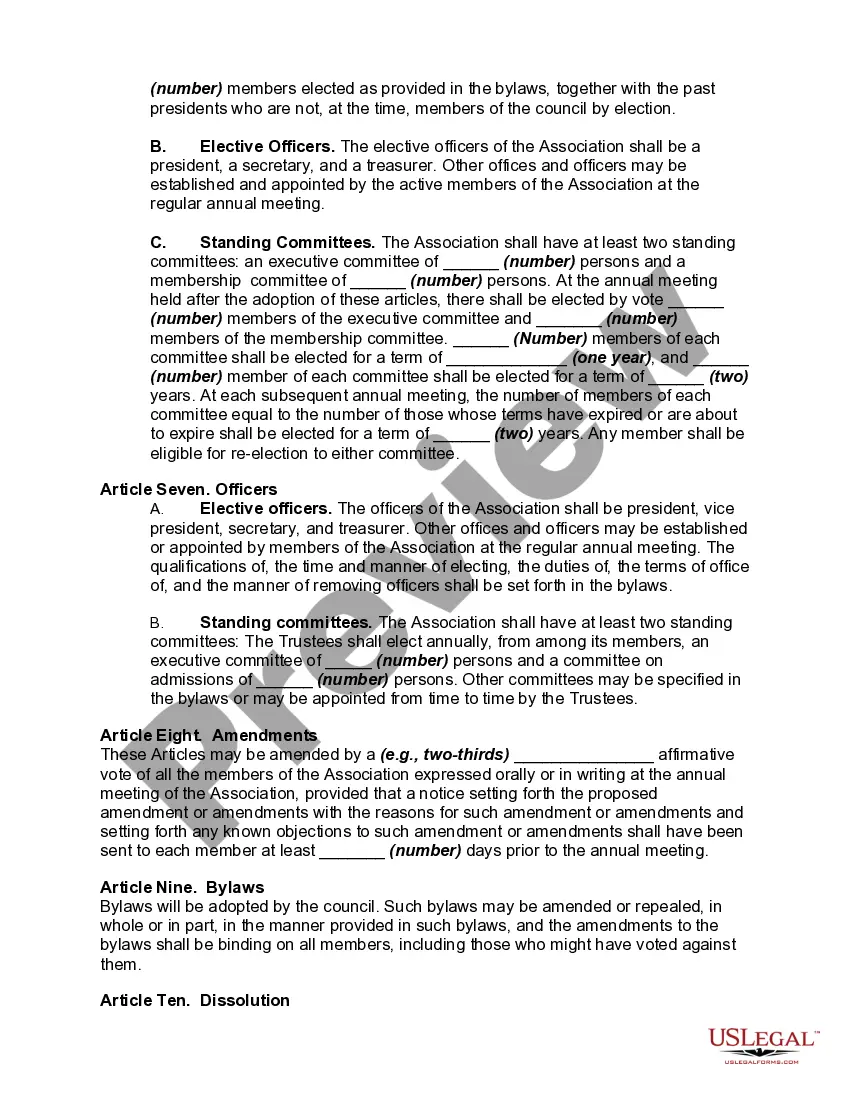

California Articles of Association for Social Club

Description

How to fill out Articles Of Association For Social Club?

If you have to full, down load, or print out lawful file layouts, use US Legal Forms, the most important collection of lawful forms, which can be found on the Internet. Take advantage of the site`s easy and hassle-free lookup to discover the documents you will need. Numerous layouts for business and specific reasons are categorized by categories and claims, or key phrases. Use US Legal Forms to discover the California Articles of Association for Social Club in just a couple of clicks.

In case you are previously a US Legal Forms buyer, log in to your bank account and click the Down load option to get the California Articles of Association for Social Club. You can also entry forms you previously downloaded in the My Forms tab of the bank account.

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape for the correct area/country.

- Step 2. Utilize the Preview method to look over the form`s content. Never forget to learn the outline.

- Step 3. In case you are unsatisfied together with the develop, utilize the Look for field towards the top of the screen to locate other types in the lawful develop format.

- Step 4. Once you have identified the shape you will need, click on the Get now option. Opt for the pricing prepare you like and add your accreditations to sign up for the bank account.

- Step 5. Procedure the transaction. You may use your bank card or PayPal bank account to perform the transaction.

- Step 6. Choose the formatting in the lawful develop and down load it in your product.

- Step 7. Complete, change and print out or signal the California Articles of Association for Social Club.

Every single lawful file format you acquire is the one you have eternally. You have acces to every single develop you downloaded with your acccount. Click the My Forms area and decide on a develop to print out or down load once more.

Be competitive and down load, and print out the California Articles of Association for Social Club with US Legal Forms. There are thousands of skilled and status-specific forms you may use for the business or specific requirements.

Form popularity

FAQ

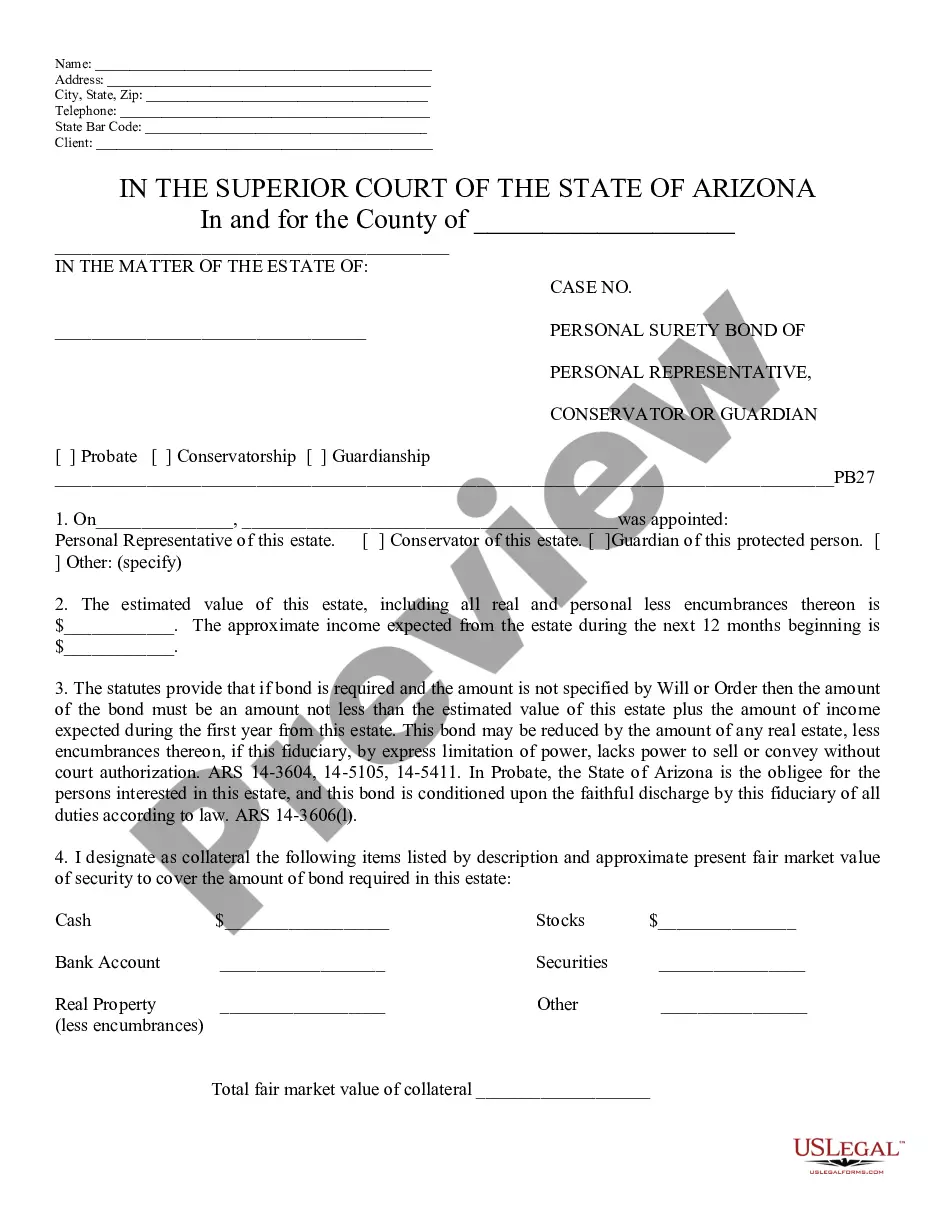

The form can be filled in on your computer, printed and mailed to the Secretary of State, Statement of Information Unit, P.O. Box 944230, Sacramento, CA 94244-2300, or can be delivered in person to the Sacramento office, 1500 11th Street, Sacramento, CA 95814.

Most nonprofits are 501(c)(3) organizations, which means they are formed for religious, charitable, scientific, literary, or educational purposes and are eligible for federal and state tax exemptions. To create a 501(c)(3) tax-exempt organization, first you need to form a California nonprofit corporation.

Form SI-100 Statement of Information can be filed online at . The form can be only completed by a corporate attorney or by the organization itself. There is a $20 filing fee that accompanies Form SI-100.

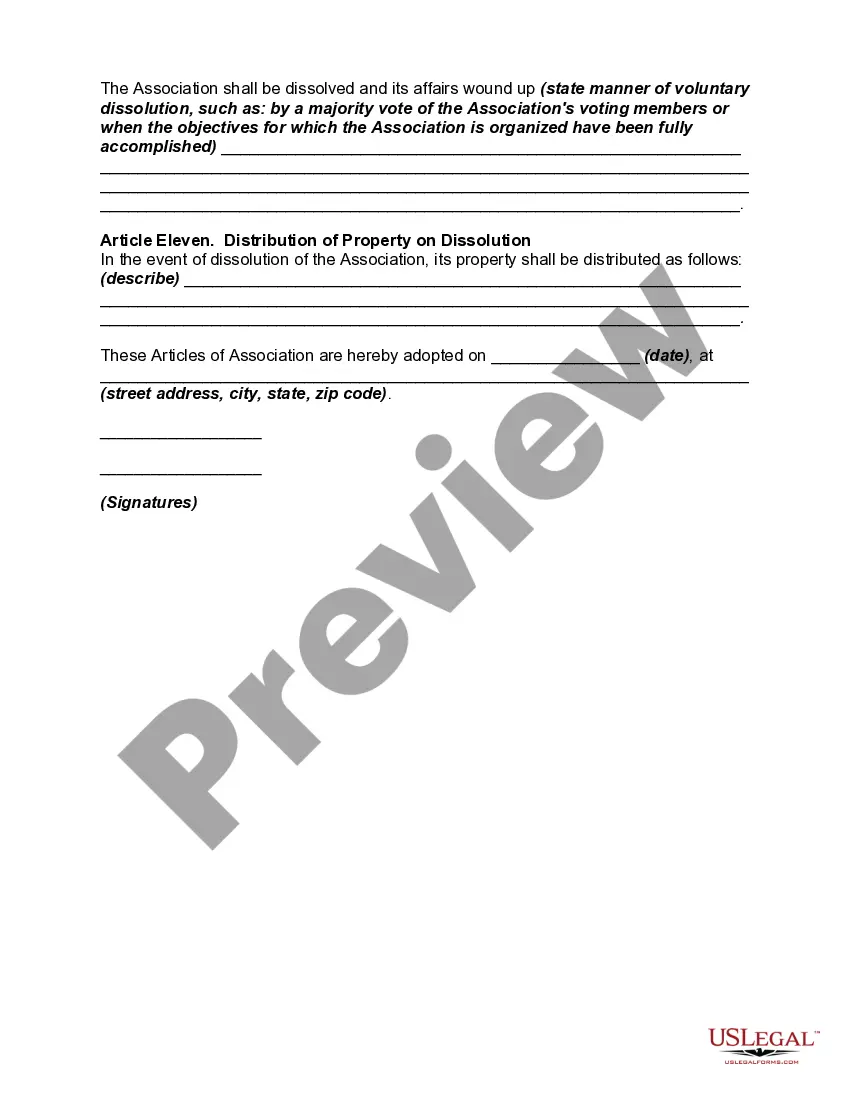

In California, you create a nonprofit by filing "articles of incorporation" with the Secretary of State's office and paying a filing fee. You'll also need corporate bylaws signed by the board of directors, though this document doesn't need to be filed with the Secretary of State.

Nonprofit articles of incorporation is the document filed to create a California nonprofit corporation. Preparing and filing your articles of incorporation is the first step in starting your nonprofit corporation. Approval of this document secures your corporate name and creates the legal entity of the nonprofit.

All California nonprofits must file the Statement of Information (Form SI-100) every two years ? with the Secretary of State. The form may be filed electronically and has a fee of $20.

California Nonprofit Filing Requirements IRS Form 990N. ... CA Franchise Tax Board Form 199N. ... CA Attorney General Form RRF-1. ... CA Secretary of State's Statement of Information.

You must submit the Statement of Information whether or not your company has conducted any business. There is a $20 filing fee and a $5 disclosure fee. You may file online. Publicly traded corporations must submit a Corporate Disclosure Statement annually in addition to a Statement of Information.