California Promissory Note with Payments Amortized for a Certain Number of Years

Description

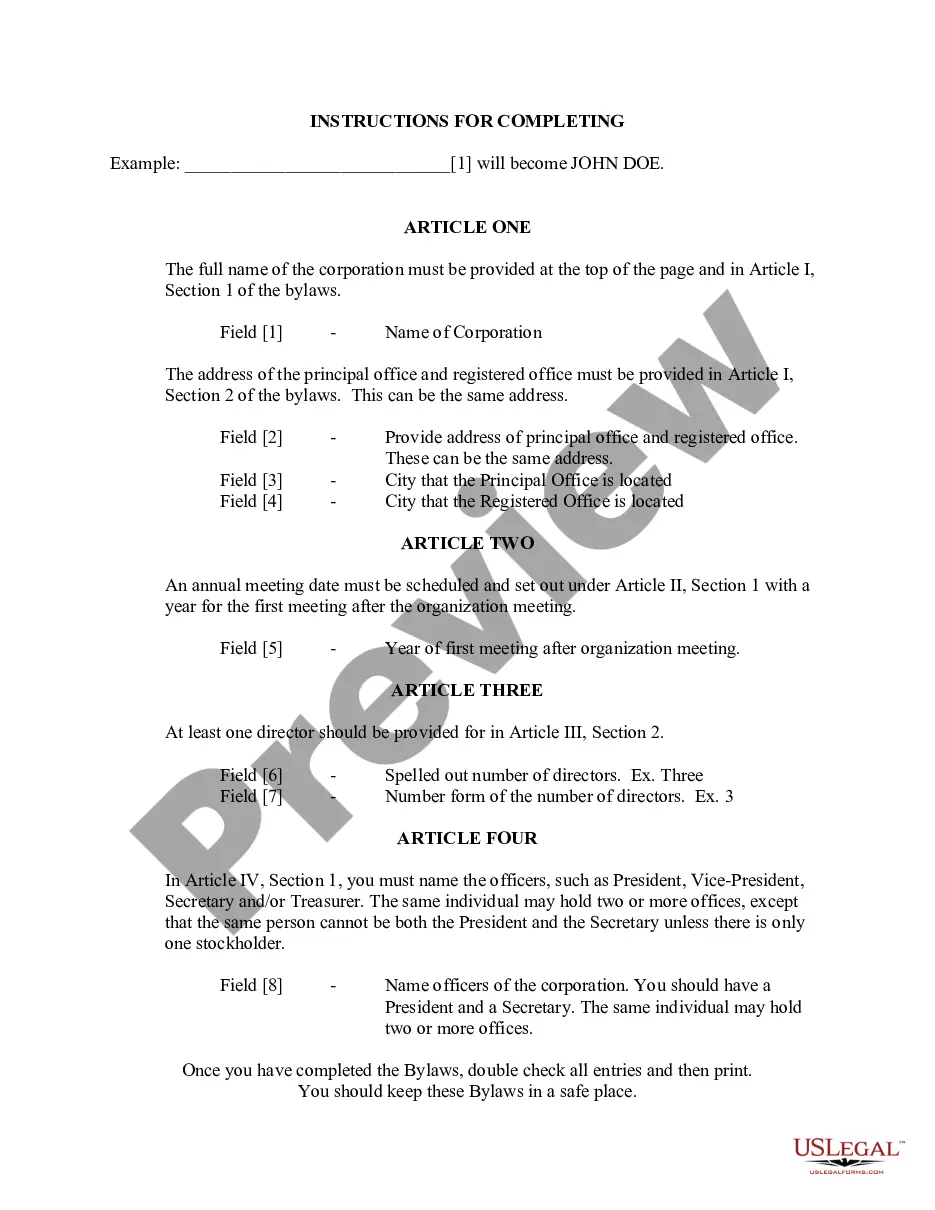

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

You can invest hours online searching for the official document template that complies with the federal and state regulations you need.

US Legal Forms offers thousands of legal documents that are evaluated by experts.

You can download or print the California Promissory Note with Payments Amortized for a Specific Number of Years from your service.

If available, use the Review button to check the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the California Promissory Note with Payments Amortized for a Specific Number of Years.

- Each legal document template you acquire is yours permanently.

- To receive an additional copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you use the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the area/town you select.

- Read the form description to ensure you have selected the correct template.

Form popularity

FAQ

A California Promissory Note with Payments Amortized for a Certain Number of Years does not inherently expire but may become unenforceable after the statute of limitations lapses. To maintain its effectiveness, both parties must adhere to the payment schedule outlined in the note. Regular communication about the status of payments is essential to prevent misunderstandings. For practical assistance drafting your note, consider exploring what uslegalforms has to offer.

The statute of limitations on a California Promissory Note with Payments Amortized for a Certain Number of Years typically ranges from four to six years, depending on the circumstances and type of note. This time limit refers to the duration a lender has to take legal action for non-payment. Knowing the statute of limitations can help both lenders and borrowers navigate their rights and responsibilities. For clarity on legal terms, uslegalforms is a worthy resource.

Yes, a California Promissory Note with Payments Amortized for a Certain Number of Years does have a time limit, which indicates when the repayment must be completed. This limit is vital for establishing clear expectations and ensuring that payments are made on time. Additionally, this time frame helps safeguard the lender's rights. You might find further insights on this through uslegalforms.

A California Promissory Note with Payments Amortized for a Certain Number of Years is generally valid as long as the borrower meets the payment obligations. However, its enforceability may vary based on state laws and the conditions included in the note. Understanding the specific validity period can help protect both the lender's and borrower's interests. Consulting uslegalforms can help ensure compliance with legal standards.

The time period of a California Promissory Note with Payments Amortized for a Certain Number of Years depends on the specific terms outlined in the document. Typically, these notes can last anywhere from a few months to several decades, depending on the agreement between the parties. It's crucial to clearly specify the duration in the promissory note to avoid confusion. For detailed assistance with drafting, consider using uslegalforms.

Monthly payments of an amortized note include repayment of a portion of the principal alongside interest. This means that over time, your balance decreases while ensuring your payment remains steady. If you're working with a California Promissory Note with Payments Amortized for a Certain Number of Years, you will appreciate the financial clarity it brings to your monthly budgeting.

EMI, or Equated Monthly Installment, refers to a fixed payment amount made by a borrower to a lender at a specified date each calendar month. On the other hand, amortization is the process of paying off a debt over time through scheduled payments, which can include both principal and interest. In the context of a California Promissory Note with Payments Amortized for a Certain Number of Years, understanding this distinction helps you manage your payment structure effectively.

In California, a promissory note remains valid for a specific period unless stated otherwise in the document. Generally, a California Promissory Note with Payments Amortized for a Certain Number of Years is enforceable for four years after the payment due date. If payments extend over several years, the validity remains as long as payments are made per the agreement. Consulting resources like US Legal Forms can assist you in understanding these timelines and ensuring your note maintains its validity.

A California Promissory Note with Payments Amortized for a Certain Number of Years can become invalid if it lacks essential elements such as clear terms, signatures from both parties, or proper consideration. Additionally, if the note is not in writing or if it includes illegal terms, it may also be deemed invalid. It is crucial to ensure that all legal requirements are met to avoid complications. Using a reliable platform like US Legal Forms can help you draft a valid promissory note.