California General Form of Assignment as Collateral for Note

Description

How to fill out General Form Of Assignment As Collateral For Note?

Are you presently in a location where you may require documentation for either business or personal reasons on a daily basis.

There are numerous legal document templates accessible online, but finding ones you can trust is not straightforward.

US Legal Forms provides thousands of form templates, such as the California General Form of Assignment as Collateral for Note, which are designed to meet state and federal requirements.

Select a convenient file format and download your version.

Access all of the document templates you have purchased in the My documents section. You can obtain another version of the California General Form of Assignment as Collateral for Note at any time if necessary. Just select the needed form to download or print the document format. Use US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the California General Form of Assignment as Collateral for Note template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Locate the form you need and ensure it is for your correct city/region.

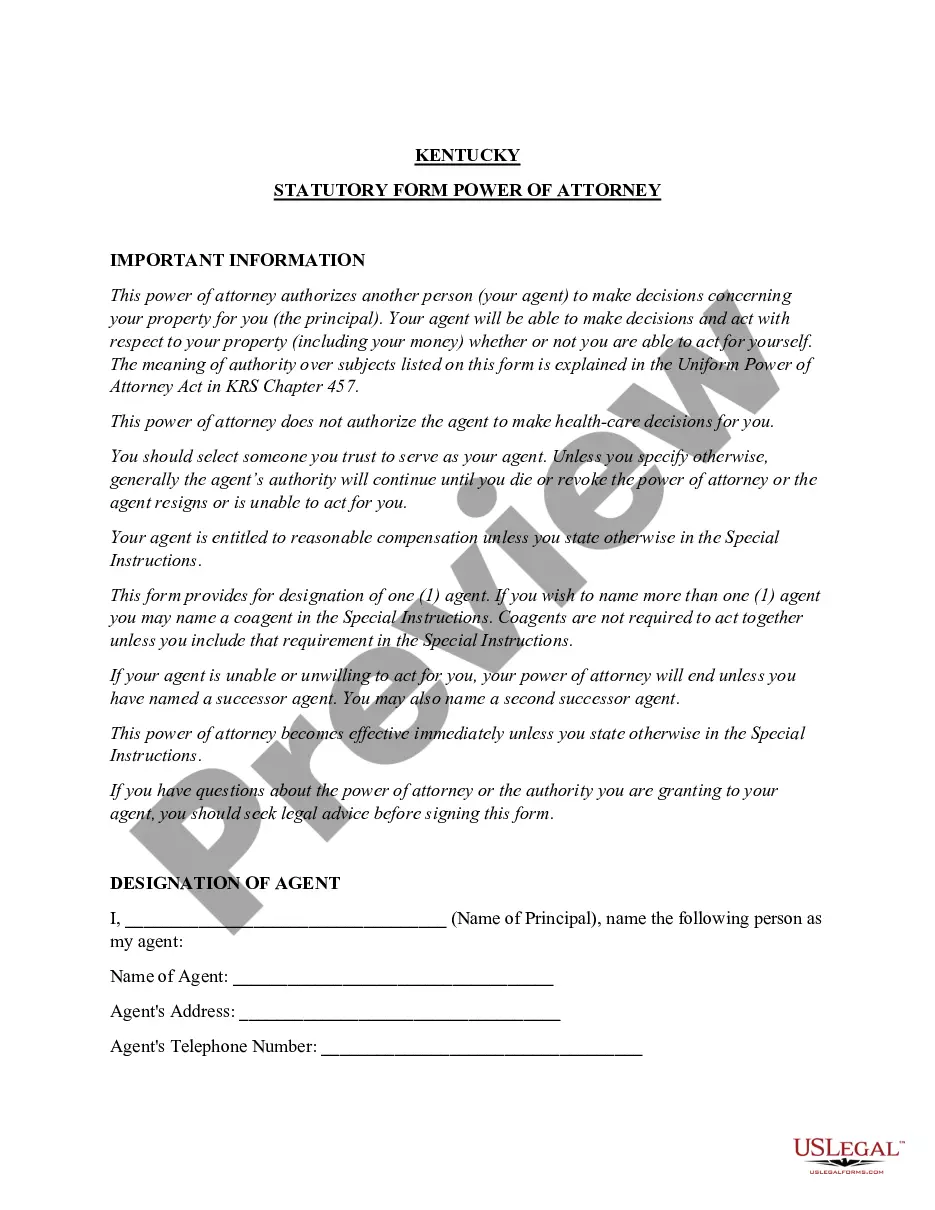

- 2. Use the Preview button to review the form.

- 3. Examine the description to confirm that you have chosen the right form.

- 4. If the form isn't what you need, use the Search field to find the form that fulfills your needs and requirements.

- 5. When you acquire the suitable form, click Buy now.

- 6. Choose the payment plan you want, fill in the required information to create your account, and pay for the order with your PayPal or credit card.

Form popularity

FAQ

Yes, a promissory note can be assigned to another party, often as a way to secure a debt or obligation. When you use the California General Form of Assignment as Collateral for Note, you formalize the process and provide legal assurance to both parties involved. This type of assignment allows the new holder to collect on the note, ensuring all terms are respected. Utilizing this form simplifies what could otherwise be a complex transaction.

A collateral assignment involves using an asset as security for a debt. In this context, the promissory note serves as collateral until the obligation is fulfilled. The California General Form of Assignment as Collateral for Note can guide you through this process, providing a clear framework and protecting both parties' interests.

Yes, a promissory note can be assigned to a trust. This transfer allows the trust to receive the benefits associated with the note, such as payments. By using the California General Form of Assignment as Collateral for Note, you can effectively document this assignment while ensuring that all legal standards are met.

Promissory notes must clearly outline the borrower's commitment to repay the specified sum at a designated time. In California, the California General Form of Assignment as Collateral for Note includes guidelines that help you ensure compliance with local laws. It is crucial to adhere to these rules to prevent disputes and ensure enforceability.

Yes, a promissory note can be sold, transferred, or assigned to another party. This legal transfer can provide liquidity and flexibility. Utilizing the California General Form of Assignment as Collateral for Note ensures that the transaction is executed correctly and that all legal obligations are fulfilled.

Yes, the assignment of a contract is legal in California, provided the original contract does not prohibit such action. This means that if the contract allows assignment, you can easily use the California General Form of Assignment as Collateral for Note to formalize the assignment process. Always consult legal advice if you're uncertain about the terms.

To assign a promissory note, you need to create an assignment agreement. This document must include the details of the original note, the assignee's information, and a clear statement of the transfer. Utilizing the California General Form of Assignment as Collateral for Note can simplify this process, ensuring that all requirements are met.

To legally enforce a promissory note, the lender must demonstrate that they have a valid agreement and that the borrower has defaulted on payments. This often involves using the California General Form of Assignment as Collateral for Note, which details the rights of the lender. By following proper legal procedures, such as sending a notice of default, the lender can initiate further actions to collect owed payments.

An assignment of a promissory note involves transferring the right to receive payments from the borrower to a new party. By using the California General Form of Assignment as Collateral for Note, both the assignor and assignee can clearly outline the terms of this transfer. This process is crucial for ensuring that the new lender can enforce the promissory note and receive payments as agreed.

The assignment of a secured promissory note is a legal process in which the original lender transfers their rights to receive payments from the borrower to another party. This often involves using a California General Form of Assignment as Collateral for Note to formalize the agreement. This assignment secures financing, ensuring the new lender has a right to collect payments, thus protecting their financial interests.