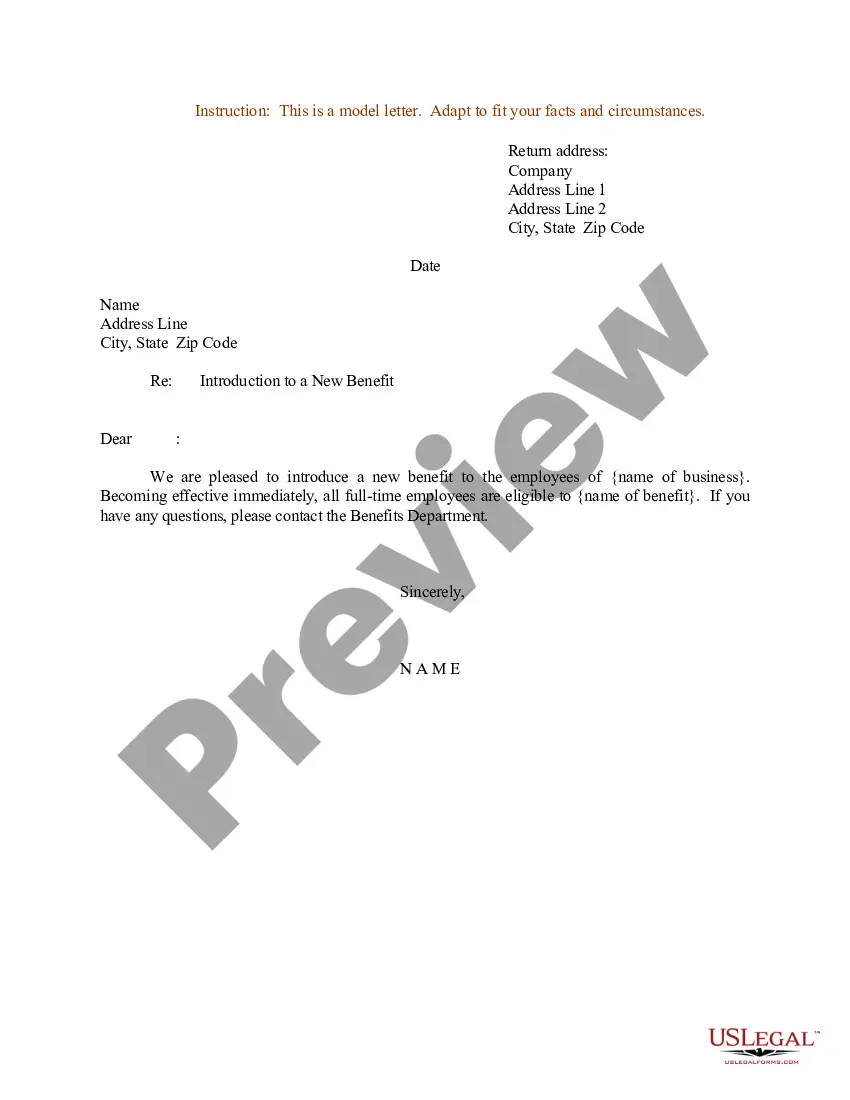

How to fill out Sample Letter For Insufficient Amount To Reinstate Loan?

If you seek extensive, retrieve, or printing sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the website's user-friendly and efficient search to locate the documents you require.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have identified the form you need, click the Get now button. Select your preferred pricing plan and provide your information to create an account.

Step 5. Complete the payment process. You can use your Visa or Mastercard or PayPal account to finalize the transaction. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the California Sample Letter for Insufficient Amount to Reinstate Loan.

- Utilize US Legal Forms to find the California Sample Letter for Insufficient Amount to Reinstate Loan in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the California Sample Letter for Insufficient Amount to Reinstate Loan.

- You can also access templates you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Verify that you have chosen the form for the correct city/state.

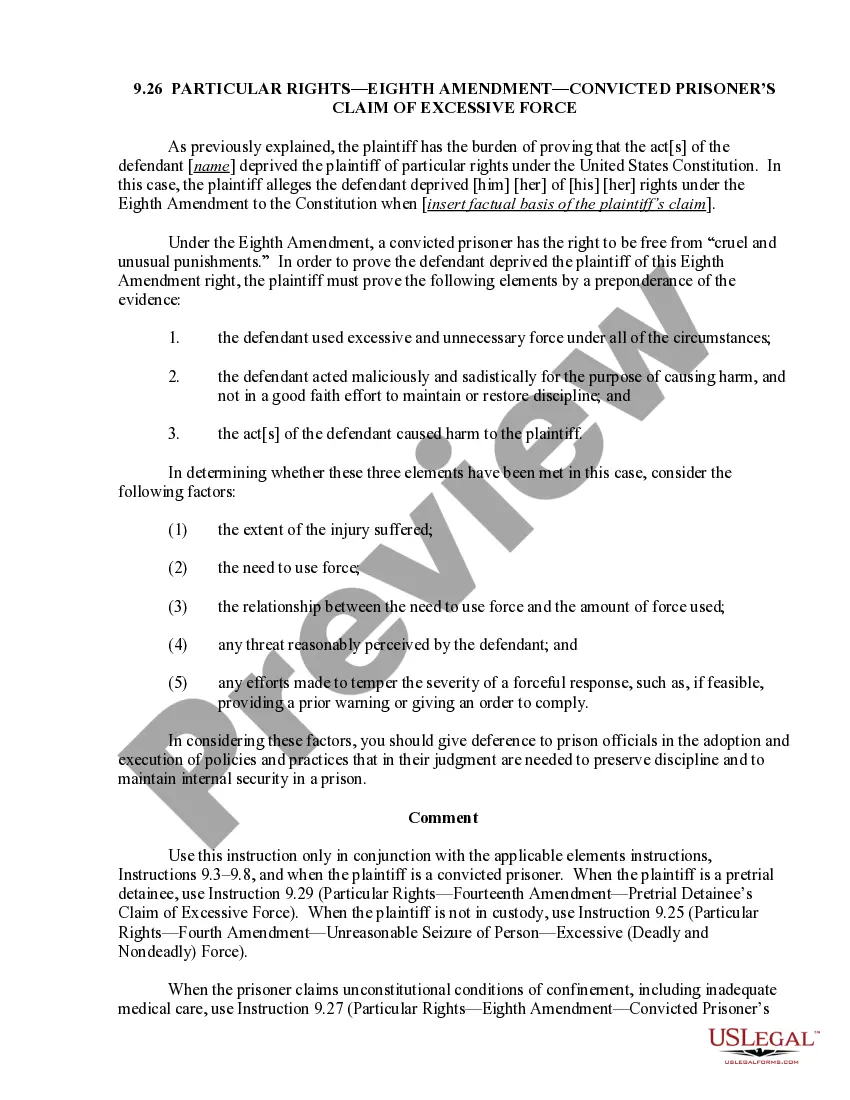

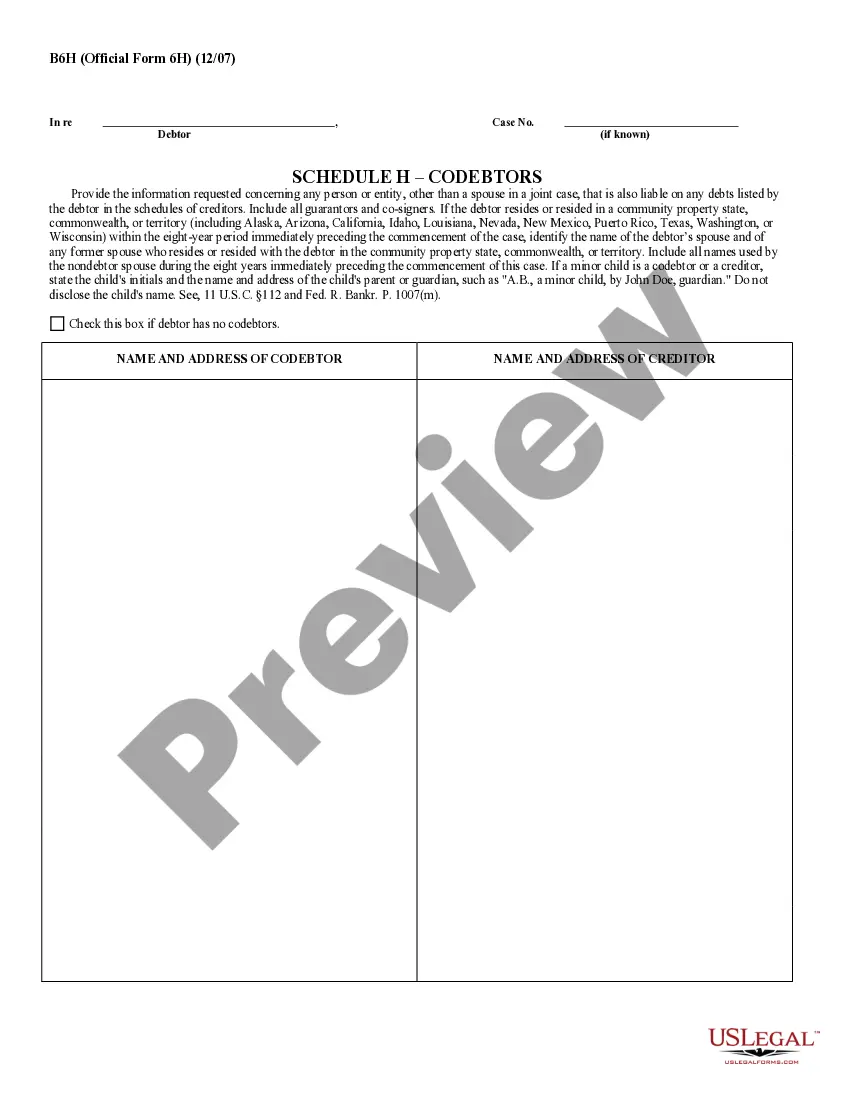

- Step 2. Utilize the Review option to examine the form's content. Don't forget to read the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The security first rule in California states that the lender must apply any payments received to the most senior loan first. This means that when there are multiple loans secured by the same property or collateral, any funds must be allocated starting from the loan with the highest priority. Understanding this rule can be crucial when dealing with loan reinstatements or related issues. A 'California Sample Letter for Insufficient Amount to Reinstate Loan' can help clarify your inquiries regarding this topic.

To write a letter for reinstatement, begin with a polite greeting and state your request clearly. Provide context or reasons prompting your request for reinstatement. Ensure that your letter is structured effectively and remains professional. Looking at a 'California Sample Letter for Insufficient Amount to Reinstate Loan' can provide you with a solid format and examples.

In a personal statement for reinstatement, introduce yourself and state your intention to be reinstated. Then explain your situation, focusing on the reasons you believe reinstatement is warranted. Conclude with a positive statement about your commitment and willingness to comply with any requirements. You might find a 'California Sample Letter for Insufficient Amount to Reinstate Loan' helpful for writing style.

To write a letter to reinstate an employee, address the letter to the individual and express your decision to reinstate them. Include the details of their previous position and any conditions related to their return to work. It's important to maintain a supportive tone throughout the letter. Consider providing a 'California Sample Letter for Insufficient Amount to Reinstate Loan' as a reference for structure.

When writing an email for reinstatement, start with a clear subject line indicating your intent. In the email body, express your desire for reinstatement and explain the reasons for your request. Keep your message polite and professional. Utilizing a 'California Sample Letter for Insufficient Amount to Reinstate Loan' as a guide can help you frame your message appropriately.

To write a letter of re-appeal, begin by clearly stating your purpose. Outline the reasons for your re-appeal and provide any supporting information. Be concise and respectful in your tone. You may want to reference a 'California Sample Letter for Insufficient Amount to Reinstate Loan' for format and clarity.

When writing a powerful appeal letter, focus on clarity and persuasion. Begin with a concise introduction that states your purpose, followed by a summary of relevant facts. Utilize the California Sample Letter for Insufficient Amount to Reinstate Loan as a framework to outline your argument compellingly. The key is to present logical reasoning and emotional appeal, encouraging the reader to reconsider your situation.

To write a denial appeal letter, start with a clear introduction stating your intention to appeal. Include specific details about your case and reference the California Sample Letter for Insufficient Amount to Reinstate Loan for guidance. Be sure to articulate your reasons for contesting the denial and provide any supporting documentation. A well-structured letter can improve your chances of a successful appeal.