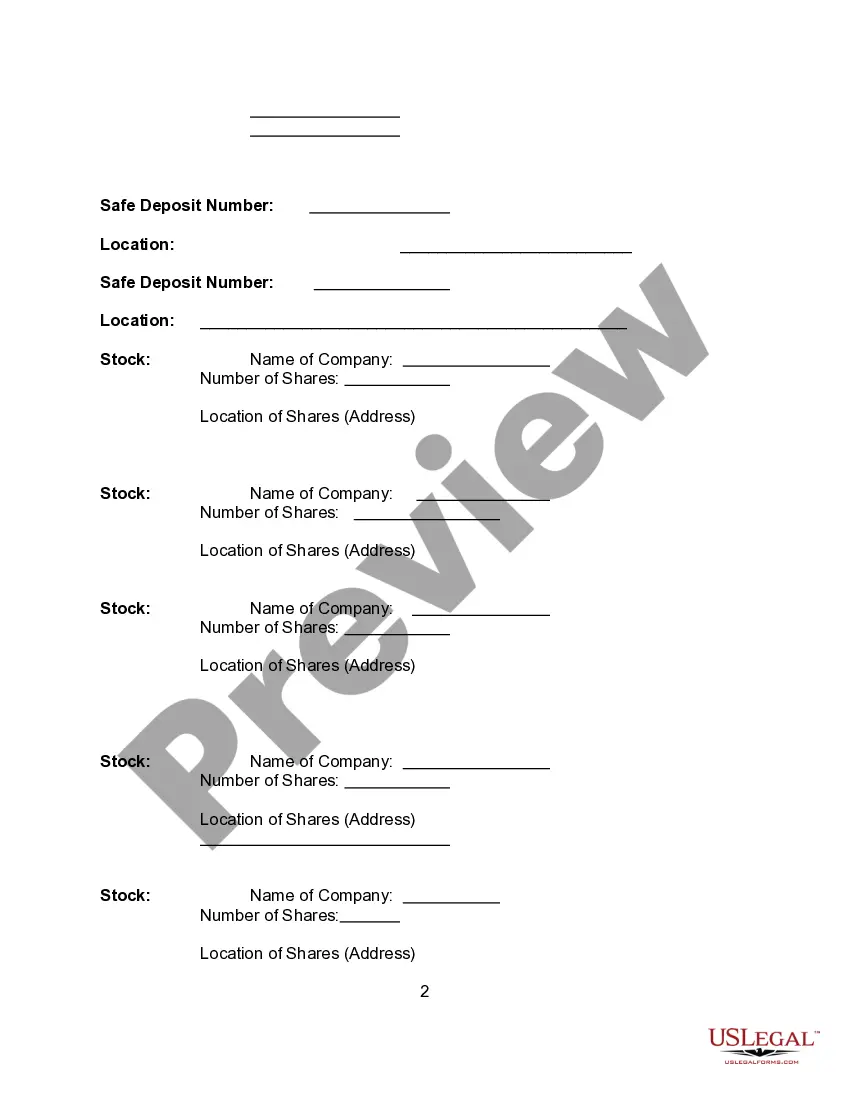

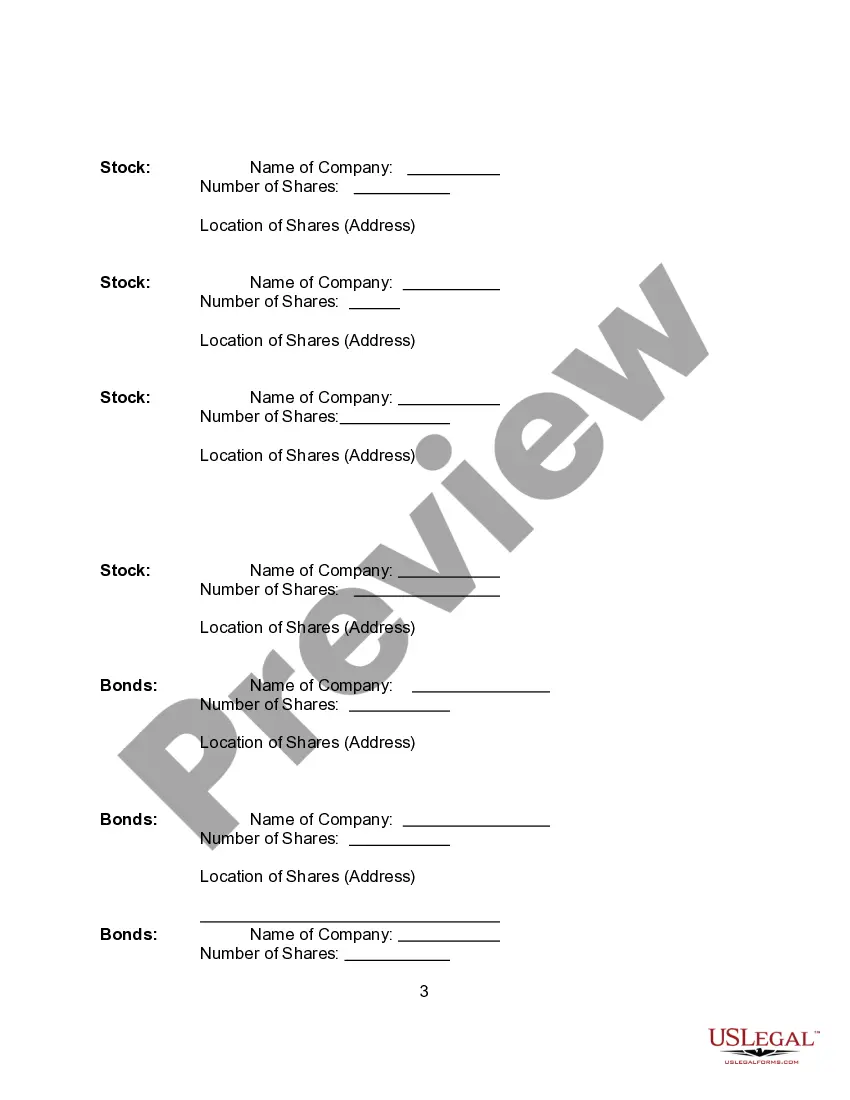

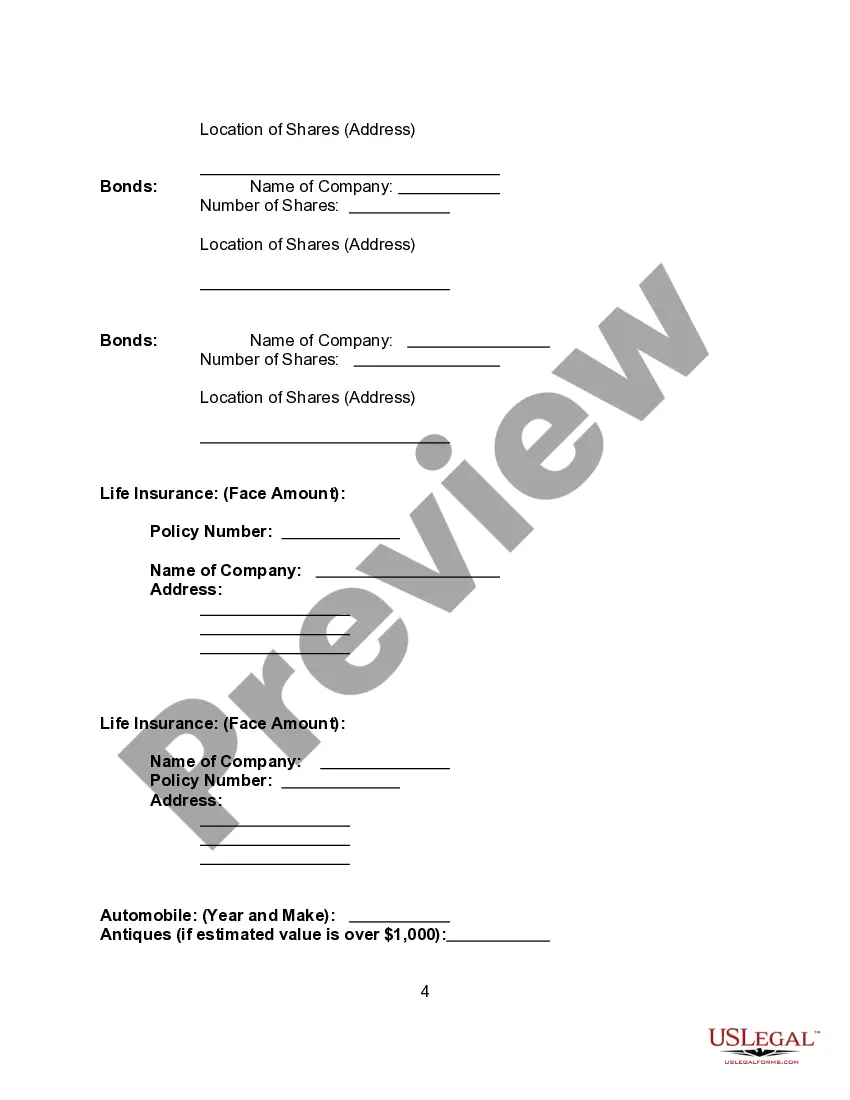

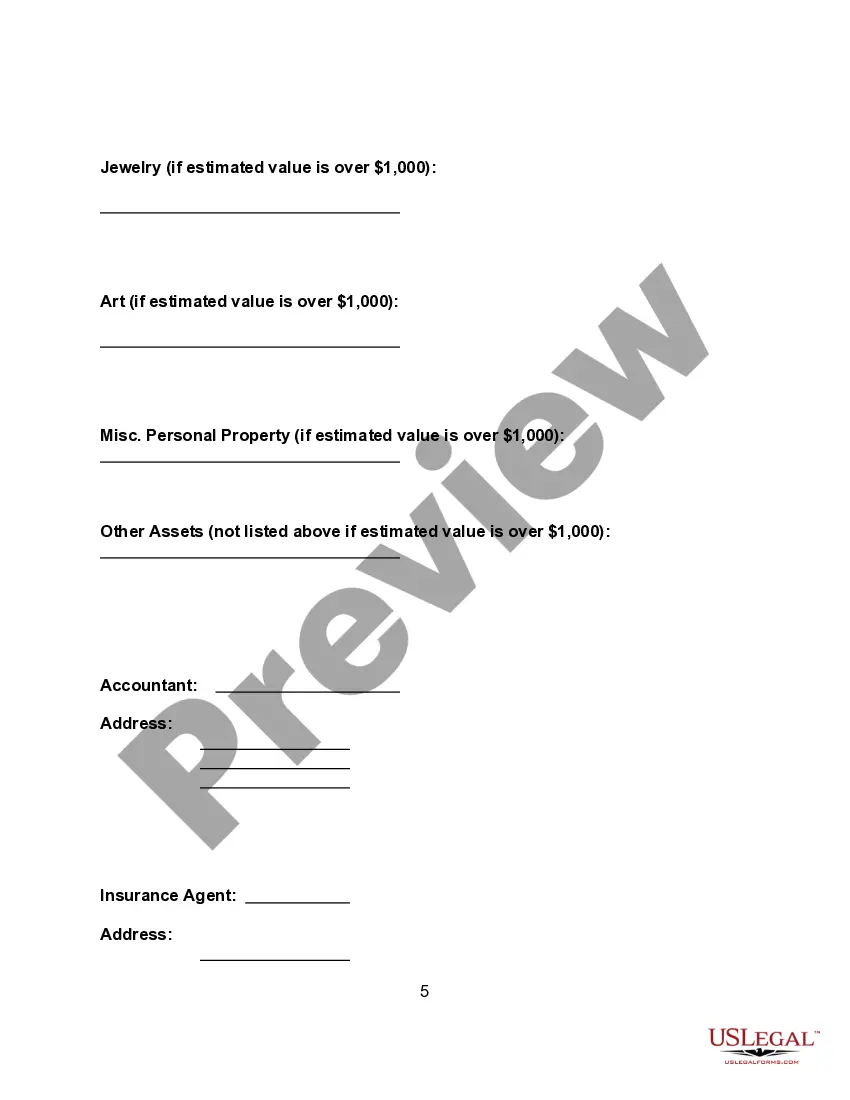

California Asset Information Sheet

Description

How to fill out Asset Information Sheet?

If you need to complete, acquire, or print out legal document templates, utilize US Legal Forms, the top selection of legal forms, which are accessible on the web.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Each legal document template you acquire is yours indefinitely. You have access to every form you obtained in your account. Check the My documents section and pick a form to print or download again.

Be proactive and download, and print the California Asset Information Sheet with US Legal Forms. There are countless professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to find the California Asset Information Sheet with just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Download button to obtain the California Asset Information Sheet.

- You can also access forms you have previously acquired in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print out or sign the California Asset Information Sheet.

Form popularity

FAQ

2018 Form 3885A - Depreciation and Amortization Adjustments.

Schedule D-1 is the first "continuation" page of capital gains/losses transactions. Capital gains and losses are considered owned by the taxpayer, not owned by a business. So they are not business assets, but instead, personal assets sold.

California law has not always conformed to federal law regarding depreciation methods, special credits, or accelerated write-offs. Consequently, the recovery periods and the basis on which the depreciation is calculated may be different from the amounts used for federal purposes.

California does not conform to the federal special or bonus depreciation for qualified property acquired and placed in service. Election to Expense Certain Tangible Property (IRC 179).

The only acceptable methods of depreciation for California tax purposes are: Straight-line. Declining balance.

Statement of Assets from Defendant At the time of sentencing, a victim is entitled to a Statement of Assets from the defendant: CR-115. This is supposed to tell you what the defendant has of value. Please make sure that the Court orders the defendant to complete this form and send it to you by a specific date.

California does not conform to the federal modifications to depreciation limitations on luxury automobiles (IRC Section 280F).

Generally, the difference between book depreciation and tax depreciation involves the "timing" of when the cost of an asset will appear as depreciation expense on a company's financial statements versus the depreciation expense on the company's income tax return.

Your California deduction may be different from your federal deduction. California limits the amount of your deduction to 50% of your federal adjusted gross income.